UK grain trade, domestic wheat balance easing but barley tight: Grain market daily

Tuesday, 14 June 2022

Market commentary

- UK feed wheat futures (Nov-22) closed yesterday at £309.50/t, up £3.50/t from Friday’s close. Nov-23 futures gained £2.50/t over the same period, closing at £268.50/t.

- UK gains followed global wheat contracts up, finding support from hot conditions set to hit the US and EU.

- Ukrainian grain harvest is forecasted to drop to 48.5Mt this harvest, from 86Mt last year, as sown area is down 25%. Export channels from Ukraine are yet to be successfully negotiated.

- The latest US crop progress report was released yesterday evening, to 12 June. Figures show maize ‘good’ to ‘excellent’ rating at 72%, down 1 percentage point (pp) from the previous week. Soyabean conditions were pegged at 70% ‘good’ to ‘excellent’. Winter wheat harvest is now at 10% complete.

UK grain trade, domestic wheat balance easing but barley tight

HMRC have now released their latest data for UK trade numbers, as up to April.

In line with the May supply and demand estimates, a change in trade dynamics and market volatility since the outbreak of war between Russia and Ukraine, appears to have impacted on UK grain import and export trade. In this article I will explore the key areas.

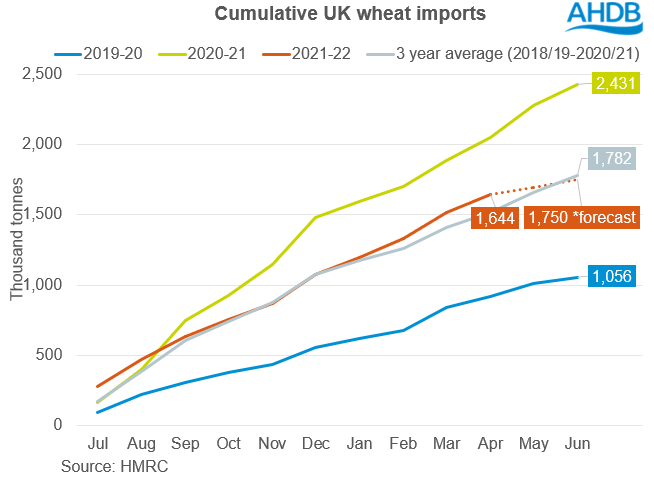

Higher wheat imports to ease wheat balance

Total wheat (including durum) import pace was strong in April, at 127.4Kt. The majority of this arrived from France (48.6Kt), Germany (42.0Kt) and Denmark (27.8Kt).

This brings season-to-date total of wheat imports to 1.644Mt. This leaves a monthly average of 52.8Kt for May and June, to reach the current full season wheat import forecast of 1.750Mt. With the 3-year average (2018/19 – 2020/21) for May (140.9Kt) and June (123.9Kt) exceeding this figure, it is likely we could see this full season import number move higher than the current forecast.

Wheat exports saw a large month in April at 54.5Kt. This is more than double the 3-year average figure for April. Though to meet current full season forecast of 530.0Kt, we would need an average monthly pace of 87.8Kt for the remaining May and June months. This is significantly higher than previous months’ export pace this season.

Could we see an easing to the wheat balance further for the season end?

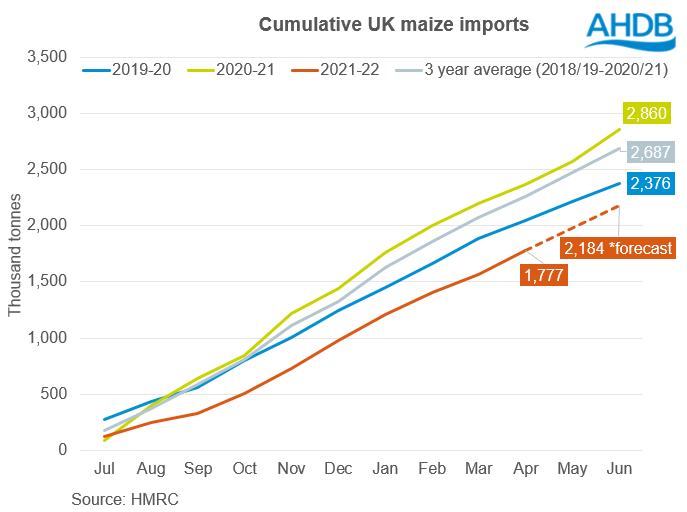

Maize imports rise as demand shifts

April maize imports totalled 206.9Kt, this is higher than the 3-year average of 183.4Kt. Maize has now priced itself into the UK market, since we have seen rising global wheat prices. Season-to-date imports total 1.777Mt.

