UK dairy product availability: Higher exports drive available supplies lower in Q2 2023

Thursday, 7 September 2023

Key trends

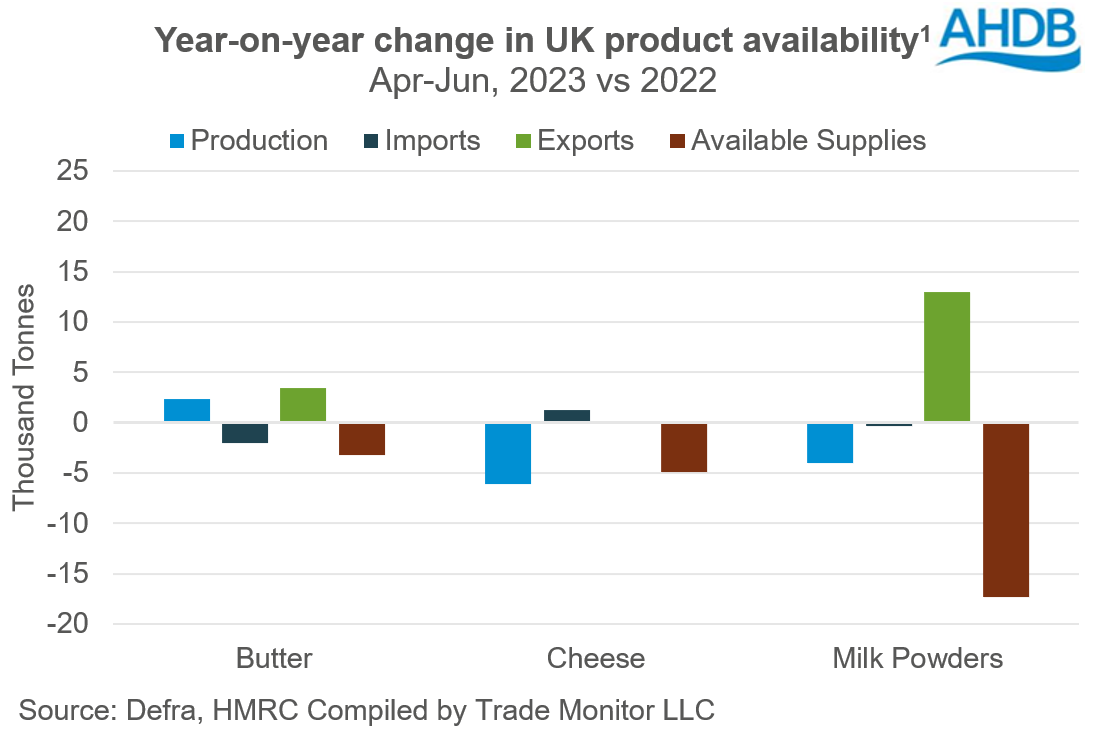

- UK has less dairy product supplies available across all categories in Q2 2023.

- Milk powders declined the most by 56%.

- Lower prices in UK have made exports of butter and powders more attractive.

The availability of manufactured dairy products remained lower in the second quarter of 2023 compared to the same period the previous year. UK milk deliveries in the first four months of the milk year (April–July) grew by 5,242m litres (0.5%) more year-on-year. Post the spring flush, milk deliveries for the month of July declined by 2.2% compared to the previous month. However, this might not support prices considering the gloominess on the demand side.

Cheese production declined by 6,000 tonnes (4.3%) on the year, while imports picked up by 1.3% (1,300 t). Exports remained almost on par with previous years at 44,000 t. Lower production resulted in an overall decline of available supplies by 2.4%.

Butter also continued the trend of lower available supplies. Strong exports, coupled with lower imports, contributed to lower supplies overall. Butter saw the largest rate of declining prices in August on UK wholesale markets making exports attractive. Exports recorded a growth of 27.2% (16,000 t) in the second quarter year-on-year. Therefore, available supplies were estimated to be lower by 8.4% (58,000 t).

Milk powders followed butter in the basket. Available supplies during April–June 2023 declined by 56.0% (14,000 t) compared to the year before, following robust exports. Though China has been quiet for some time, good demand from United Arab Emirates and South East Asia drove exports. Production and imports were recorded lower by 10.9% and 3.2% during the period.

*product availability is defined as: production + imports – exports

Going forward milk deliveries are likely to decline amid price cuts and post flush. The demand scenario looks uncertain amid inflationary pressure and gloomy macro-economic environment. However, market commentators would expect to see some revival of demand after the summer holidays.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.