Soyabeans to keep rapeseed supported short term? Grain market daily

Friday, 17 February 2023

Market Commentary

- UK feed wheat futures (May-23) closed at £240.75/t yesterday, down £1.25/t from Wednesday’s close. The Nov-23 contract closed at £236.75/t, down £1.75/t over the same period. UK prices followed the movements in Paris and Chicago wheat markets.

- European wheat prices fell to a one-week low yesterday on continued pressure from competitive Black Sea exports and weakness in the Chicago market.

- Yesterday the International Grains Council cut their forecast for 2022/23 global maize production by 8.5Mt, with the estimate now at 1,153Mt. With the cut mainly driven by the US (-5.1Mt) and Argentina (-2.5Mt).

- Paris rapeseed futures (May-23) followed the US soyabean market up yesterday, closing at €553.25/t, up €3.00/t from Wednesday’s close – read more below to what’s been driving this.

- The latest Food & Farming podcast is now live discussing the latest cereals and oilseed Agri Market Outlooks.

Soyabeans to keep rapeseed supported short term?

Over the past few months, we have been discussing the weather in South America, which at times has been repetitive. Although this continent is over 5,000 miles away the fields of East Anglia, it really will continue to impact the price that you receive at the farm gate for your rapeseed. Rapeseed and soyabean values has effectively converged since around October 2022, and soyabeans to some extent are propping up rapeseed prices currently.

Currently spot prices (into Erith, Feb-23) of rapeseed are still high based on historical values, published at £476.00/t last Friday in our delivered survey, with harvest prices matching this. The EU is well supplied for this marketing year and is importing lots of Ukrainian and Australian rapeseed/canola, and new crop rapeseed is currently faring well, so can this support continue?

South American focus

Well, this is the point where we continue talking about soyabeans and Argentina’s drought, which is still on-going and providing that floor to the market. Yesterday, Buenos Aires Grain Exchange announced that there will be additional cuts to their soyabean crop estimate. They currently estimate this crop at 38Mt, down from 48Mt estimated at the start of the cropping cycle, but additional cuts are expected from the prolonged drought they are experiencing.

To start with, farmers had delays on getting this crop into the ground due to the drought. Now continued above-average temperatures are impacting the sown crop development, in the key farming regions in the North of the country.

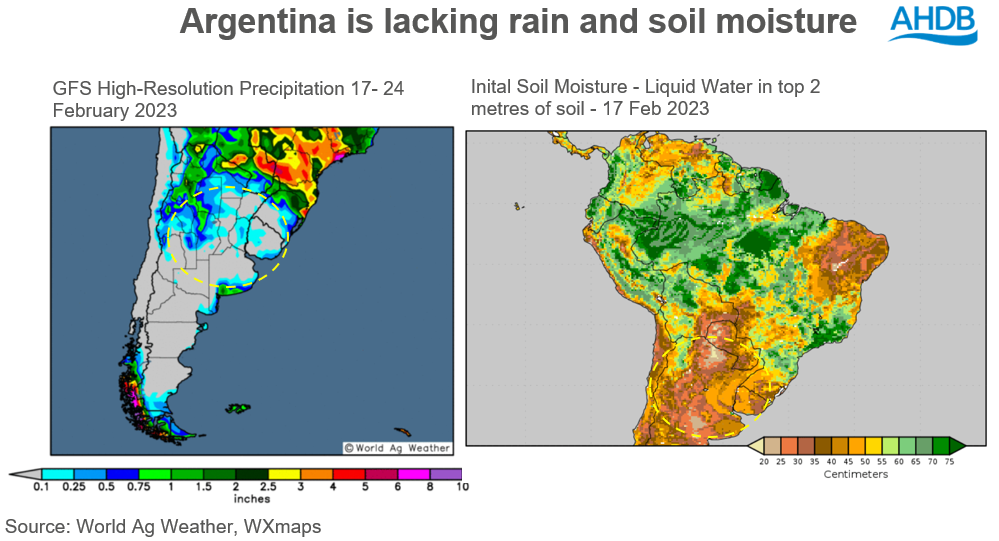

Over the next seven days rains continue to be patchy, and initial soil moisture in parts is as low as 20-25cm (liquid water in the top 2 metres of soil), this will continue to negatively impact this crop. Further to that, early frosts in the coming days could further impact Argentina's soya and maize crops in the south of the country's main farming region.

Moreover, Southern parts of Brazil have also been impacted by this dry weather, especially in Rio Grande Do Sul. Yesterday, AgRural revised down their Brazilian soyabean crop from 152.9Mt to 150.9Mt, citing that drought in Southern Brazil is contributing to this revision, please note though this crop is still very large.

Where now for the market?

The oilseed market remains focused on this Argentinian soyabean crop revision, which is keeping rapeseed prices supported somewhat. However, bear in mind that a risk premium for this La Niña impact has been priced into soyabean markets, building for months. Though, if these revisions are larger than expected we could see support continue short term.

However longer term, the large Brazil crop can still weigh on the oilseed complex which could give rapeseed prices that room to drift lower in the coming months.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.