2020/21 Black Sea wheat planting progress: Grain Market Daily

Wednesday, 20 November 2019

Market Commentary

- May-20 UK feed wheat futures gained yesterday, closing up £0.75/t, at £151.75/t. Prices had fallen since the start of the week. Elsewhere, Chicago wheat futures (May-20) closed up $1.65/t, at $190.68/t. Prices responded to downgrades in US wheat quality and tightening southern hemisphere production estimates.

- Paris rapeseed futures have climbed so far this week, closing yesterday at €388.25/t, a €1.50/t rise. Rapeseed has been supported by concerns over Canadian production with snowfall impacting harvests.

- Vegetable oils have also seen support on tightening palm oil supply and demand dynamics. Nearby, Malaysian palm oil futures have climbed 23% since the beginning of October.

2020/21 Black Sea wheat planting progress

With the UK domestic market reacting to ongoing adverse weather preventing winter crop planting, it’s important to consider winter planting in major wheat producing nations. This will have a significant impact on global markets.

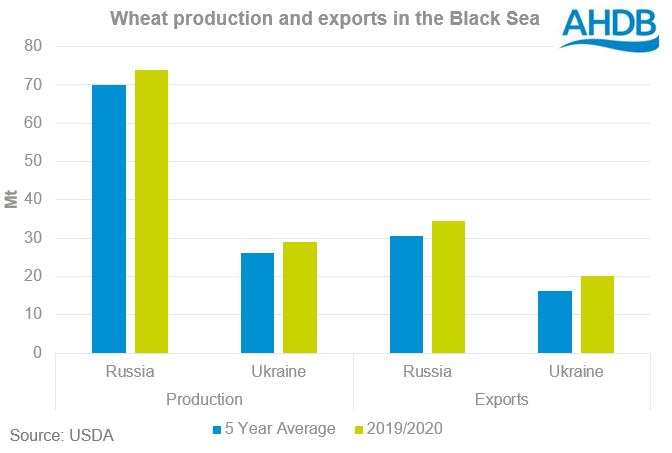

The Ukraine and Russia are both large net exporters of wheat. Collectively producing 103Mt of wheat in 2019/20 (Ukraine 29Mt, Russia 74Mt). Together, Russia and Ukraine are forecast to account for approximately 30% of global wheat exports.

Going forward the Black Sea region will continue to be an important supplier of grain for the global market.

Ukraine

The Ukrainian projected planting area is 6.2Mha for 2020/21 marketing year, up 2.6% on 2019/20, according to UkrAgroConsult. As of last week, winter wheat planting is 95% complete.

In the last 7 days Ukraine has experienced abnormally warm weather for November, which has contributed to the growth and establishment of winter crops.

Nearly the whole of the country has experienced varying precipitation. Areas with crops that have received sufficient rain have started tillering and forming nodal roots. That said, low soil moisture is a watch point for some regions.

Russia

In the latest USDA supply and demand estimates, Russia’s 2019/20 production was revised up by 1.5Mt on last month’s prediction, to 74.0Mt, this coincided with a 0.5Mt increase on exports, to 34.5Mt.

Sowing of new crop winter wheat is almost complete, marginally ahead of last year’s pace. Insignificant soil moisture and precipitation in the last few weeks has caused some concerns. However, recent precipitation in Southern Russia in the short-term has been welcomed.

While dryness concerns for winter wheat in Russia will be watched closely, it is worth noting that 26% of Russia’s wheat production last year was spring wheat.

With crops establishing well in the Black Sea and US (read more here), new crop markets may well be capped.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.