Maize supplies in focus: Grain market daily

Tuesday, 6 August 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £192.05/t yesterday, up £1.85/t from Friday’s close. The May-25 contract ended the session at £203.35/t, up £1.25/t over the same period.

- Domestic wheat prices followed US wheat futures up yesterday, largely on the back of short coverings, and steady harvest progress in Western Europe. However, support is limited by welcomed rains in Argentina, as longer-term focus shifts to Southern Hemisphere crop development.

- Paris rapeseed futures (Nov-24) fell €18.50/t yesterday, closing at €453.75/t. The May-25 contract ended the session at €456.00/t, down €17.25/t from Friday’s close.

- European rapeseed prices did not follow movement in the wider oilseeds complex yesterday. In both grain and oilseed markets, European prices moved slightly differently to US and domestic futures due to a strong Euro, and economic fears in financial markets.

Maize supplies in focus: Grain market daily

Winter wheat harvest is now nearing completion across parts of the Northern Hemisphere, and any adverse weather will likely have minimal impact on the remainder of the wheat crop at this point in the season. As such, with a forecast tighter wheat balance in 2024/25, and therefore expectations of a greater dependency on maize, focus has turned to maize crop conditions and development.

Both in the US and across much of Europe, maize crops will now be in their silking or dough phase. At these phases, the crop is very sensitive to moisture or temperature stress, and therefore weather across key growing regions is a watch point.

US maize in good condition

According to the USDA’s crop progress report released yesterday evening, 88% of the US maize crop had reached the silking phase (in line with average). In total, 46% of the crop has reached the dough phase, ahead of the five-year average of 38% for this point in the season.

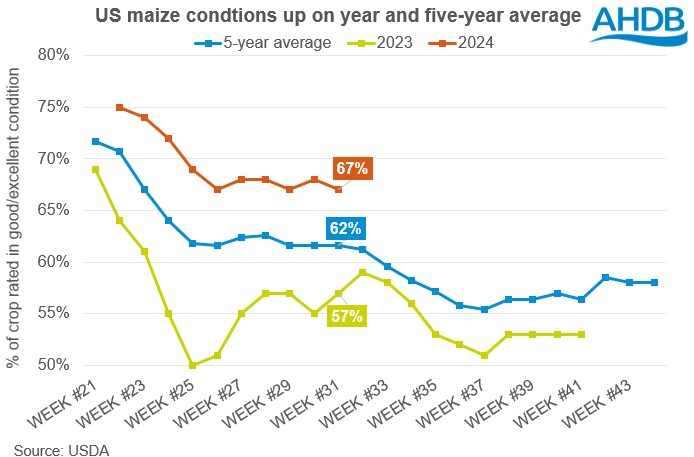

In terms of conditions, as at week ending 4 August, 67% of the maize crop was in good or excellent condition, up from 57% last year, but down from 68% last week. This remains well above the five-year average of 62%.

Looking ahead, forecasts of cooler and wetter weather across key growing regions could be beneficial to the crop over the coming week.

European maize in poor condition

While US maize is looking well, concerns are growing over European conditions. A Ukrainian producers group said yesterday that a record heatwave in July could reduce the 2024 maize harvest by about 6 Mt from last season.

Other parts of Eastern Europe have also suffered, with yield forecasts in Bulgaria, Hungary and Romania all cut in the most recent MARS report.

Looking ahead, temperatures look to remain higher than normal over the coming week in Eastern Europe, though rain is due in some areas which could offer some relief to the crop.

What does this mean for UK wheat growers?

As previously mentioned, due to expectations of tighter global (and domestic) wheat supplies this season, it is likely we will see some demand shift to maize. As such, any change in price direction for maize markets will likely impact wheat.

If we see further hot and dry weather across Eastern Europe, we could see some support in markets, with further impact on yield prospects. However, this support will likely be balanced out, or at least capped by the good conditions and forecast bumper crop in the US. Something to keep an eye on over the next few weeks.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.