UK markets struggle against the prevailing global sentiment: Grain Market Daily

Friday, 22 November 2019

Market Commentary

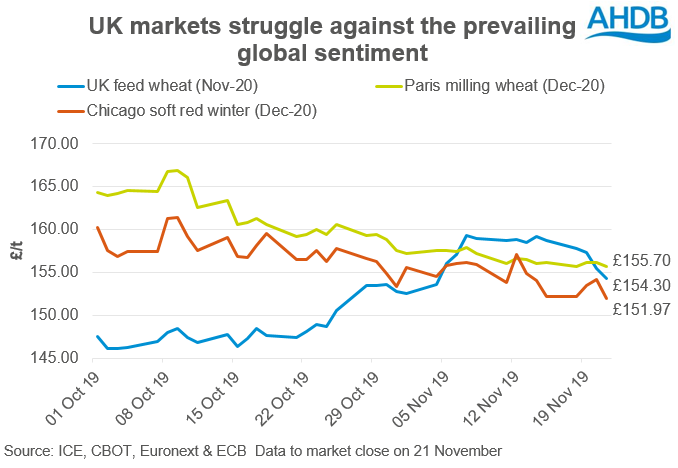

- UK wheat futures (Nov-20) closed yesterday at £154.30/t. The lowest close price since 4 November. Nov-20 futures have fallen £4.95/t Thursday-Thursday. Global market drift and improved weather over the last week have subdued domestic market growth.

- The Argentine Agriculture Ministry increased their estimate for soybean planting, up a further 100Kha, to 17.7Mha. Due to political uncertainty around potential export tariffs, farmers are opting for soyabeans over maize, potentially adding pressure to the oilseed complex and biodiesel markets.

UK markets struggle against the prevailing global sentiment

The latest International Grains Council (IGC) global supply and demand estimates point toward a continuation of the current bearish global grain market sentiment.

Starting with the current 2019/20 overall grain outlook, the IGC increased its total global grain production forecast by a further 5Mt to 2162Mt.

A large proportion of the forecast increase was due to an upwardly revised US maize harvest, with yields better than initially feared. This will come as little surprise to markets with Chicago maize futures (May-20) having fallen almost 7% from the October highs.

In contrast, 2019/20 global wheat production was revised down by just under 1Mt. However, EU-28 wheat production was raised by over 1Mt, creating an overall bearish picture for the EU and UK markets, with an increased overall exportable surplus.

Yet while the EU wheat supply was revised up, falling demand has also been hinted at. The Algerian government, which imports predominantly French wheat, announced plans to cap milling wheat imports at 4Mt, down from the annual 6Mt.

Greater European supply, coupled with the possibility of reduced export demand will continue to weigh on European old crop prices.

Looking to 2020/21, early estimates by the IGC are for a modest 1% increase in the global wheat area. This area increase may well be on the conservative side as Ukrainian planting, according to UkrAgroConsult, is set for a 2.6% increase, in contrast to the IGC forecast decline (read more here).

Overall the global outlook for remains bearish in 2019/20, with the possibility for a further area increase into 2020/21.

However new crop prospects for the UK, and to some extent in parts of France, are in contrast to the prevailing global production outlook. Following significant gains to new crop futures, further increases may now require now a shift in global market outlook.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.