UK beef and lamb import tariffs to remain high post-Brexit

Thursday, 21 May 2020

By Rebecca Wright

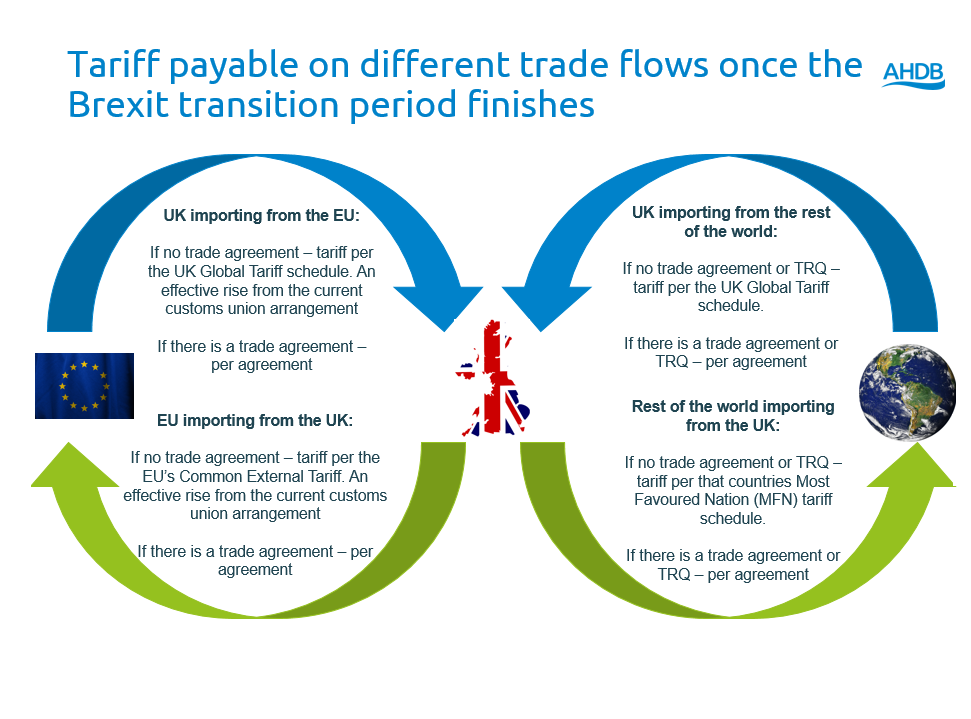

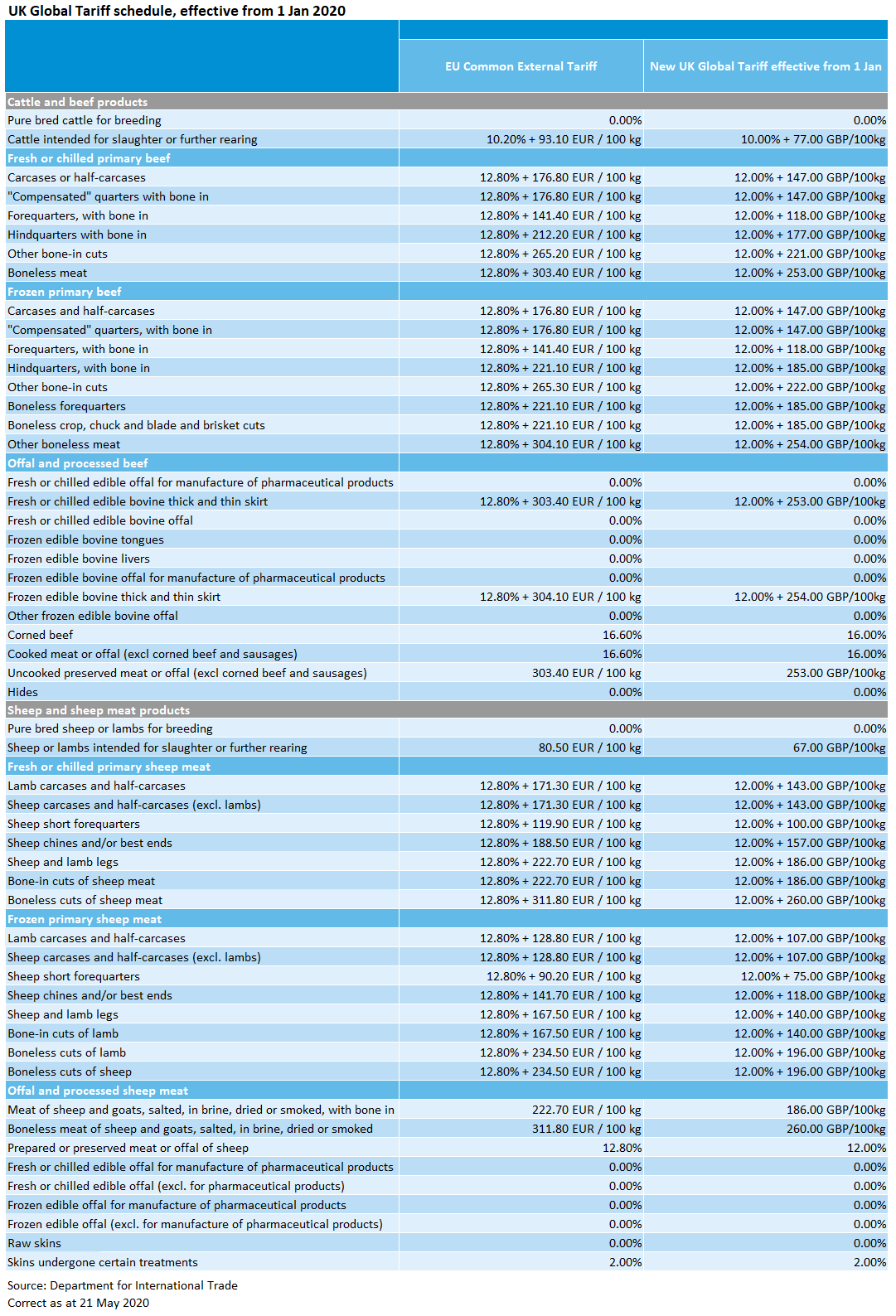

Earlier this week the UK government announced the new Most Favoured Nation (MFN) tariff regime – the UK Global Tariff (UKGT). These tariffs are due to come into force on the 1 January 2021, the day after the Brexit transition period ends. These tariffs would apply to all countries and