UK beef imports lower, but why?

Thursday, 19 December 2019

By Rebecca Wright

Much attention has been paid to UK exports so far this year, which have been increasing in volume, but at lower prices. But, what has been happening on the import side, and perhaps more importantly why?

What has happened to the figures?

In short, volumes have been down. In October, UK imports of fresh and frozen beef declined by 13%, to 22,300 tonnes, according to HMRC data. Ireland continued to be the largest supplier, with 16,400 tonnes, but this was 14% lower than last year. Imports from the Netherlands and Poland also declined, to 1,600 tonnes each. Imports from South American countries declined from 900 tonnes in October 2018, to 300 tonnes this October. Imports from New Zealand and Australia have also declined. It is a similar story in the year to October data, which recorded a 15% decline to 204,100 tonnes.

So why the drop?

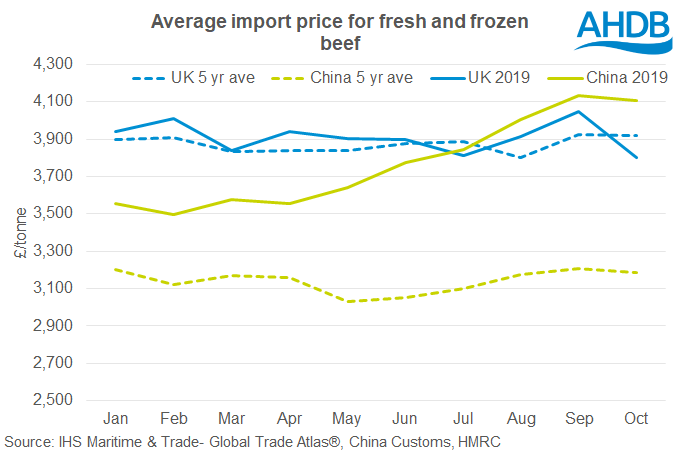

Weak domestic demand is partially behind the decline in imports but the global market also has an influence, especially on beef from outside of the EU. China has been the key story of 2019 for global protein demand, with the outbreak of African Swine Fever. Chinese imports of beef in the first ten months of 2019 have increased by 55%, to 1.3 million tonnes. Many of the countries sending less into the UK have increased their shipments to China. Historically the Chinese import prices were around 20% below the average UK price. Now, however, the average Chinese import price is above the average UK price.

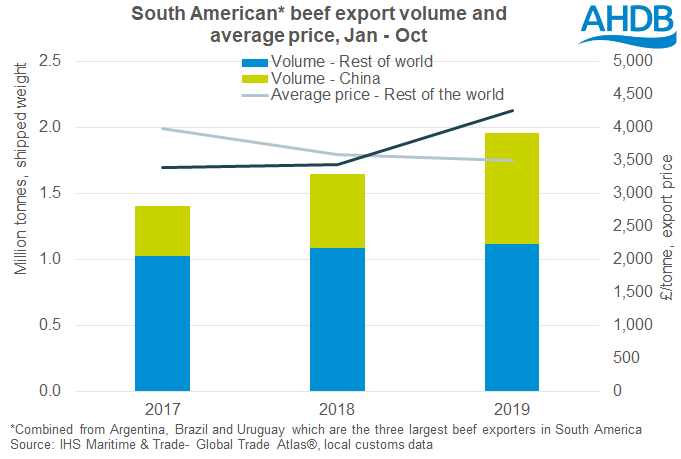

Looking at data from the three largest South American exporters, Argentina, Brazil and Uruguay, it is clear the impact China is having on the global market. Average price to China has sharply increased, and even overtaken the rest of the world price. Farmgate prices in many of these countries have also begun to record rises.

Domestically, it has been fairly well reported that beef consumption is under pressure in the UK, as well as across Europe. UK import volumes are not isolated from the rest of the market, with domestic production, and exports also playing a part. Between them production, imports and exports have to balance out, through the price mechanism, to meet demand. It’s when supplies and demand go out of balance that we typically start to see larger price movements. Either side of the equation can push the market out of balance. When supply is higher than demand typically leads to price declines. This can make the UK a less attractive market for imports, and can also stimulate export volumes. When demand is above supplies, prices rise to attract product to the market, either through increased production, increased imports or a decline in exports. Most likely it would actually be a combination of these.

Looking at the domestic supply situation as a whole, production + imports – exports are back 6% year-on-year in the first ten months of the year. While some of this change can be attributed to changes in frozen stocks level, this suggests a decline in domestic consumption. GB retail data from Kantar has been recording declines for much of the year. Not only has demand been falling, but also there has been some switching from steaks towards products using mince beef, which typically has a much lower retail price.

Not only have retail sales been under pressure, but also in the 12 months ending September 2019 beef out of home eating sales of beef declined 6.0%, according to data from MCA.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.