Speculative risk to prices? Analyst's Insight

Thursday, 28 January 2021

Market commentary

- UK feed wheat futures May-21 prices closed at £208.40/t yesterday, down £0.10/t on Tuesday. Meanwhile, the Nov-21 contract lost £0.35/t to close at £165.90/t.

- The dip follows a decline in the US maize and wheat futures, as a stronger US dollar made US goods less attractive in export markets. Profit taking by speculative traders was also reported to be a factor.

- In contrast, soyabean futures rose due to good demand for US soyabeans. This, and a weaker euro against the US dollar, helped Paris rapeseed (May-21) to gain €4.75/t to €436.75/t.

- The Deputy Chief Economist at the USDA expects US farmers to plant more soyabeans and more maize this year due to the higher prices. In November, the USDA projected US farmers would plant more soyabeans but less maize. Their forecasts will be updated next month.

Speculative risk to prices?

Global grain and oilseed prices rose through the latter part of 2020. Dry weather raised questions about South American crop prospects, while import demand from China was strong.

Speculators buy in

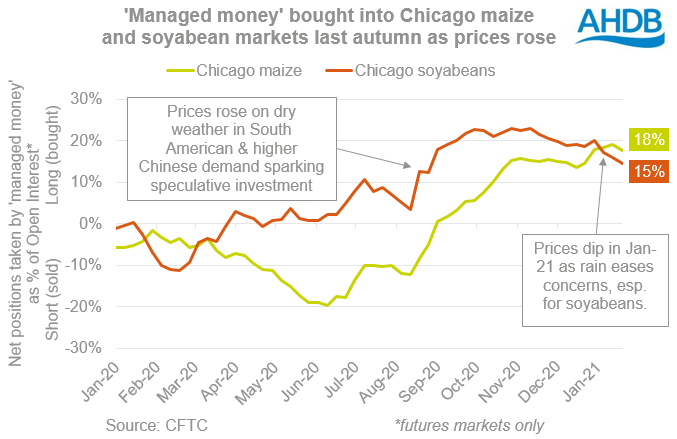

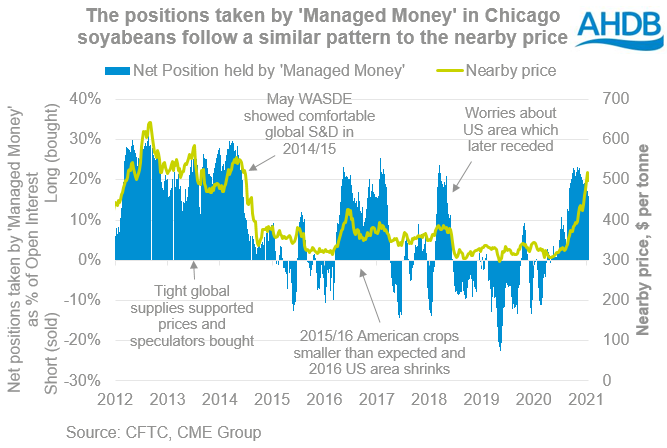

As prices rose, speculative traders bought into the Chicago maize and soyabean futures markets. This enabled trades to happen and may have also added to the speed or extent of the price rise. This matters for us as UK prices followed global prices higher.

The overall or ‘net’ positions held by ‘managed money’ is shown below. The net long positions held in Chicago soyabeans in late 2020 were the highest since early 2018. Meanwhile, the net long positions held in Chicago maize in mid-2020 are the largest since mid-2016.

Rain cools sentiments and prices dip

Recent rain has improved crop conditions in South America and cooled some of the worry about global supplies in the later part of the 2020/21 season. We are still a long way from knowing if enough rain fell and so the final size of the 2020/21 crops.

But this easing of concerns has been enough to push Chicago soyabean prices down. Between 14 and 22 January, the May-21 contract lost nearly $43.00/t, or roughly £31.85/t.

Chicago maize futures fell by less; $13.68/t (roughly £10.27/t) over the same period. This is potentially because there is more risk to South American maize production than soyabeans. The largest maize crop in South America, the Brazilian Safrinha crop, is just starting to be planted. In contrast, the vast majority of soyabeans are planted and growing.

Long positions can be profitable for speculative traders when the market rises. Conversely, speculative traders can profit from short positions when prices fall. Holding a long position in a falling market often means losing money, at least in the short term, so it makes sense that recently the Managed Money have reduced the long positions they hold.

This sell off may have contributed to the speed or extent of the recent falls in price.

Risk remains as we look to where next

The current risk is that the Managed Money still hold relatively large net long positions in Chicago soyabeans and large long positions in Chicago maize futures.

This means there’s a sizeable risk if prices fall again. If prices fall and speculative traders hold long positions, they could be at risk of losing money so they may choose to sell some of these positions. This could again add to the speed or extent of the fall. Any fall in the US markets could drag UK grain and rapeseed prices lower.

On the flip side, these are far from the largest long positions held by speculative traders. So there could be room for them to buy more if more bullish news emerges, but currently the market has a more considered feel. It would need fresh news about smaller crops or higher demand to push prices higher.

Speculative traders can, and do, influence grain and oilseed prices in the short term. But after the initial surge or fall, it is supply and demand that ultimately determines market direction.

Some of the next key things to look out for are:

- South American crop conditions and harvest results

- Chinese import demand

- Whether La Nina lasts after February, as some forecasts suggest may happen. This could support the Brazilian Safrinha crop yields.

- US planting intentions published on 31 March.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.