Analyst Insight: A look at factors that could weigh on 2020/21 UK wheat prices

Thursday, 14 November 2019

Market Commentary

- UK feed wheat futures (May-20) have seen rises this week, gaining £1.25/t since Monday to close yesterday at £151.50/t.

- US winter wheat plantings are reportedly progressing at a normal pace and nearing completion, with production predicted at 33.6Mt. The latest USDA crop progress report stated 92% of winter wheat was planted as of 10 Nov,.

- Forecasts to French wheat exports this season have seen upward revisions this month. Total exports outside the EU are expected to reach 12.0Mt, according to the latest FranceAgriMer report yesterday. This adds to expectations that France aims to capitalise on a reduced Russian presence in global markets.

A look at factors that could weigh on 2020/21 UK wheat prices

The UK’s trade position on global markets can change each season. In years of lower wheat production, the UK’s stance will turn to a net importer. Domestic wheat prices are likely to be capped by prices of imported wheat and other cheaper alternatives such as maize.

This season, ongoing difficulties in planting winter cereals could likely translate into a lower production figure than the 16.28Mt last season. In this case, the UK will switch to a net-importer scenario, similar to the 18/19 season. Greater importance is then placed upon the nature of imports, be that wheat, barley or maize. Already, wheat futures are beginning to see support from a difficult beginning to the season. These difficulties could also translate into increased spring cereal acreages, although they may struggle to recoup the deficit from low winter wheat production.

Given the threat of a low cereal production figure and the support that could give to domestic prices, it is important to remember there are factors to take into account that could act as a ceiling to such gains.

Could a carryover of old-crop occur?

One difference this season is the potential for a large carryover of old-crop, alleviating some of the supply deficit. This season, a 2.8Mt UK surplus of wheat available for export or free-stock has incentivised large movements of wheat out of the country. According to the latest trade figures, 414Kt of wheat has been exported from July-Sept this year. However, November and December are typically quiet months for export trade, thus a build-up in supply could overhang markets.

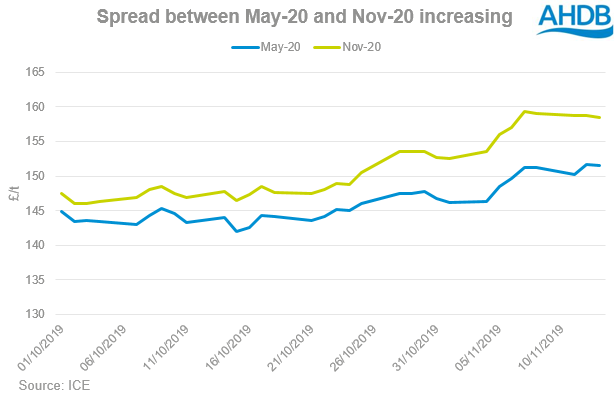

The incentive to carry wheat has been growing in recent weeks, with the spread between May-20 and Nov-20 wheat futures as of 13 Nov widening to £10.25/t from £3.50/t on 11 Oct. There is also potential for delivered premiums to further stretch out as we move through the season. The spread between delivered feed wheat (East Anglia) and Nov-20 wheat futures stood at £14.50 on 08 Nov. Many areas in the north have faced planting delays from flooded fields and may need to price accordingly to incentivise wheat to move up the country. Yesterday (12 Nov), Nov-20 futures were at £158.80/t.

Are imports a factor?

However, we must remember that the UK is a reasonably small player in global markets. Therefore, providing there isn’t disruption to nearby global markets also, wheat and barley import prices are likely to remain at a discount which may somewhat pressure domestic prices. If domestic cereal prices begin to rise, livestock producers may look to cheaper imports for feed supplies.

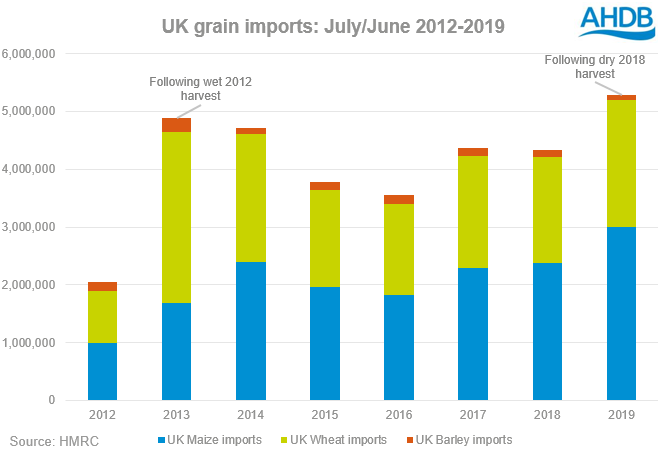

In previous net-import seasons, UK imports of wheat totalled near to the 2Mt mark. In the 12/13 season following a very poor domestic harvest, imports of wheat were at 2.95Mt, of which 1.06Mt was of German origin.

Another factor is the presence of maize given its close interchangeability with wheat, especially in feed markets. In 18/19, a record 2.99Mt of maize was brought into the UK at a discount to domestic wheat and barley prices. Of that 2.99Mt, over 930Kt was of Ukrainian origin. However, the potential for an increase in maize imports will depend on the price incentive. Any-origin imported maize usually operates at a discount of £25/t to domestic feed wheat prices.

So, while supporting factors for domestic prices are becoming more prevalent as we move into the season, it is important to bear in mind the global factors, usage and interchangeability that could put a lid on potential gains.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.