Smallest EU-27 wheat crop since 2018: Grain market daily

Friday, 9 August 2024

Market commentary

- Nov-24 UK feed wheat futures closed at a two-week high of £192.75/t last night, after the contract gained £0.65/t from Wednesday’s close. Meanwhile, the Nov-25 contract closed at £196.00/t, up £0.15/t from Wednesday.

- European wheat futures have edged higher this week. Concern about European production (read more below), as well as international tenders and stability in Russian export prices is for now offsetting pressure from US maize markets. Nearby Chicago maize futures fell to their lowest level in nearly four years (30 September 2020) yesterday.

- Nov-24 Paris rapeseed futures rose €9.00/t yesterday to settle at €469.00/t (approx. £404.00/t) due to rises in soy oil and crude oil futures prices. The contract has now made back most of Monday and Tuesday’s losses. Nov-25 Paris rapeseed futures remain slightly below current season prices, closing at €462.00/t (approx. £398.00/t) yesterday.

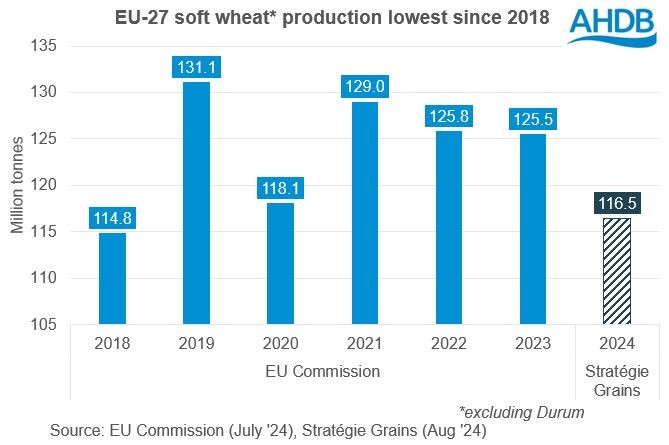

Smallest EU-27 wheat crop since 2018

European wheat production estimates have fallen this week, as yields continue to be poorer than expected in top producers France, and Germany. This follows persistent rain through key periods for crop development and harvest. Lower estimates this week from private forecasters, the USDA’s Foreign Agricultural Service (FAS) and the French and German governments show the challenging picture.

Across the EU-27, soft wheat production (wheat exc. Durum) is now pegged at just 116.50 Mt by Stratégie Grains. This is 5.8 Mt lower than the company’s previous projection and would be the smallest crop since 2018 (114.8 Mt, EU Commission). The company also highlighted quality concerns.

This morning, the French government cut its estimate of the country’s soft wheat crop by 3.3 Mt to 26.3 Mt. This is down 25% from 2023 and is the smallest crop since 1987. Argus Media is even more pessimistic, putting the crop at 25.2 Mt. Better weather over the past week has helped the French wheat harvest, reaching 88% complete by 5 August, but progress is still eight days behind average (FranceAgriMer).

Rain has also delayed Germany’s harvest, with anecdotal reports of lower yields and protein contents but also notable regional variation. The German Statistics Office put its first estimate of the 2024 wheat crop at 19.7 Mt, down from 21.5 Mt in 2023 and the lowest since 2003.

Barley and maize estimates also reduced

At 50.6 Mt, Stratégie Grains’ latest estimate for the EU-27 barley crop is still above 2023’s very small crop. But it is now below the five-year average. Both the FAS and Stratégie Grain put maize production at around 60 Mt and below last year’s crop. This is despite a larger area, and is due to the heatwaves in Eastern Europe.

Market impact

The smaller EU crop numbers are offering some support to prices, wheat in particular. The outcomes of numerous international tenders could influence price direction going forward. Further clarity on quality will be important for milling (and malting) premiums.

However, a positive US maize outlook is limiting gains in feed grain prices and could yet bring more pressure. US national weather service confirmed yesterday that average temperatures across the ‘Corn Belt’ (weighted by productivity) were below the long-term average. This is typically associated with US yields being close to, or above, their long-term trend; the USDA currently predicts the 2024 yield just below the long-term trend. The market is expecting the USDA to increase its yield forecast in Monday night’s World Agricultural Supply and Demand Estimates.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.