- Home

- News

- The financial impact of COVID-19 market disruption and production reduction measures on dairy farms

The financial impact of COVID-19 market disruption and production reduction measures on dairy farms

Tuesday, 28 April 2020

By Mark Topliff and Kate Parkes

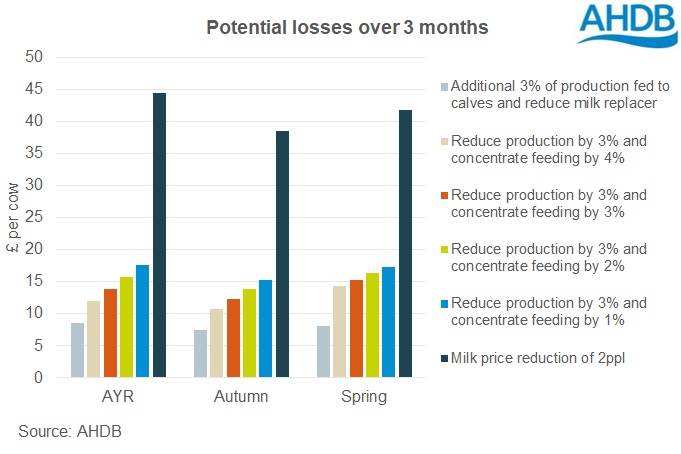

Several dairy processors have reacted to the impact of COVID-19 disrupting the markets by announcing various measures such as reducing the milk price and/or production levels for a period of time. In this analysis, the greatest negative financial impact to dairy producers would come from a reduction in their milk price for 3 months. In contrast, diverting more milk output to feeding calves and reducing milk replacer costs, would have the smallest impact over the same period. This is on the back of the middle 50% of British all-year round calving herds, on average, having negative net margins according to the latest AHDB costings.

As the reduction in milk price would affect the total output from farms this would have the biggest loss with all else being the same. A 2ppl drop in price for 3 months would mean around a £38 to £45 per cow loss depending on the system. In the scenario where a producer is asked to reduce production by 3%, there is some cost saving to be made with a reduction in concentrate fed thus mitigating some of the financial impacts. However, it is estimated that the net loss would still be in the range of £11 to £18 per cow.

There are various options for how milk output can be reduced. Reducing feed rates is one option. Targetting cows or groups where it will have the lowest impact such as by stage of lactation or lowest yields. Careful management would be required to make sure a drop in concentrate isn’t substituted by more of another feed e.g. grazed grass so potentially having little effect on reducing yields. Or potentially affect health or future fertility.

If a farm was put in the situation of a 2ppl reduction in milk price, forced to dispose of 2 bulk tanks on every other day collection and feeding 3% of milk output to calves over a 3 month period, the net loss could be in the region of £70 to £82 per cow.

About the figures

- Base data is 2018/19 farm accounts data from Promar International and Partners updated using the latest market prices available, to provide estimated figures for the 12 months to January 2020

- Data used in the model is from the middle 50% of farms in terms of financial performance

- Milk price used is 29.15ppl - the latest available Defra GB average (excluding bonuses) for January 2020

- Youngstock heifer rearing revenue and costs are included

- Decoupled subsidies are excluded

- Three month period modelled is April-June using a typical seasonal profile of milk production

- Any additional costs for disposing of milk have not been included

- Reductions in concentrate feeding have been modelled at a range of levels, to reflect the fact this will vary between farms and take time to reduce

- Savings on calf milk replacer have been included and costings for this are based on Alana Bolton’s research as part of the AHDB Calf-Calving programme and Volac’s feeding guide

Listen to our podcast about the effect of Coronavirus on the dairy industry

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.