Full season imports are estimated at 2.184Mt. To reach this number, pace for May and June would need to continue from April with an average monthly import of 203.5Kt, likely an achievable target.

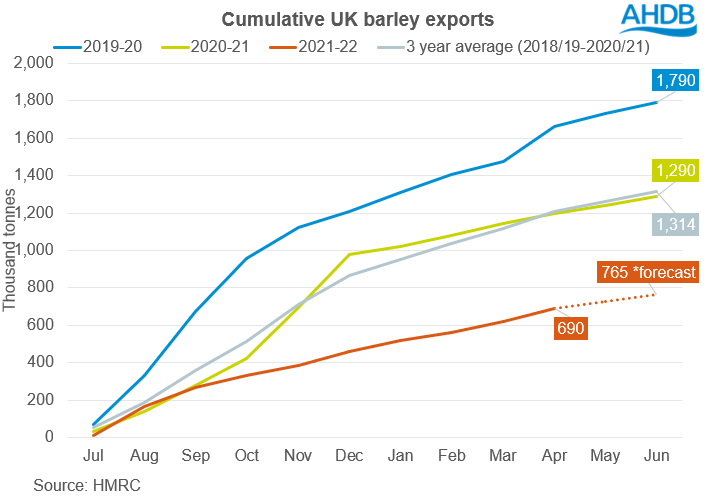

Barley exports firm – squeezing an already tight balance?

Barley exports continue, with April totalling 70.7Kt. This brings season-to-date exports to 690.3Kt. To reach the full season forecast of 765.0Kt, May and June would need to see an average monthly pace of 37.3Kt. This looks significantly below the 3-year average of 54.3Kt for May and 51.7Kt for June.

With the domestic balance of barley already very tight this season will be the smallest balance forecast since 2007/08.

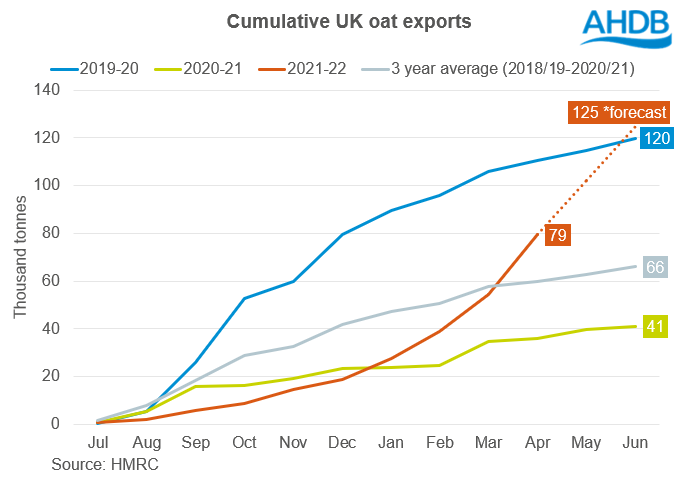

Oat exports rising

Finally, oats have been reportedly very competitive into the EU. April data shows 25.0Kt was exported, to main destinations the Netherlands, Germany, Spain, Finland, Denmark, and Belgium.

This brings season-to-date exports to 79.4Kt, with a full season forecast at 125.0Kt. To reach this forecast, firm April exports will need to be continued for May and June.

To conclude

Heading into next season, the wheat balance looks to be easing slightly, but the barley balance remains tight.

Looking to next season supply, there remains uncertainty around the size of the global harvest 22 crops. This, along with the war between Russia and Ukraine, is providing fundamental support to global grain price levels.

Looking closer to home, the EU weather is currently hot, and the UK is forecasted to turn hot at the end of the week. Weather watching continues, to understand what the quantity and quality of crops will look like for harvest.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.