Smaller UK oat crop despite area rise: Grain market daily

Friday, 30 October 2020

Market commentary

- Most global grain and oilseed prices eased again yesterday due to continuing concerns about the economic impact of measures to combat rising coronavirus cases. The measures could also reduce demand for biofuels as people again travel less and result in less demand for the products used to make them. Selling pressure by speculative traders was also reported as a factor.

- These worries more than outweighed very large weekly export sales of US wheat and maize, plus the IGC trimming its forecast of global maize production in 2020/21.

- UK feed wheat Nov-20 futures closed at £187.00/t, down £0.65/t from Wednesday’s close. However, the Nov-21 contract only declined by £0.05/t to £157.60/t.

- Paris wheat was the main exception to the global trend. Because the euro weakened after news from the European Central Bank, the Dec-20 futures contract rose €1.00/t to €205.00/t.

Smaller UK oat crop despite area rise

2020 crop pegged at 1.016Mt

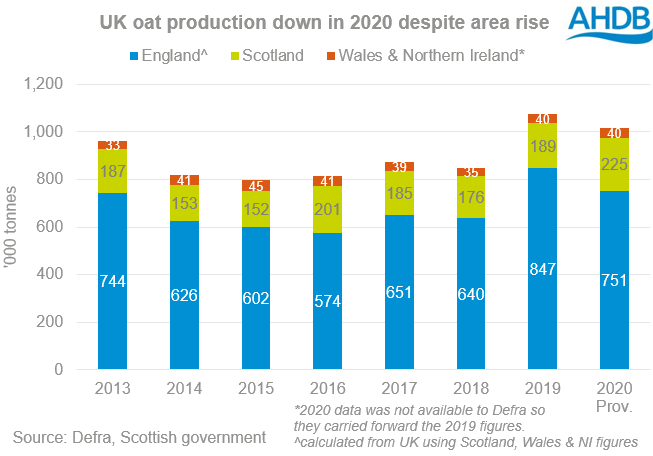

Despite the UK oat area rising 16% in 2020 to 211Kha, we’ve provisionally harvested a 6% smaller crop than last year at 1.016Mt. However, there’s also markedly different pictures in England and Scotland.

The English area is up 19% from 2019, but production is provisionally down 11%. This is down to challenging growing conditions for winter oats, which likely limited yields, plus more spring oats being sown after the wet autumn limited all winter cropping. Spring oats generally yield lower than winter oats.

There is also uncertainty over production in Wales and Northern Ireland. As these figures won’t be available until later in the year, Defra carried forward the 2019 production figures instead.

In contrast, the Scottish government report a 7% rise in area and a 19% rise in production, due to strong oat yields. If confirmed this would be the largest Scottish oat crop in recent years.

While the 2020 crop is far smaller than was feared earlier in the year, it’s still relatively large. This, plus the improved quality of the crop, is keeping spot ex-farm milling oat prices subdued. However, it’s important to remember the milling oat market is driven by contract growing, where pricing is based on UK feed wheat futures prices and spot prices bear little relation to these values.

Lower stocks cushion too

In 2019/20, the largest crop in the 21st century was harvested. However, by the end of the marketing year on 30 June 2020, stocks were estimated to be 9% below the June 2019 level at 106Kt. The main reasons for this were increased domestic consumption and the largest volume of exports since 2002/03 at 120Kt.

This said, there’s some uncertainty over the stock figure because of concerns over the data showing amount of oats held on-farm. Defra estimate that 24Kt of oats were on farms in England and Wales at the end of June 2020 but the confidence interval was very wide at 37Kt. This means on-farm stocks could have been much higher or lower than 24Kt and so we are wary over this data.

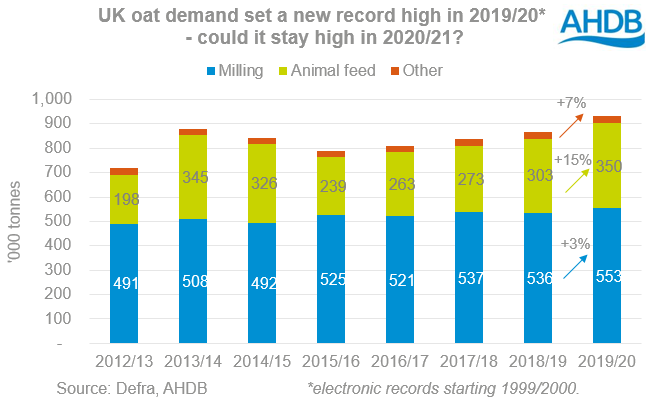

Domestic consumption was up 8% on the year, with milling demand up 3% to 553Kt after being relatively stable in 2018/19.

Could animal feed usage stay high?

Wheat is the main grain used as animal feed in the UK and the small size of the 2020 crop poses a challenge. Barley is being used wherever possible due to its greater availability and price discount to wheat.

Last season, an estimated 350Kt of oats were used as animal feed, an increase of 16% year on year and highest on our records back to 1999/2000. Spot ex-farm feed oat prices continue to offer incentive to use where possible so we potentially could see the amount of oats used as animal feed remain high.

Animal feed usage could be particularly important later in the season, if our exports of oats are impacted by changes to the UK’s trading relationship with the EU.

Trade challenges ahead

The quality and size of the 2020 crop could limit the UK’s need for imports though this season, which would be important as imports of oats into the UK from 1 January will be subject to a £74/t tariff. Unless the UK agrees free trade deals with countries such as the EU or Canada, it would be very expensive to import oats.

Meanwhile, UK oat exports into the EU will face a tariff of €89/t unless a trade deal is agreed. In the past 5 seasons, 95% of UK oats have been exported to the European Union but it’s difficult to see how any UK oats could be competitive into the EU in the second half of 2020/21 unless a trade deal is agreed.

The UK usually exports a greater volume of oats than it imports, so overall if a trade deal isn’t agreed it’s more likely to pressure on spot oat prices than support them.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.