UK barley facing a large export campaign: Grain Market Daily

Wednesday, 12 August 2020

Market Commentary

- London wheat futures (Nov-20) increased yesterday to close up £1.50/t at £162.75/t.

- This morning, the EU re-introduced import duties on non-EU maize imports, following US maize and freight rates falling below a regulatory price floor for ten consecutive days. The import tariff is set at $6.42/t (£4.93/t).

- Markets await the release of the USDA WASDE report published later today at 5pm GMT. We took a closer look at its importance yesterday.

- The recent Egyptian tender (GASC) for 120Kt of wheat for Sept/Oct delivery was met exclusively by Russian origin, at a price of $219.60 ($205.50/t FOB + $14.10/t freight).

UK barley facing a large export campaign

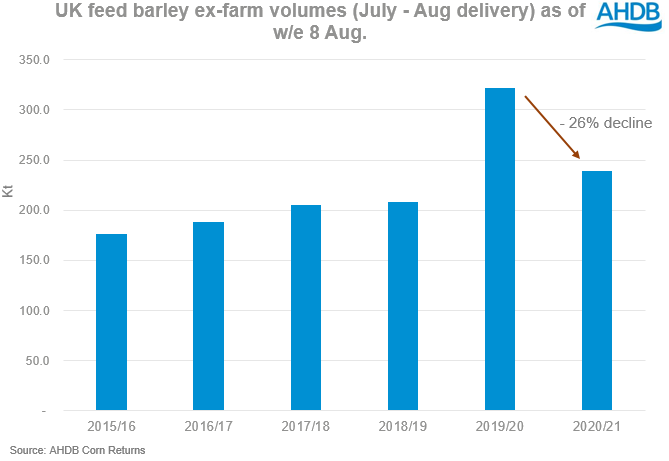

With another season requiring a large domestic barley export campaign, volumes moving off farm will need to pick up to avoid a surplus overhanging domestic markets. Taking a look at corn-return volumes this year highlights purchased feed barley volumes for Jul – Aug delivery sit 26% lower than last season (up to week ending 6 Aug).

Both the estimated 1.2Mt barley ending stocks figure for last season and increased (19%) barley plantings this season look to ensure a well-supplied market. Despite challenging growing conditions this year, the area increase could well outweigh any yield reductions.

Feed barley prices have remained pressured this calendar year. From the week ending 02 Jan to 06 Aug; the UK feed barley price (corn returns) increased just £1.90/t, compared to a £10.30/t increase for UK feed wheat.

The need to export this season will again face potential Brexit disruptions, though at a later point of January. Last season, over half (54%) of barley exports were shipped before the original October deadline. Given the new deadline of 31 December for leaving the EU, we may well see this activity again, in order circumvent potential tariffs.

Is there sufficient demand on the continent to support the market? Strategie Grains has pegged estimated EU barley production figures 1.7Mt above last season, at 64.2Mt. Additionally, the presence of maize imports will also add a degree of competition for feed markets.

With barley harvest progress now picking up across the EU, exports this season in the EU-27+UK have kicked off to a fairly slow start. As of 09 Aug, new season shipments to non-EU destinations were back 51% year-on-year.

Well what does this mean?

The pressure on domestic barley prices is seemingly set to remain for the foreseeable period. Yes, there is a degree of support from a low UK wheat production figure, but the relatively limited interchangeability between barley and wheat means exports are the port of call for barley markets, primarily to move to feed markets.

A well supplied EU27 and maize imports will provide competition, while traditional third country destinations may see impacts on their domestic demand due to changes in policy affecting barley requirements in feed rations.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.