Should I store or sell my grain? Grain market daily

Friday, 24 March 2023

Market commentary

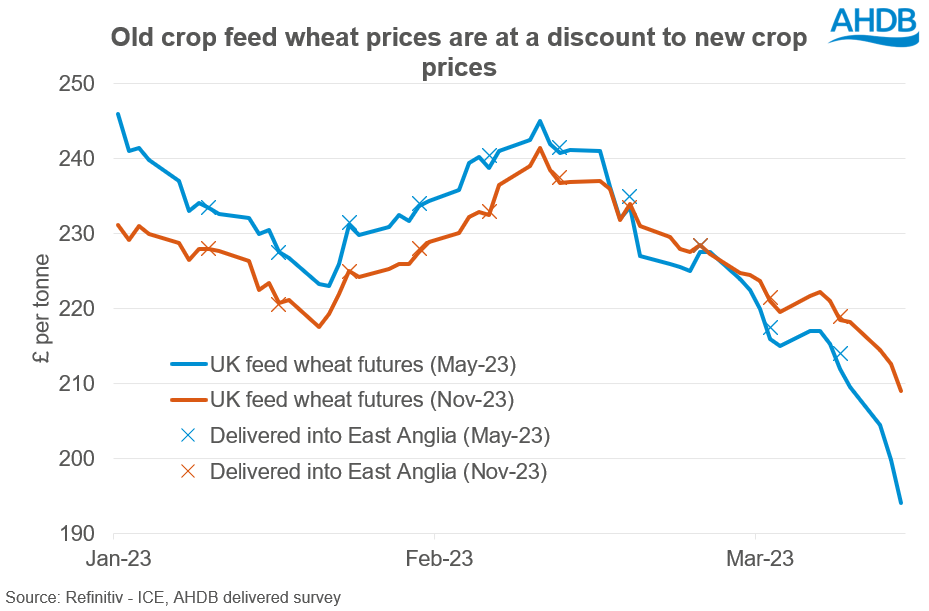

- Old crop UK feed wheat futures (May-23) closed yesterday at £194.20/t, gaining £0.20/t on Wednesday’s close. Repositioning after significant falls. While new crop futures (Nov-23) were down £1.90/t over the same period, closing at £207.10/t, marginally closing the premium to old crop futures.

- Our new crop domestic market followed the Paris market down yesterday, as Black Sea exports continue to pressure the market, and improving crop conditions in Europe weigh on prices.

- Today, old crop UK feed wheat futures (May-23) are trading back up at £204.00/t as at 14:00. New crop futures (Nov-23) are trading at £216.00/t. This reaction comes as there has been some reports from Vedomosti Business Daily that Russia may consider temporarily halting wheat and sunflower exports, nothing is confirmed yet. However, it reported that the Russian Agriculture Ministry would meet industry representatives this week to discuss the idea (Refinitiv).

- Paris rapeseed futures (May-23) closed yesterday at €436.25/t, gaining €5.75/t on Wednesday’s close. The contract gained for the first time since 03 March, breaking 13-day losing streak, which saw the contract pressured by €108.00/t (to 22 March).

- The latest AHDB carbon article is now published on which explores the price disparities between carbon markets.

Should I store or sell my grain?

As mentioned in yesterday’s Analyst Insight, old crop wheat futures are dropping lower and lower. The domestic wheat surplus available for either export or free stock has been well documented in the AHDB cereals supply & demand estimates since October. With harvest approaching, stores may need to be cleared as there isn’t the physical space for many growers to keep hold of old crop.

As the graph shows above, there has been a change in the trading relationship between old and new crop UK feed wheat futures contracts. This has also been reflective in the AHDB domestic delivered prices too, which reflects our physical traded market.

However, with this drop in old crop futures could there be opportunity to continue storing harvest 22 into next year? Or will the gains from the interest from cash in the bank outweigh the continued cost to store your grain? In this analysis I am further building on the interest rate calculation used in the “Does storing grain peak your interest?” article released in December. There is an update to prices, and interest rates, which since December have seen significant shifts.

To sell or store?

Interest rates are continuing to increase in order to control domestic inflation, as shown yesterday in the Bank of England’s statement, which increased the base rate to 4.25%. Current top easy-access savings account are offering up to 3.4%, and with notice savings account (120 days), offer as high as 3.65% (Money Saving Expert).

