Spanish pork exporters diversifying

Wednesday, 15 June 2022

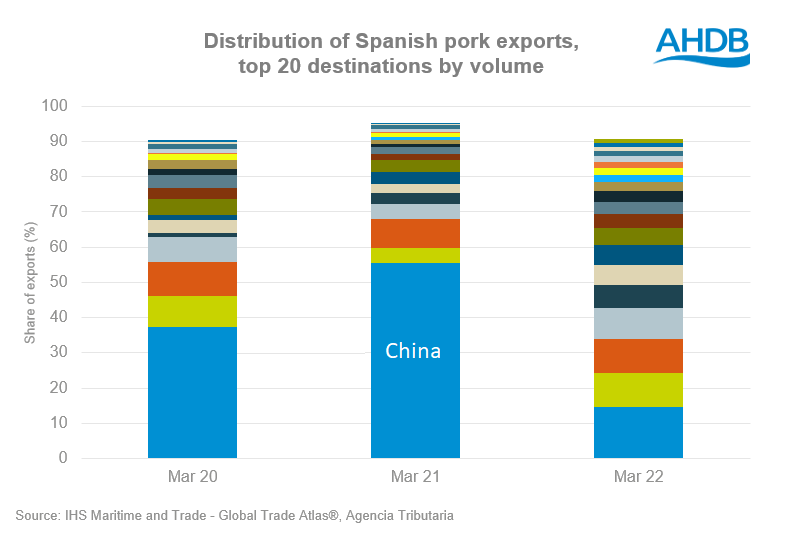

A long running theme in the European pig meat sector has been the ascendency of Spanish production. Pig meat production in 2021 was over 5 million tonnes, compared with less than 3.5 million tonnes ten years ago. Much of the more recent expansion has been underpinned by exports, to China in particular. However, as demand from that market has faltered of late, Spanish pork has been finding demand at home and elsewhere.

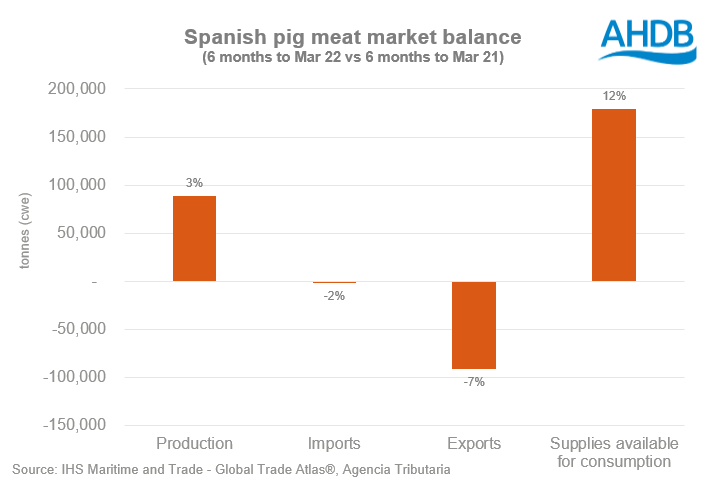

Production has grown so far this year, even with widespread challenges in rapidly rising costs of production, although we might now at least expect a slight seasonal downturn in clean pig availability.

By adding together production and imports (of which there are very little) and taking away export volumes, it’s possible to get an indication of changes in supplies available for consumption on the domestic market (including changes in frozen stocks). This would suggest that in the six months to March, more Spanish pork may have been consumed at home, although there are still reports that pork in store is still plentiful.

Spain has somewhat led the rapid rise in European pig prices seen in recent months, as Spanish abattoirs have hotly competed for pigs. We would also typically expect a draw on frozen inventory in these circumstances.

A notable feature of Spanish exports is how they have apparently become much more diversified since volumes to China have reduced. While the top 20 destinations still accounted for around 90% of total exports in March 22, as they did in the same month a year earlier, more recently most markets have each taken a greater and more equal share.

Notable expansion has taken place in trade with Italy, Poland, South Korea, Japan and the Philippines. In March 2022 the UK imported 6,000 tonnes of Spanish product compared with 3,000 tonnes a year earlier.

Overall export volumes are somewhat lower of course, 1.24 million tonnes in the six months to March 2022 compared with 1.33 million tonnes in the six months to March 2021. However, we can say that Spanish exporters have obviously been working hard to find new homes for pork possibly originally intended for the Chinese market, with remarkable success.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.