The regional divergence of processing and production

Thursday, 20 February 2020

By Patty Clayton

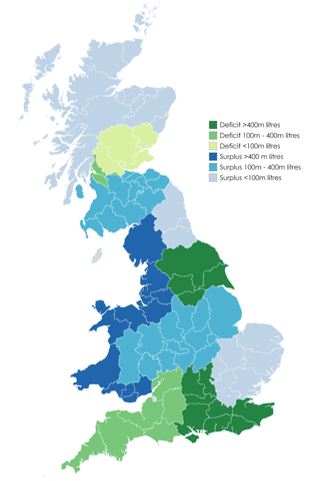

In recent years, both Scotland and Wales have seen increasing surpluses of milk as production growth has surpassed the ability to process the milk. The closure of some processing plants has added to the growth of these regional surpluses, increasing the volume of milk being transported to England.

In contrast, investments in processing capacity in England have outpaced production growth. Between 2014/15 and 2018/19, production in England increased by around 1% (78m litres), compared to 4% in Scotland and more than 9% in Wales. Processed volumes In England increased by an estimated 210m litres (2%) over this time, partly as a result of the increased volumes arriving from Scotland and Wales.

As with Scotland and Wales, there are some regional imbalances in England, as processing investments have not always matched regions of milk production growth.

While it appears that there is significant excess processing capacity in some areas of England, this provides the ability to handle the surplus volumes coming in from Wales and Scotland[1].

What has happened at a regional level?

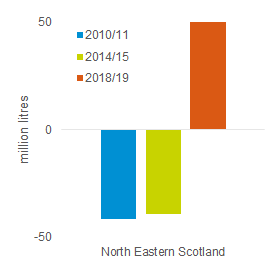

North Eastern Scotland

Here, the reduction in processing has been the reason for the switch from being a net importer of milk for processing to a net exporter of milk. Milk deliveries in the region have remained stable over the period.

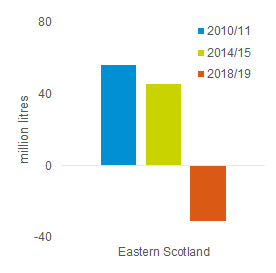

Eastern Scotland

A deficit in milk has developed in this region as increases in processing have occurred while milk production has dropped by around 8% (11m litres).

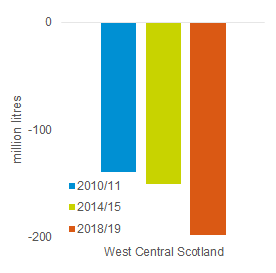

West Central Scotland

The deficit in milk has grown between 2010 and 2018 as processing has increased while milk production has remained relatively static.

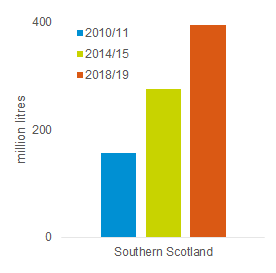

Southern Scotland

Milk production in this region is estimated to have increased by 25% in the period between 2010 and 2018, equivalent to around 230m litres. While processing grew marginally between 2010 and 2015, it has fallen since, contributing to the rising surplus.

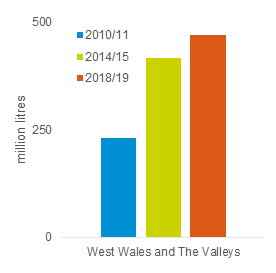

West Wales and the Valleys

Milk production has grown here by 29% between 2010 and 2018, amounting to more than 300m litres of additional milk. There was minimal additional processing added until after 2014, which meant the surplus initially grew considerably. Between 2014 and 2018, processing increased by just under 100m litres, which helped to absorb some of the growth in farm deliveries, although not all.

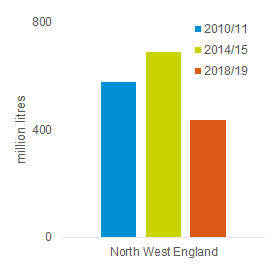

North West England

Milk production has grown steadily in the North West, rising by 10% between 2010 and 2018. Investments post-2014 has helped to reduced the surplus to an estimated 385m litres in 2018.

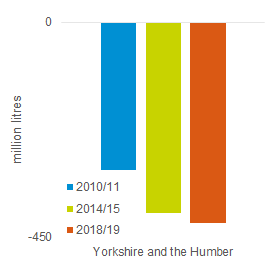

Yorkshire and the Humber

Milk production dropped by an estimated 20m litres (3%) between 2010 and 2018. Processing remained relatively unchanged meaning the deficit has increased over that time.

West Midlands

Processing and production volumes moved in opposing directions between 2010 and 2014, with production growing and processing decreasing. As a result the milk surplus increased.

The opposite then occurred in the next four years, with production dropping while processing increased.

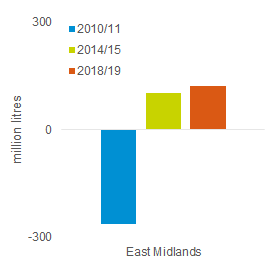

East Midlands

Plant closures between 2010 and 2014 meant the region moved into a surplus position, which has been maintained as milk production has seen only minimal growth.

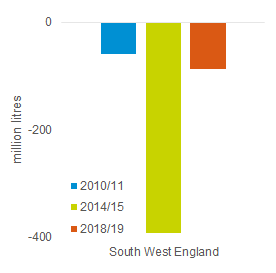

South West England

While milk production has been steadily increasing in the region between 2010 and 2018, large investments in processing capacity between 2010 and 2014 pushed this region into a deficit position. Since then, there has been some reduction in processing, reducing the deficit.

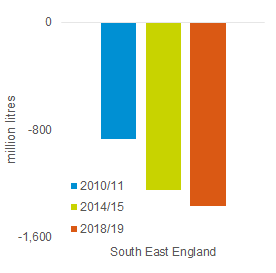

South East

Large investments in processing capacity between 2010 and 2015, with steadily declining milk production have led to the growing deficit in this region. The deficit is currently estimated at 1.4bn litres per year.

[1] Scottish and Welsh milk will not necessarily be processed in these regions, but the spare capacity provides the ability for all GB milk to be processed.

Sources: Defra, Eurostat, AHDB estimates

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.