Sheep market update: prices hold firm throughout October

Thursday, 16 November 2023

Key points:

- GB finished prices remain firm, averaging 564p/kg for October.

- Defra clean sheep slaughter is higher than September, up to 1.1m head.

- Liveweight SQQ prices grew in October, up 4p to 255p/kg.

- Store trade continues to be strong as prices remain above last year.

- Imports of sheep meat have grown, as volumes from Australia rise.

Price update

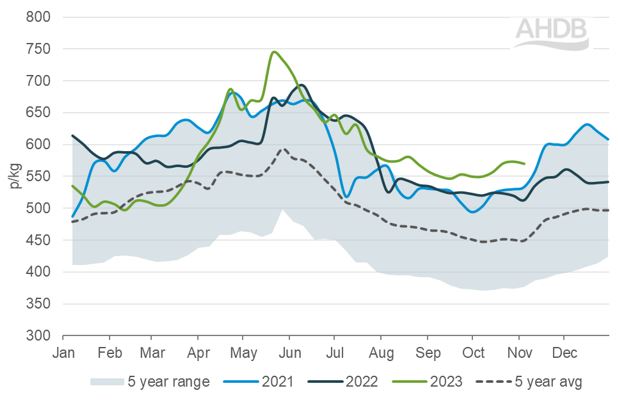

The GB deadweight SQQ grew to 564pkg for the month of October, an increase of 14p from September, and growth of 44p from the same time last year. Prices gained momentum throughout the month, ending at 569.8p for the w/e 04 November. This week provided the largest year on year change since the new season began, with growth of 57p. Defra clean sheep slaughter for October sits at 1.1m head. This is an increase of 102,000 head from September, as we move closer to seasonal production peaks. Throughputs for October are however the lowest in the last five years, indicating a general tightness of supply.

GB deadweight lamb SQQ

Source: AHDB

Looking at the liveweight equivalent, the SQQ price ended the month as it began at 252.2p/kg. There was some upward movement throughout the month to a high of 258.2p, which gave an average price of 255p for October. This is slight growth of 4p from September, and 26p from the same time last year. Average weekly throughputs are slightly higher than the same time last year, at 110,000 head per week for October, an increase of 5,000 head per week from 2022.

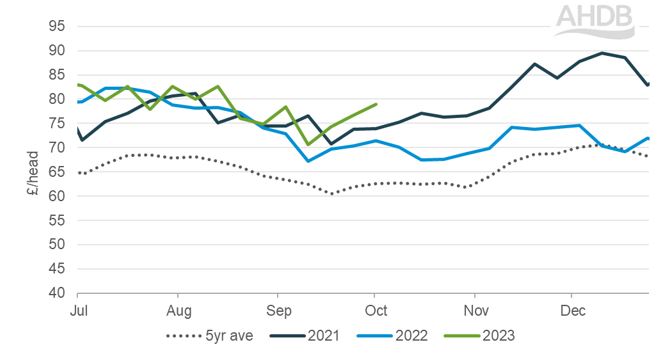

GB store prices remain firm, sitting at £77.40 per head for the week ending 04 November, growth of £7.60 (11%) from the same time in 2022. Auction markets across GB are suggesting that store trade is still strong despite persistent higher than usual prices, and reports of bad weather making it harder to finish lambs. This may suggest that demand for stores is strong, despite uncertainty on what finished prices may do in early next year when stores would be ready to market.

GB new season store lamb prices

Source: AHDB, LAA, IAAS

Trade update

The domestic lamb market is being supplied through a higher level of imports compared to the previous month and year. Total imports of sheep meat grew by 123 t on the month to reach 4,460 t for September, up 730 t from September 2022.

Suppliers of these imports have shifted, as volumes of imports from Australia have grown following expansion of its sheep flock and access to tariff-free trade with the UK. Imports from Australia were just under 1,200t for September, up by 270 t from August. This is similar to the levels seen between January - April 2022, so is not unprecedented. We continue to monitor the levels of imports coming from Australia as the TRQ progresses. Prices in Australia remain very internationally competitive thanks to a record sized sheep flock.

Volumes from our largest supplier - New Zealand - have fallen from last year, down 330 t. Australian product may be displacing some other imports due to its price competitiveness. Imports from New Zealand totalled 2,300 t, a fall of 410 t from August.

Sheep meat exports have grown to 6,850 t for September, up 400 t from August, with growth of 450 t from 2022. Lower production volumes in the EU have supported exports to countries in the continent. With further falls in production expected in the EU, we could see growth in exports if seasonal religious events boost demand.

What does this mean for the UK?

With new season lambs slower to come forward this year, alongside favourable export conditions, the tighter marketplace has offered support to the trade. As we move into the Christmas period, we may see greater numbers coming to market, alongside continued pressure from imported product.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.