products not covered by a trade deal or an agreed Tariff Rate Quota (TRQ) with the UK. There is the potential for these tariffs to be changed and adjusted in the future, should the need arise.

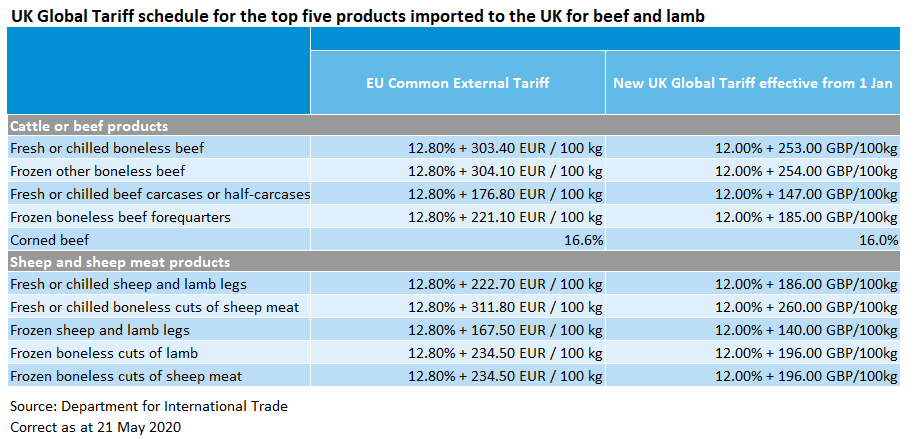

For beef and lamb, the tariffs broadly mirror the level of the EU’s current Common External Tariffs. There is some simplification, and the new tariffs are expressed in sterling rather than euros.

What does this mean for UK imports?