If space allows, could there be a cost benefit to holding onto this grain for a little longer, or will the gains from high interest rates outweigh this?

Below is a list of assumptions used in this analysis:

[1] Wheat has been stored from 18 August 2022, to reflect the timely fashion of harvest 2022.

[2] Payment for selling now, is assumed movement on 31st March 2023 and that the grower receives money in the bank from the start of May – not instantly, to reflect a delay in payment. Storage until Hvst-23 is an assumed sale on 15 August 2023.

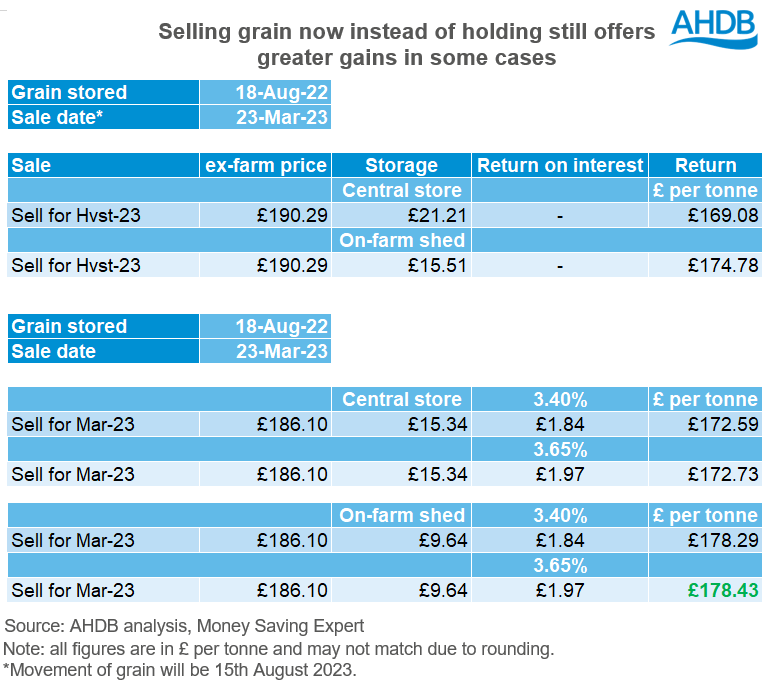

[3] For this analysis I have used an indicative ex-farm spot price and harvest-23 price for East Anglia. This has been calculated using yesterday’s UK feed wheat futures close for May-23 (£194.20/t) and Nov-23 (£207.10/t), and applying a premium for delivery into East Anglia. This premium is a calculated average from our delivered survey from data for this year to date.

To then get a spot price (Mar-23), I have worked back £2.00/t from the May-23 calculated value. For the harvest price, I have applied a discount of £10.00/t (harvest pressure) from the calculated Nov-23 value.

I have taken these values and deducted £7.00/t haulage rate to reflect an ex-farm price, therefore close proximity to both store or feed mill (in East Anglia), is assumed in this analysis.

Please note this is an indicative value to aid this analysis, not a quoted price. Delivered prices (up until 23 March) will be updated later today here.

[4] Storage fees are indicative values with an in/out fee of £3.20/t and £2.50/t, respectively. Also, there is a weekly storage cost of £0.30/t a week. Please note that the on-farm storage is the same to reflect depreciation and costs, however, the in/out fee has been deducted.

The results: selling now may hold greater gains

This analysis shows that selling now could be more cost effective then storing your grain until harvest-23 despite the price carry into the new season. The most profitable scenario, as of right now, is selling today and gaining on the interest (3.65%) in the bank over that period. The smallest income scenario would be selling for harvest-23 out of a central store, using these calculations.

Interestingly, selling for harvest-23 out of farm storage (£174.78/t) is higher income than selling today of out a central store.

Conclusion

Old crop UK feed wheat futures (May-23) discount to new crop has increased, but there is still a greater financial gain in some cases for selling grain today, gaining on the interest from the bank, than continuing to store your old crop until the new crop year. Other benefits also include cash flow and clean stores ready for harvest-23. The key factor now is knowing your cost of storage as well as your breakeven point, as this is critical in making the business decision on what to do with your grain as we approach the end of the 2022/23 marketing year.

Please note that this analysis is based on yesterday's close on the domestic wheat market. Price movements remain volatile at the moment and prices are constantly changing. Therefore, this close may not be representative at the time of reading but the messaging remains key.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.