Yorkshire delivered feed wheat premiums to remain strong? Grain Market Daily

Friday, 7 January 2022

Market commentary

- UK wheat futures (May-22) closed yesterday at £217.50/t, down £3.50/t on Wednesday’s close. The November-22 contract closed yesterday at £190.55/t, down £3.70/t on Wednesday’s close.

- UK prices followed the pressure on both the Paris and Chicago wheat futures, with strong harvests from Argentina & Australia helping to ease global supply concerns a little.

- Argentina’s wheat harvest for 2021/22 is now estimated at 21.8Mt, up from the previous estimate of 21.5Mt. Yields are higher than expected according to the Buenos Aires Grains Exchange.

Yorkshire delivered feed wheat premiums to remain strong?

With the introduction of mandated E10 fuel in the UK since last September and the expected re-opening of the Vivergo bio-ethanol plant at the start of 2022, we need to consider the implications on regional wheat prices in the North East.

Both Ensus and Vivergo plants are expected to be running in 2022. Previous pricing and analysis has shown us premiums extend in this region when demand is high for feed wheat

Premiums in Yorkshire have started strong

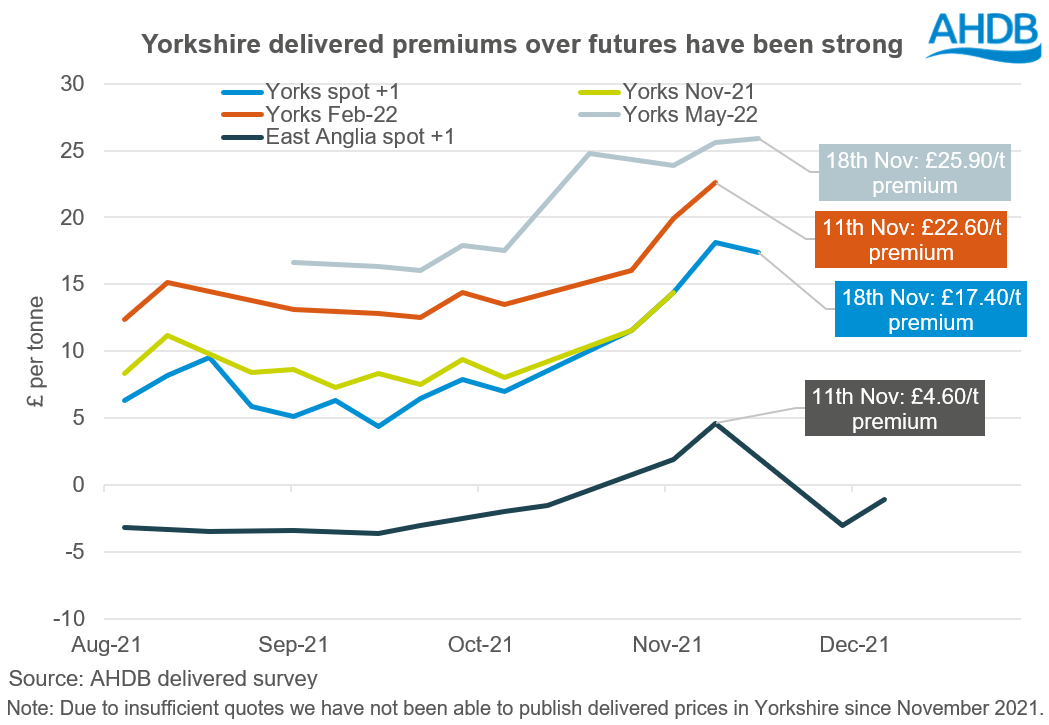

With Vivergo Fuels announcing their reopening back in February 2021, premiums over futures in the Yorkshire region have started strong throughout this marketing year so far, in comparison to East Anglia.

As the graph shows, spot month (+1) delivered into the Yorks started this marketing year at £6.35/t over futures and the Feb-22 spot price was £12.35/t over futures.

Since then, these premiums have extended even further. Based on the latest data we (up until 18th November), these premiums are now £17.40/t and £25.90/t over futures.

To add perspective, at the same point last year (Nov-20) spot premiums into Yorks were c.£7.10/t over futures values.

More than a positive carry

Premiums have extended going into 2022 for delivery into Yorks since the start of this marketing year. This is due to expectations that demand will be higher in this region from the beginning of the year.

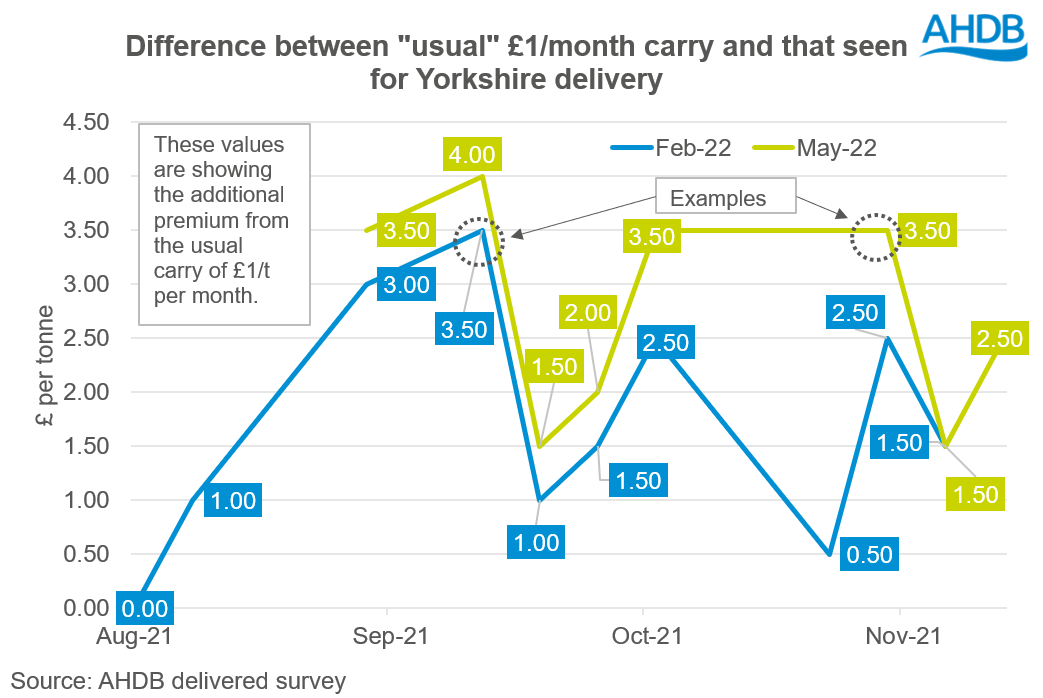

The graph above shows so far throughout this marketing year, the delivery prices for Feb-22 and May-22 into Yorkshire has an extended carry from the conventional £1.00/t per month.

For example, in September the carry for delivered feed wheat from spot to Feb-22 should have been c.£5.00/t. However, in our delivered survey there were quotes for a £8.50/t carry, offering an additional £3.50/t on top of the usual carry.

Another example, in November the carry for delivered feed wheat from spot to May-22 should have been c.£6.00/t. However, in our delivered survey there were quotes for a £9.50/t carry, offering an additional £3.50/t on top of the usual carry.

Premiums to remain strong?

If both plants are running successfully for the second half of this marketing year, we could anticipate that delivered values will remain strong in this region. Since the start of 2021/22 marketing year, delivered values have been pricing in that demand is expected to increase in this region.

What could also drive premiums up are complications around haulage, which could further offer support.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.