The impact of these tariffs will vary depending upon to which country and which products we are thinking about. For imports from countries outside of the EU the new UKGT brings little change. Once the UK is outside of the European customs area there is the chance for the UK to negotiate trade agreements of its own. These may include a reduction or removal of tariffs on beef, lamb and other agriculture products in the future.

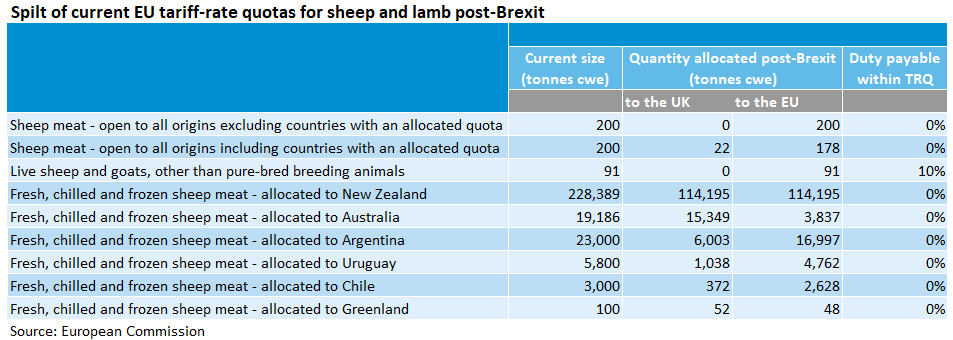

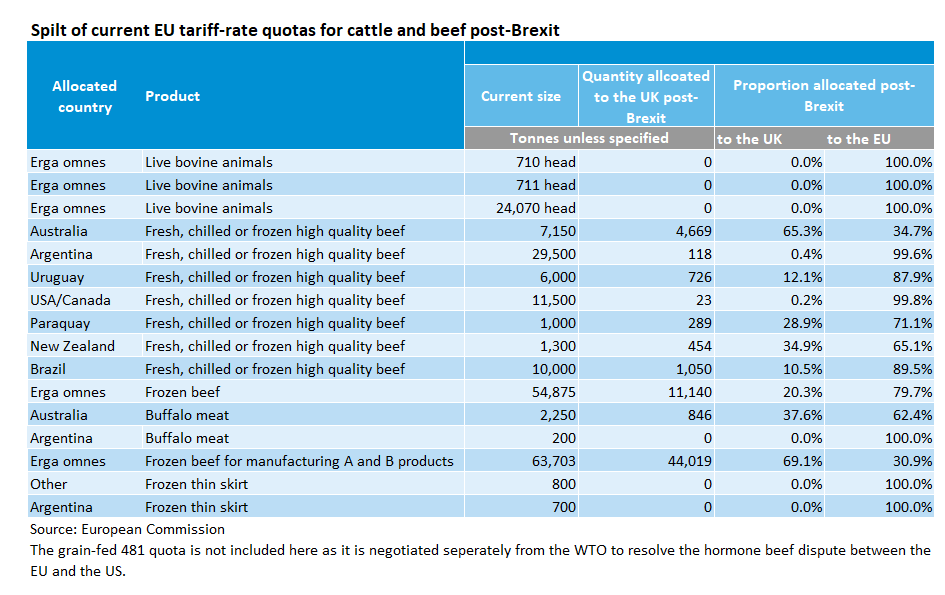

Tariff-rate quotas

Although the most-favoured nation tariff for imports of beef and lamb products remain at a high level some countries will continue to have access at a reduced rate either through a TRQ or a trade agreement. For example, New Zealand will have a zero-rated quota of 114,184 tonnes cwe for sheep meat entering the UK. There will also be, among others, an erga omnes (open to all) quota for frozen beef of just over 44,000 tonnes cwe coming to the UK. These are the UK’s share of TRQs negotiated and used while a member of the EU. They are being spilt based upon historic usage. The UK could, if the government of the day feels it is required, introduce new erga omnes TRQs for any product.

The above tables and information only relate to the import of products to the UK. When exporting the UK is subject to the tariffs as set by the importing nation. All the tariffs are potentially subject to change and adjustment in the future and only come into force from 1 Jan 2021 once the Brexit transition period finishes.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.