UK feed wheat prices take a breath: Grain market daily

Wednesday, 9 March 2022

Market commentary

- May 22 UK feed wheat futures returned to week earlier levels yesterday, to £295.00/t, losing £8.00/t from Monday. New crop wheat futures also fell £5.50/t, settling at £243.50/t.

- Global wheat markets also lost ground yesterday, with Chicago wheat futures (May 22) closing at $472.66/t, down $2.76/t on the day. However, May 22 Chicago maize futures gained $0.89/t to close at $296.46/t. Likewise, Chicago soyabeans (May 22) gained $11.11/t on Monday and closed at $620.81/t.

- The easing in wheat prices can be partly attributed to a rise in Brazilian exports. On the back of situation in Ukraine, it has been reported that Brazil is to export more wheat and maize than usual for this point in the season. A deal to export 100Kt of wheat from Brazil was made last week, with wheat from Brazil looking quite competitive due to the high dollar and weaker domestic demand, according to a Refinitiv source.

- The latest USDA World Supply and Demand Estimates (WASDE) is due to be published later today, which will include its updated projections for global production and trade.

UK feed wheat prices take a breath

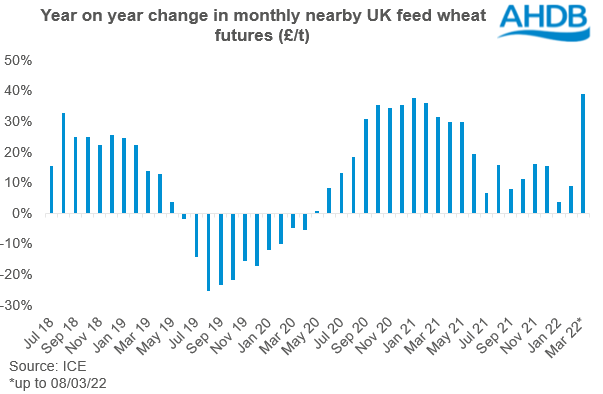

Despite UK feed wheat futures closing down yesterday, prices remain at very high levels. February marked the 22nd consecutive month that UK nearby feed wheat futures gained on the year. The monthly average nearby UK feed wheat price for February was £222.12/t, 9% up on year earlier levels. While we are only a week in to March, as it stands, the current monthly average is 39% up on March 2021 at £279.40/t.

While the current turmoil in the Black Sea has been driving the UK market over the past couple of weeks, the tighter supply and demand situation domestically has played its part in elevating UK prices over the past few months.

In the January UK supply and demand estimates, the balance of wheat for 2021/22 is forecast at 1.986Mt, the lowest since 2015/16. The tight balance is due to strong domestic demand, on the back of an increase in bioethanol and animal feed usage. Full season wheat imports are currently pegged at 1.45Mt for 2021/22. However, with the current situation globally, will this volume be realised? We have already seen the spread between feed wheat and feed barley widen over the past couple of weeks, which in theory would make barley more attractive for some rations. This could take some demand away from imported wheat.

The next UK supply and demand update is due to be published on 24 March, providing an update on the domestic situation.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.