UK barley will need to remain competitive: Grain market daily

Friday, 20 August 2021

Market Commentary

- The third AHDB harvest report is now out. Unsettled weather across GB has continued to cause delays to harvest. Winter wheat clearance is the lowest since 2017.

- Nov-21 UK feed wheat futures closed yesterday at £191.00/t, down £2.75/t from the previous days close.

- Chicago Dec-21 soyabean futures tumbled $12.21/t from Wednesday to Thursdays close. This follows favourable weather forecasts in north-western parts of the US Midwest which could boost crop prospects and also improved export demand.

UK barley will need to remain competitive

Today see’s the release of the third AHDB harvest progress report with updated yield estimates. Along with yesterday’s Defra English areas, we can take a closer look at production.

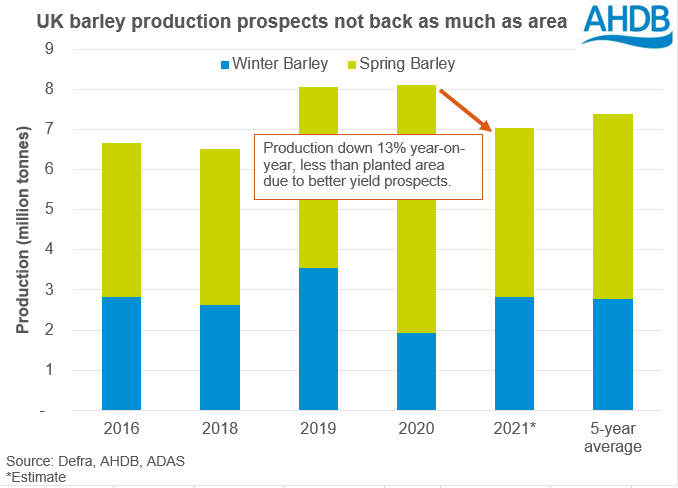

As Megan highlighted yesterday, both the AHDB Planting and Variety Survey (PVS) released 8 July, and Defra census released yesterday, suggest a drawback in barley planted area. This is driven by spring barley, as the winter barley area has increased.

Winter barley varieties are generally higher yielding, due to the longer growing season, and therefore the drop in barley production will likely be smaller than that in planted area. Although the Defra figures only cover England, on average 72% of total barley by area is grown in England and that increases to 85% for winter barley.

Using yesterday’s English area figures, applied to the 5-year average area share, we could estimate the UK areas. Using the median yield estimates from todays harvest report we could estimate production. While our harvest reports to date point to winter barley yields being slightly better than average, at 6.9-7.1t/ha vs a five-year average of 6.8t/ha, spring barley yields are based on a small sample of the early harvested crops. While preliminary results are good, sample sizes are still small at this stage in harvest.

- Winter barley: 2.82Mt

- Spring barley: 4.22Mt

- Total barley: 7.04Mt

Although back from 2020 harvest by 13%, it is only 5% behind the 5-year average.

What does this mean for ex-farm prices?

Sales of new-season barley have been strong so far. Looking at corn-returns volumes, we can see that purchased feed barley volumes for July-August delivery (to 12 August) is up 7% from last year. Barley has been at a decent discount to wheat, likely incentivising purchases. At the end of July, the ex-farm barley price was at a £61/t discount to feed wheat, compared to £40/t at the same point last year. Over the last 2 weeks the barley price has crept up, but this is following global grains.

Barley will need to remain competitive. Although we anticipate good inclusion into animal feed rations, an export market will remain key. Global grain markets have seen elevation recently, following the bullish USDA report last week, but have since settled back down. Although this offers support to barley prices, a sizeable crop, and the need to remain competitive into feed markets will keep some pressure prevalent.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.