Small increase for UK pig meat exports in March, imports lower

Thursday, 21 May 2020

By Felicity Rusk

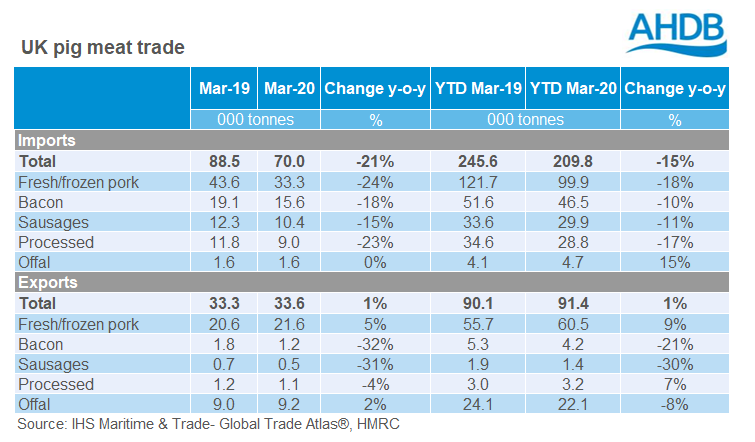

In March, UK imports continued to track below previous year levels for most products. Meanwhile, overall exports recorded very marginal growth on the year.

Exports

In March, the UK’s pig meat export market continued to record growth on the year, though the increase remained relatively modest in volume terms.

.png)

The UK exported 21,600 tonnes of fresh/frozen pork in March, 5% more than in March 2019. Exports to China continued to show strong growth compared to the previous year. In March, the UK exported 10,200 tonnes of pork, almost 80% more than in March last year. This annual growth rate is a little smaller than the levels recorded in 2019. However, the monthly volume shipped was still the third highest on record, beaten only by October and November last year.

We also saw offal shipments return to growth in March, recording a marginal increase (2%) on the year, supported by an uplift in shipments to China.

There have been numerous reports of logistical challenges supplying China this year due to the coronavirus pandemic. Several reports have highlighted ongoing challenges with container availability, particularly refrigerated ones. However, it seems UK exports in March were still strong. Whether we could have sent more if circumstances had been more favourable is unclear- the UK is a net importer of pork, there will be limitations on how much we can reasonably expect to send.

Although still well above early 2019, average export prices to China have been dropping this year. At £1.63/kg, fresh/frozen pork prices were 2% down on February and the lowest since last August. At the time, there was increased competition from cheap US pork. Chinese wholesale prices have also eased a little.

Overall pig meat export growth was constrained by declining volumes to other destinations. Volumes to Hong Kong were particularly affected, as has been the case throughout 2020, falling by 70% (-1,600 tonnes) year-on-year. Most shipments to key EU countries also declined, especially the Netherlands (-36% or 1,300 tonnes) and Ireland (-22% or 1,200 tonnes). The 25% tariff on pork exports to the US also seems to be having an impact, with this trade falling by over 80% (-900 tonnes).

Imports

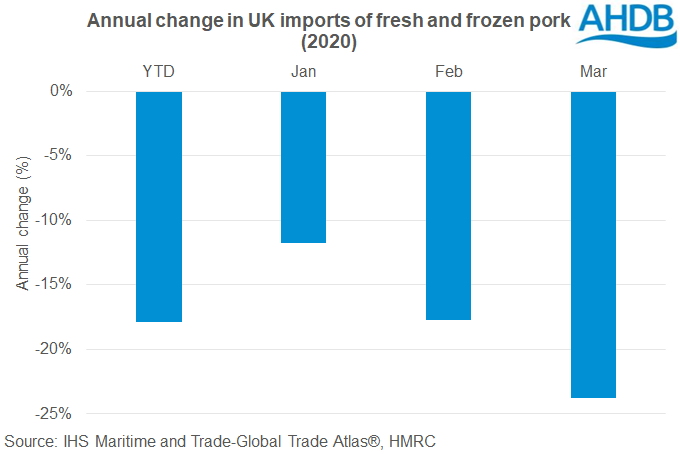

In March, UK imports of pig meat continued to track below last year’s levels. A total of 33,300 tonnes of fresh and frozen pork was imported during the month, 24% less than in the same month in 2019. Shipments from all major sources fell in March.

UK imports of pork have been falling away since last April; demand has been relatively weak, and EU pork has been relatively expensive. While ‘panic-buying’ was exhibited in March, it was most pronounced in final week following the introduction of the lockdown measures. As such, we are likely to see any effects of this in the April trade data. The closure of most foodservice venues during the lockdown may well depress import demand overall though. Data for this is not available, but anecdotally it is thought that imported product is disproportionately used in foodservice.

Imports in March recorded a particularly strong decline on the year. This could be due to the uplift in imports seen in early 2019 ahead of the March 29th Brexit date, though volumes are also below 2018. Additionally, the weakening of sterling against the euro with already relatively high prices for EU pork may have affected import levels.

Imports of other pig meat products, such as bacon sausages and processed, also recorded a decline in March. Meanwhile, imports of offal remained steady on the year.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.