What could high temperatures mean for European maize crops? Grain market daily

Tuesday, 30 July 2024

Market commentary

- Nov-24 UK feed wheat futures fell £2.60/t yesterday to settle at £189.90/t. The May-25 contract lost £2.75/t to close at £201.25/t over the same period.

- Yesterday, UK feed wheat and Paris milling wheat futures were pressured as competitive exports from Russia continue to weigh on prices. However, Chicago wheat futures gained on strong demand and repositioning ahead of the USDA’s crop progress report. According to the USDA report, spring wheat condition (good to excellent) was rated 74%, down from 77% a week ago, and below analyst expectations of 75%.

- Nov-24 Paris rapeseed futures settled at €476.50/t yesterday, down €3.75/t from Friday’s close. The May-25 contract also lost €3.75/t yesterday, to close at €479.25/t. Rapeseed prices followed Chicago soyabean futures lower.

- Soybean prices fell to a fresh three-year low yesterday on forecasts of favourable weather across the US Midwest, suggesting a potentially bumper harvest (LSEG). Also, slow export sales in the US have raised concerns about demand.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

What could high temperatures mean for European maize crops?

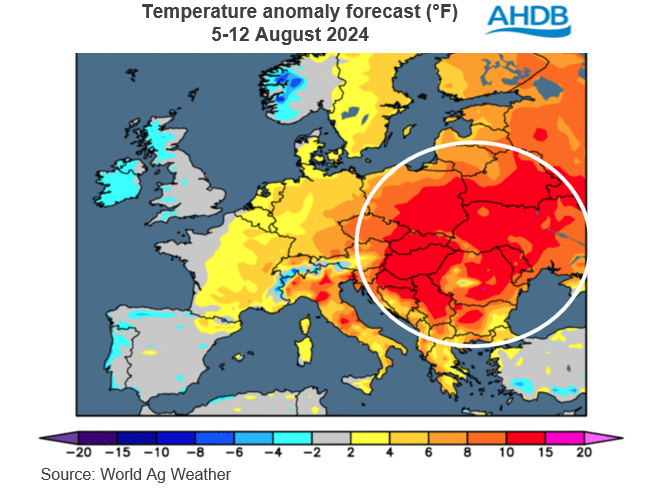

The hot and dry weather in Eastern Europe as of late has raised concerns over the development of maize crops in the region. Historically, high temperatures can be linked to reduced maize yields, especially when crops are in their critical yield forming stages.

Last week, the European crop monitoring firm, MARS, reported that unusually hot weather (often above 35°C) and little rain has significantly affected summer crops during flowering. This resulted in a lower yield estimate than previously expected. MARS trimmed its maize yield forecast for the EU-27 2024 harvest to 7.24 t/ha, down from the 7.55 t/ha estimated in June.

Ukraine has experienced one of its warmest periods on record, with dry conditions in the south since mid-June. As a result, consultancy firm ASAP Agri cut its forecast for the 2024 Ukrainian maize harvest by 5.0 Mt to 24.1 Mt last week.

The situation is not different in Russia, where hot and dry conditions have again impacted the development of the country’s maize crop. Agricultural consultancy firm SovEcon, lowered its 2024 production estimate for Russia by 1.2 Mt to 13.4 Mt due to persistent dry and hot weather in the south.

Similarly, in other regions of eastern Europe including Bulgaria, Hungary and Romania, yield forecasts were cut in last week’s MARS report. Yield estimates were lowered by 15% in Bulgaria, 14% in Hungary and 10% Romania when compared to June’s forecasts.

Weather forecasts also point to a continuation of hot and dry conditions in key growing areas, raising the chances of further reductions to yield predictions.

What does this mean for global grain prices?

This season, EU-27 maize production is projected to reach 62.87 Mt. While this represents a 0.3% increase on the year, it remains 3.7% below the five-year average. As the weather looks more unfavourable in the coming days, more reductions are possible.

The EU’s position as a major global maize producer means that the ongoing hot and dry weather could have implications on global supply. However, maize crop conditions in the US are currently favourable with global ending stocks also projected to rise, meaning prices are moving relatively sideways at the moment.

Given the tight wheat outlook this season, some feed demand is expected to shift towards maize. As a result, fluctuations in global maize prices are likely to influence wheat prices. As such, if further revisions are made to the EU crop, any support in prices could in turn filter through to domestic wheat price direction. Something to watch over the coming weeks.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.