UK futures on course for first weekly rise of 2024: Grain market daily

Friday, 23 February 2024

Market commentary

- Both old- and new-crop benchmark prices in UK feed wheat futures gained £1.70/t yesterday. The May-24 contract rose to £164.30/t, while the Nov-24 contract closed trading at £182.70/t

- This followed a rise in Paris milling wheat futures on a pick-up in demand, with smaller gains for Chicago wheat (more below). However, Chicago maize futures lost further ground as speculative traders continued to sell amid positive South American prospects (LSEG). Nearby Chicago maize futures reached its lowest level since November 2020

- Paris rapeseed futures slipped back a little yesterday under pressure from Chicago soya bean futures amid the advancing South American harvests (LSEG). Selling by speculative traders was also a factor. The May-24 rapeseed contract lost €6.25/t to close at €416.00/t (approx. £356.00/t), while the Nov-24 contract fell €3.50/t to €422.00/t (approx. £361.50/t)

UK futures on course for first weekly rise of 2024

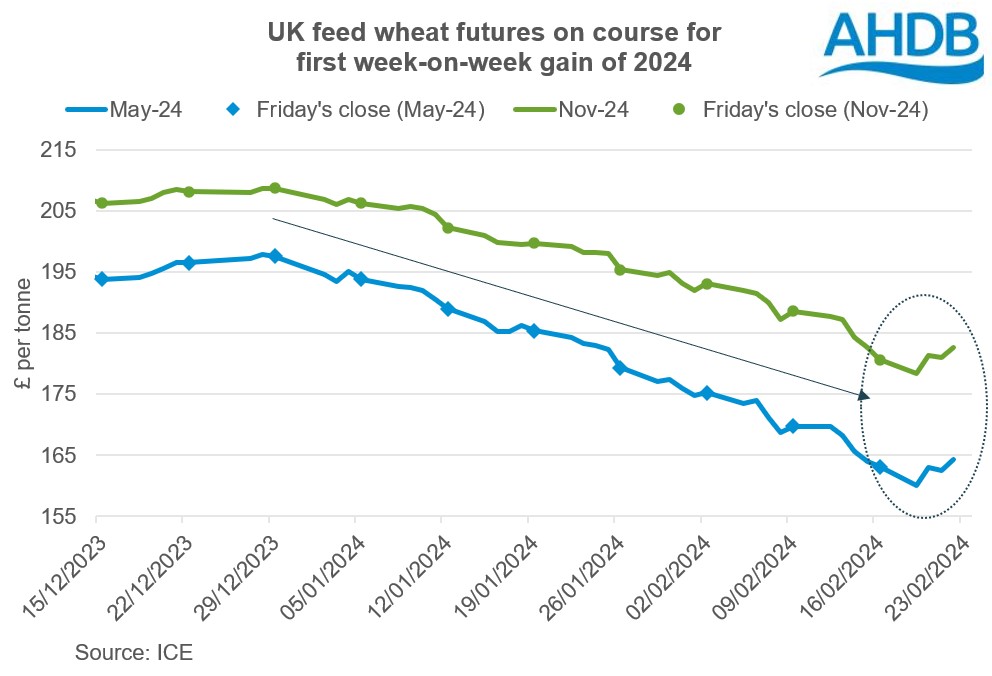

May-24 UK feed wheat futures edged higher again yesterday and could be on course for the first week-on-week rises of 2024. The contract has closed lower than the previous Friday each week so far this year.

On Monday, the May-24 contract fell to its lowest level so far of £160.00/t, £3.15/t below last Friday (16 Feb). The nearby contract also fell to £154.00/t on Monday, its lowest price since 7 May 2020 as concerns about high global supplies continued.

But UK feed wheat futures have since seen some recovery. The May-24 contract is currently (midday) trading around £167.00/t, £3.85/t higher than last Friday’s close.

While trading has been variable in Chicago and Paris wheat futures, both are currently on course for overall gains this week. This follows:

- A potential pick-up in demand, both within France and in international markets. There have been tenders from Tunisia, Jordan and Bangladesh this week (LSEG)

- Short covering in wheat futures by speculative traders

- Reports that the US could impose new sanctions against Russia to mark two years since the invasion of Ukraine. Export competition from Russia has been weighing on markets

- Warmer weather in the US could prompt some winter crops to leave dormancy. While it’s not currently forecast, if cold weather returns these crops could be vulnerable

However, more news seems likely to be needed to support further rises. South American maize prospects remain positive, with planting of Brazil’s Safrinha maize crop going well. Following the recent heatwave, the Rosario Stock Exchange cut its estimates for the Argentinian maize crop by 2.0 Mt and soya bean crop by 2.5 Mt. Both forecasts are still well above last year’s levels. Plus, while more rain is needed to keep the forecasts stable, this is expected in the coming days.

French winter crop conditions are also broadly stable. As of 19 February, 69% of wheat (exc. durum) and 71% of winter barley is rated as good or very good. Spring barley planting progress remains slow and well behind last year.

US export sales data could provide some more direction later today. This is usually released on a Thursday but was delayed by the US federal holiday on Monday.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.