Threat of higher input costs for 2022 crops: Analyst's Insight

Thursday, 12 August 2021

Market commentary

- Nov-21 UK feed wheat futures closed at £189.45/t yesterday, down slightly (£0.30/t) from Tuesday as stronger sterling offset rises in Paris wheat futures. Sterling reached its highest level against the euro since February 2020 yesterday, at £1 = €1.181 (Refinitiv).

- Paris wheat futures Dec-21 contract gained another €2.00/t to €239.75/t yesterday as rain continues to delay European harvests. Questions over quality are growing. IKAR also cut 1.5Mt from its estimates of the Russian wheat crop to 77.0Mt.

- However, US wheat futures were almost unchanged. There is hesitation ahead of the key USDA world supply and demand estimates, which will be released tonight (5pm BST).

- Paris rapeseed futures also rose. The Nov-21 contract gained €7.50/t to close at €553.00/t (approx. £468/t).

Threat of higher input costs for 2022 crops

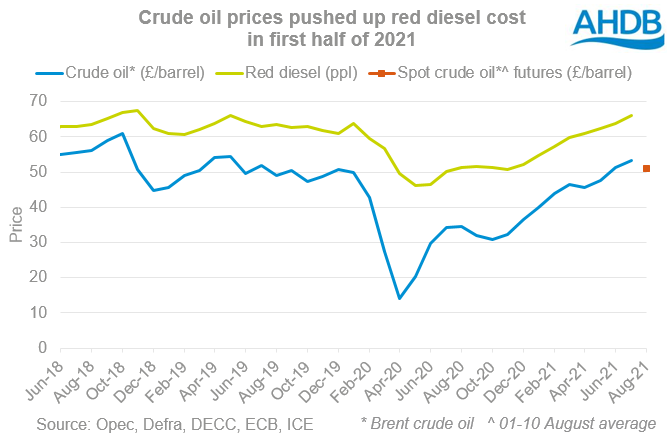

Planting of winter crops for harvest 2022 is already underway, but higher costs of key inputs could challenge their margins. In recent months, the price of crude oil and natural gas has risen considerably. This points to higher prices for red diesel and ammonium fertilisers (made from these commodities) than for the 2021 cr op.

UK feed wheat futures and Paris rapeseed futures prices for the 2022 crops are up from where they were earlier in the year. However, they are still well below the current prices for the 2021 crops, and no way of knowing how they will evolve.

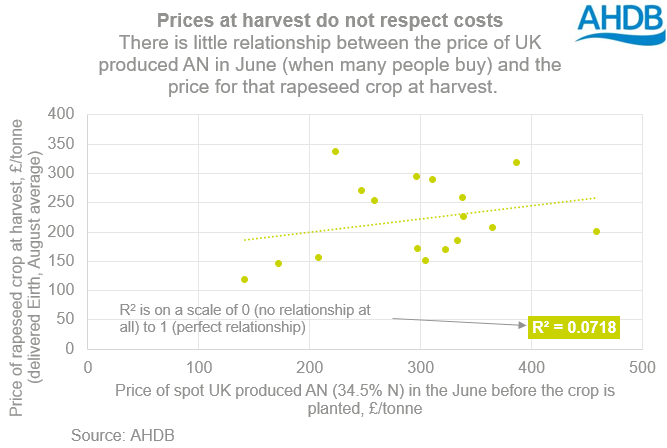

There is a link between spot grain prices and spot ammonium nitrate (AN) prices. Higher grain and oilseed prices give an incentive to expand areas or chase higher yields. But, there is very little relationship between input prices in the June/July before a crop is planted (when many price their fertiliser) and the prices for the crop when it’s harvested.

Unless the 2022 crop prices rise by similar amounts to input costs, the rise in input prices poses a threat to margins. Having a budget can help keep a handle on the impact of changes to costs on the potential margin. In AHDB’s FarmBench it’s possible to create a budget for the year ahead.

There is more on the latest situation for two key inputs, red diesel and ammonium fertiliser, plus what might be around the corner, below.

Red diesel most expensive since Nov-18

It won’t surprise anyone that there is a strong relationship between Brent crude oil spot prices and UK red diesel prices.

In July, the average price for red diesel was 66.0ppl. This is 31% higher than a year earlier and the highest price since November 2018. Nearby Brent crude oil prices reached a peak of $77.16/barrel on 5 July, the highest price since October 2018. Economic growth and people traveling more as COVID-19 restrictions ease, especially in the US, pushed up demand. Yet, oil production by the OPEC countries and their partners was still curtailed.

Nearby crude oil prices eased back in July after OPEC+ agreed to boost production. However, prices remain volatile. There’s concern that higher oil prices could stall the global economic recovery. The impact of new COVID restrictions in Asia, especially China, on demand is also a worry.

These concerns, plus the phase-in of higher production by OPEC+ countries means prices for forward delivery are lower than the spot price. The forward prices are still relatively strong, but might temper the possibility for futures rises in diesel prices.

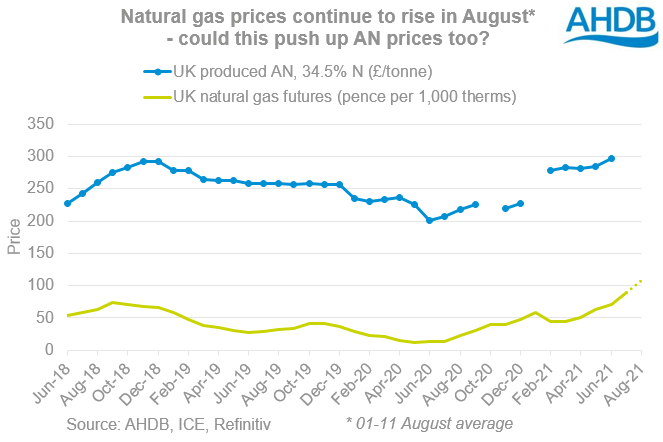

Fertiliser prices up sharply from 2020

The prices of key fertiliser products have all risen in 2021. For example, in June, the average spot price for UK produced AN (34.5% N) was 49% higher than in June 2020. This is the highest price reported by AHDB since our survey began in 2017. It is also the highest price since April 2014 based on historic data from Farm Brief.

Natural gas represents 60-80% of the variable input cost in the production of nitrogen fertiliser (EU Commission). Unfortunately, natural gas prices have soared in 2021. ICE’s UK natural gas futures (nearby contract) reached its highest since 2005 at 114.46 pence per 1,000 therms yesterday (Refintiv). This is also 4.6 times the price a year ago (11 August 2020).

The cold start to spring 2021 ran down natural gas stocks in Europe. Production is down in Europe and one Europe’s top producing locations in the Netherlands may close for good this year. There are also lower imports from Norway and Russia.

At the same time, demand for natural gas is rising. This is partly as economies recover from COVID but also due to the need to meet emissions targets. Gas is a ‘cleaner’ fuel than coal. Many countries around the world are cutting coal usage, but are still building their renewable energy production. So, they are now using more gas. In addition, the global goal to reduce usage of all fossil fuels means there is less incentive to invest in new gas supply.

As a result, the latest futures prices for natural gas through the coming winter are even higher than spot prices. Prices for next spring (March onwards) and summer are lower than spot prices, but they are still relatively high.

Things could change as the autumn and winter progress but the current outlook is for the cost of natural gas to stay high. As a result, it seems unlikely that prices for ammonium fertilisers will ease for a while and could rise further.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.