Analyst insight: How low could wheat go?

Thursday, 23 March 2023

Market commentary

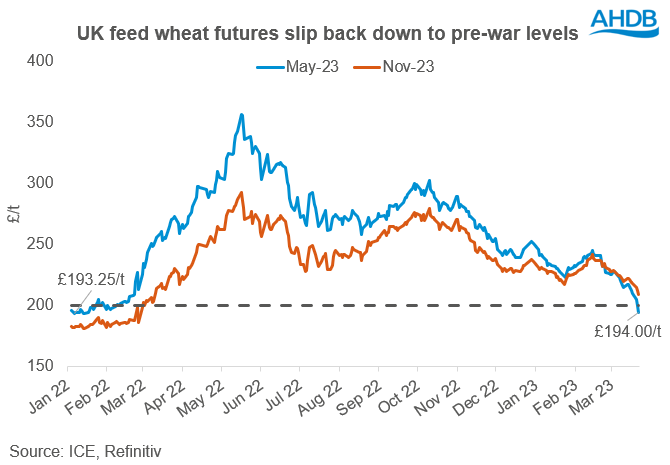

- May-23 UK feed futures closed at £194.00/t yesterday, down £5.75/t from Tuesday’s close. The Nov-23 contract lost £3.55/t over the same period to close at £209.00/t. Read more in the main section below about what is driving wheat prices lower.

- Paris rapeseed futures (May-23) closed at €430.50/t yesterday, down €10.50/t from Tuesday’s close, pressured by falls in palm oil and soyabean markets.

- The Bank of England have increased interest rates further today to 4.25%, following an unexpected increase in inflation rates in February. The CPI inflation rate rose by 10.4% on the year in February according to latest data released by the ONS yesterday. The rise in inflation is higher than expected by Bank of England economists and was driven largely by a rise in alcohol prices in out of home establishments.

How low could wheat go?

May-23 UK feed wheat futures fell for the sixth consecutive session yesterday to close at £194.00/t, down £5.75/t from Tuesday’s close. New crop futures (Nov-23) also closed down £3.55/t yesterday, settling at £209.00/t. With old crop prices declining at greater rate to new crop, the carry into new crop has been getting larger, with Nov-23 now at a £15/t premium to May-23. Since the start of the year, May-23 UK feed wheat futures have lost £37.70/t (16%), while the Nov-23 contract has lost £16.90/t (7%).

The question at the forefront of most peoples minds at the moment is how low could wheat go? With the lack of psychic powers, unfortunately we are unable to answer that question. What we do know is that the market is currently being dominated by bearish sentiments, with the extension of the Ukraine grain corridor, continued abundant Russian supplies and improving conditions across key Northern Hemisphere growing regions. That said, its important to highlight that the global supply and demand situation remains on somewhat of a knife edge.

Yes, the Ukraine export corridor deal has been extended, but only for a further 60 days, which takes us through to the middle of May. Russia were being increasingly obstinate with the latest extension, so we could see increased volatility as we approach May, if Russia make any further demands around another possible extension. We also need to bear in mind, that even though Ukraine are able to ship grain under the deal, how much have they actually got available to export? With the disruptions of war in the country, harvest 2022 was smaller and the planted area for harvest 2023 is also expected to be lower.

As well as a likely reduction in Ukrainian supply, a major weather event between now and harvest, could see the tables turn. An adverse weather event, either in the US, here, or wider Europe is not uncommon at this time of year and would impact production for the coming harvest. Lastly, a switch up in demand, could also have an impact on price direction.

As it stands at the moment, the sentiment in the market remains bearish. However, as we progress towards harvest, there are a number of factors, which could lead to a switch in price direction. The events of the past three years could be described as somewhat unprecedented. However, from the start of January 2022, May-23 UK feed wheat futures have risen from just under £200/t to over £350/t in May 2022, and now have fallen by over £150/t, to back below £200/t. These are extreme circumstances and won't be repeated regularly. The market has offered significant spot and forward profits (albeit forward profit eroded as input prices rose higher). At this point, it is worth reflecting on why decisions were made to sell or not sell over the past year. What drove you to market your grain in a certain way and what can you learn from that to help develop your selling strategy going forwards.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.