US maize yields in focus ahead of WASDE: Grain market daily

Tuesday, 11 August 2020

Market commentary

- UK feed wheat futures (Nov-20) closed at £161.25/t yesterday, down £1.40/t from Friday’s close and its lowest price since 4 May.

- The contract followed drops in Chicago and Paris futures, due to optimism about the size of the Russian wheat crop (more in yesterday’s Market Report). A lift in the strength of sterling against the euro also added pressure to UK prices.

- However, Chicago maize prices (Dec-20) lifted from the new contract low set on Friday after the USDA reduced the US crops condition score rating slightly.

- Paris rapeseed futures (Nov-20) lost €25/t yesterday, closing at €375.00/t, as positive conditions continue for canola (rapeseed) crops in Canada and Australia.

US maize yields in focus ahead of WASDE

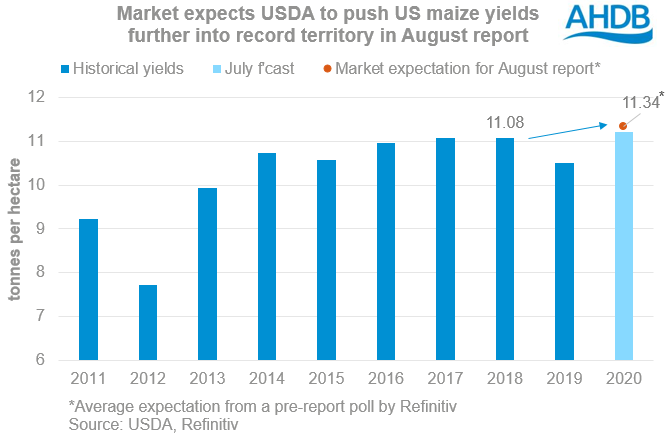

Grain prices have fallen over the past week or so due to rising optimism over Russian wheat and US maize production. This Wednesday at 5pm, the USDA will release its first forecast of the 2020 US maize yield based solely on crop conditions in its World Supply and Demand Estimates (WASDE).

From May – July, the US maize yield forecast is based largely on historical trends. The August forecast is the first based on crop conditions. However, this year is slightly different. One of the sources of information usually used to produce the August, and all later yield forecasts, won’t be available until September according to Refintiv. This August yield forecast will be based solely on farmer surveys, casting a bit more uncertainty over the August figure.

A survey of industry participants by Refinitiv show expectations for an increase in the USDA’s US maize yield forecast and so production. Weather conditions were generally supportive for crops through much of July, but there’s currently reports that more moisture is needed to maintain potential in some areas, including the top producing state of Iowa.

Speculative traders were short of maize last week and likely to be still, as prices are broadly similar to where they were last Tuesday. As such, a smaller than expected increase to the US maize yield could push up prices and spark short covering and further gains. However, a larger than expected increase, or within range estimate, would likely mean pressure on prices.

How could this impact the UK?

The price of maize in particular is set to be a key influence on UK cash prices this season due to our import requirements, as David discussed last week. So with US maize prices already historically low, unless the crop is sharply smaller than expected, it’s likely to act as an anchor on world and UK grain prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.