Analyst Insight: Limited scope to export wheat as UK S&D remains tight

Thursday, 27 January 2022

Market commentary

- UK wheat futures (May-22) closed yesterday at £221.55/t, down £6.45/t on Tuesday’s close. November-22 closed at £199.50/t, down £4.50/t on Tuesday’s close.

- Domestic prices followed both the Chicago and Paris wheat markets down. The sharp fall were due to profit-taking as there was potential progression towards resolving the Russian-Ukrainian crisis. The US said on Wednesday it will set out a diplomatic path to address Russian demands.

- Chicago soyabeans (May-22) futures gained 2.19% yesterday, setting a new contract high of $531.68/t. The sharp increase came as soy oil futures rallied with energy markets, and concerns about reduced output from South America.

- AHDB’s latest Agri market outlook is now online. Check out the webpage, which has outlooks for all our agricultural sectors.

Limited scope to export wheat as UK S&D remains tight

AHDB released its latest 2021/22 UK cereal supply and demand estimates this morning. This includes insights into wheat, barley, oats, and maize. Furthermore, both exports and commercial end-season stocks have been estimated, which isn’t usually done until May.

To no surprise, the UK wheat supply and demand picture remains tight. Total 2021/22 wheat availability is now estimated at 16.85Mt, 2.33Mt more than in 2020/21. Wheat availability is down from November’s projections by 35Kt. The reason for this is the final Defra wheat production estimate being revised down. Final production of wheat in 2021 is estimated at 13.988Mt, up by 4.33Mt year-on-year.

Despite higher wheat production year-on-year, availability is still tight this season owing somewhat to the tightest opening stocks this century.

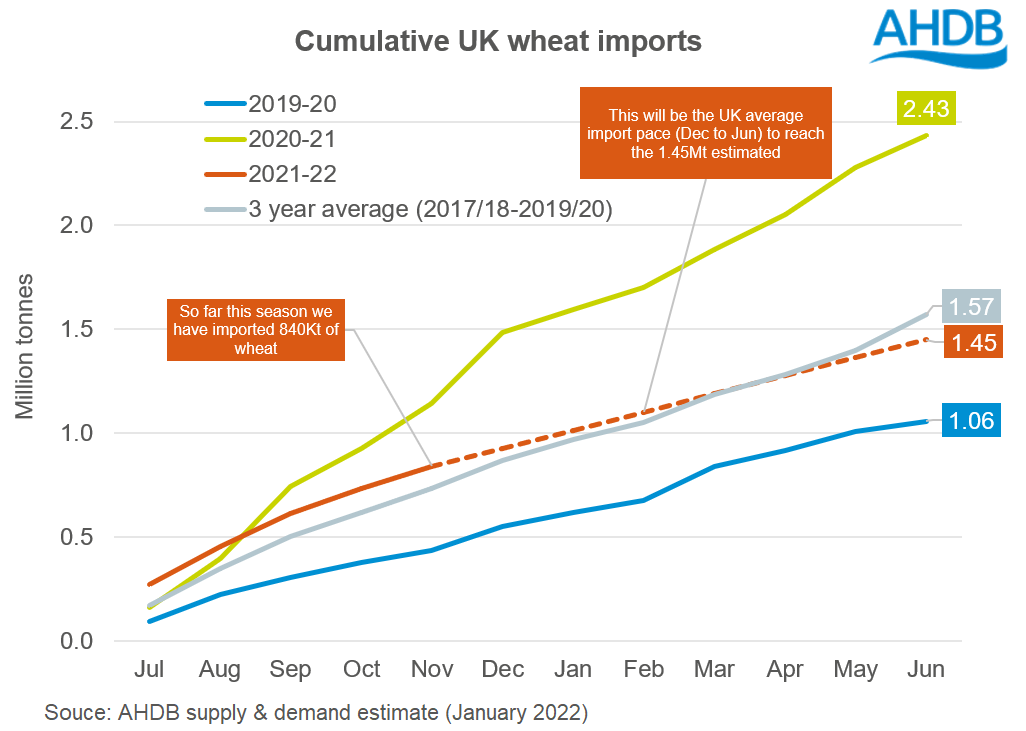

Meanwhile, imports of wheat remain unchanged from November’s estimate of 1.45Mt, 0.98Mt down on the year. From July to November 2021 the UK imported 0.84Mt of wheat, compared to 1.11Mt over the same period in 2020. Logistical challenges and strong freight rates have been consistent issues for trade this season to date. Import volumes have fallen back from a historically strong start as the season has progressed.

At 7.25Mt, human and industrial (H&I) consumption of wheat in 2021/22 is 0.66Mt higher than 2020/21. The increase is largely driven by the bioethanol and starch sectors, as a result of the introduction of E10 in September 2021.

Wheat usage in animal feed is expected to increase by 1.28Mt on the year, to 7.28Mt. This returns volumes more in line with the 2018/19 and 2019/20 seasons. The 2021/22 estimate increased from November due to the continued backlog issues facing the livestock sectors, These backlogs are expected to extend into 2022, with herd reductions not being realised until later into 2022.

The balance of total availability and domestic consumption of wheat is estimated at 1.99Mt. This is just 370Kt more than 2020/21 levels and the second lowest this century. Tight opening stocks, coupled with a rebound in consumption to 2018/19 and 2019/20 levels, mean the picture remains relatively tight.

Due to this tightness wheat exports are pegged at 250Kt and commercial end-season stocks are pegged at 1.736Mt, 319Kt more than 2020/21.

For full analysis and figures, be sure to check out the UK cereals supply and demand estimates webpage.

For commentary on other grains see below:

Total availability of barley is estimated at 8.10Mt in 2021/22. This is 1.46Mt lower than year earlier levels, driven by lower production and opening stocks.

In 2021/22, H&I usage of barley is estimated to rise by 148Kt on the year to 1.87Mt. With the country continuing to recover post COVID-19 lockdowns, demand by the brewing, malting, and distilling (BMD) sector is expected to recover.

At 4.09Mt, barley usage in animal feed is estimated to be 1.22Mt lower than in 2020/21. With the barley discount to wheat reducing since the start of September, wheat inclusions in rations are estimated to increase, at the expense of barley.

The balance of barley supply and demand is estimated to be marginally smaller (-377Kt) than 2020/21 at 1.93Mt. The UK has exported 382Kt of barley from July to November. This leaves 0.81Mt to either be exported from December to June or carried over into next season as free stock.

Total availability of oats is estimated 133Kt higher on the year at 1.29Mt. Defra’s final estimate for oat production is 92Kt higher than in 2020/21 at 1.12Mt, but down 25Kt from the provisional estimate.

At 531Kt, H&I usage of oats in 2021/22 is unchanged on last season. Oat miller’s usage is expected to increase marginally, but more due to the exceptional extraction rates achieved last year than a wholesale increase in demand.

In 2021/22, the balance of oat availability and domestic consumption is estimated at 306Kt, 110Kt more than in 2020/21.

Oat exports are forecast at 58Kt, 17Kt more on the year. This leaves estimated closing stocks at 248Kt, 101Kt higher year on year.

In 2021/22 total availability of maize is forecast at 2.25Mt, 0.83Mt less than last season. This is primarily driven by fall in imports.

Full season imports of maize are forecast to be 0.82Mt lower than last season at 2.04Mt. So far this season (Jul-Nov), the UK has imported 0.72Mt, down 41% on the same period last year. But, should maize prices soften later in the season, and the grain become more attractive in price relative to other cereals, we may see imports start to rise.

With domestic consumption not declining at the same volume as availability, the balance of supply and demand is forecast to fall by 212Kt to 320Kt.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.