Tight wheat supply entering 2022/23: Grain market daily

Friday, 11 February 2022

Market commentary

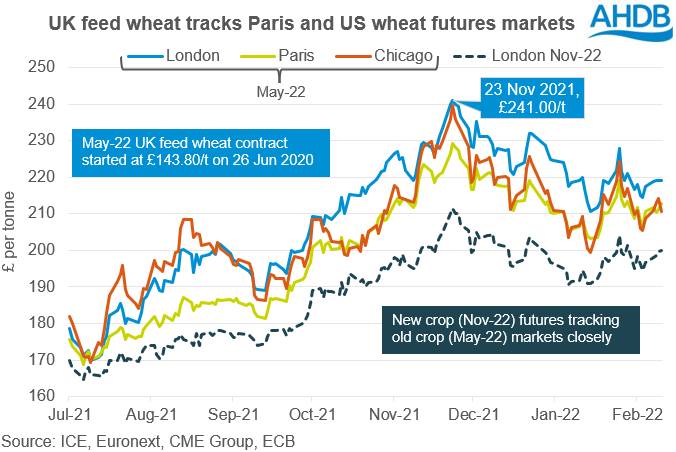

- Despite trading in a £4.00/t range through the day, UK feed wheat futures (May-22) closed yesterday almost flat from the previous day (-£0.10/t) at £219.15/t. The Nov-22 contract also only moved marginally, closing at £200.05/t, up £0.35/t.

- US soyabeans (May-22) look set for a week-on-week gain despite a slight dip yesterday, closing at $579.21, down $6.98/t from the day before. A relatively bearish report from the USDA is counterbalanced by continued dryness concerns in South America.

- Paris rapeseed has traded independently from soyabeans. Yesterday, the May-22 contract rose €3.50/t, to close at €686.25/t. This said, it looks to be on course to record a weekly drop.

Tight wheat supply entering 2022/23

The global wheat supply and demand picture remains tight for 2021/22. Using the latest USDA estimates, major exporters’ wheat stocks-to-use is now 12.8%. This is down 0.5% from January’s numbers. The five-year average stocks-to-use for major exporters is 17.5%, so this season is looking particularly tight.

Not only does this offer support to prices in the short term, but also will offer some support going into the next marketing year.

With opening stocks looking tight into 2022/23, eyes focus on a possible recovery in production.

Domestically, it seems that there is little increase expected in the wheat area. AHDB’s Early Bird survey of planting intentions shows a 1% increase year-on-year and pegs plantings for harvest-22 at 1.81Mha.

In Europe, there is also little in the way of recovery in area. Stratégie Grains recently increased its forecast for the EU-27 wheat area, but it is now in line with last harvest at 21.70Mha. This said, there is scope for a reduction to be made as the French government reduced its wheat area estimate to 4.75Mha from 4.92Mha. Stratégie Grains currently peg Frances’s wheat area at 4.93Mha.

What does this mean for the UK?

Domestically, the current wheat supply and demand outlook is also tight. As a result, the UK is pricing at import parity levels and follows trends in the European and global markets.

This marketing year (2021/22) ex-farm feed wheat (current month delivery) has traded at unprecedented levels. It reached an all-time high of £226.50/t in early December-21. Although prices have slipped since then, they have remained historically elevated. Any supportive news on a global front will inevitably support UK markets too.

With a tight situation heading into 2022/23, new crop markets are tracking old crop prices very closely (as demonstrated in the graph above). This will likely continue until at least there is more news pointing to a crop recovery. Markets await Canadian planting intentions and subsequently weather forecasts to see if there will be a rebound here too.

Prices could come under some pressure if a global recovery looks on the cards. But they will likely stay relatively elevated versus pre-2021/22 levels due to the tight stocks.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.