SFI soils payments given a boost for 2023: Grain market daily

Thursday, 6 July 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £194.50/t, gaining £3.00/t from Tuesday’s close. Nov-24 futures closed at £198.35/t, gaining £2.35/t over the same period.

- Domestic prices followed both the Paris and Chicago wheat markets up yesterday. Markets were supported by renewed concerns over a supposed planned attack on a nuclear power plant in the Russian occupied southern region of Ukraine. The risk of a nuclear accident caused support in markets, which have recently been more constrained in their reaction to Russia’s threat to quit the Black Sea Initiative, read more information here.

- Further to that, there was concerns over weather stress for US spring wheat crops on the northern Plains. Also, the US winter wheat harvest lags as the USDA reported. As at 2 July, the US winter wheat harvest was at 37% complete, behind last year’s pace of 52%, and the five-year average of 46%.

- Paris rapeseed futures were mixed yesterday with the Nov-23 contract closing yesterday at €456.25/t, gaining €0.50/t from Tuesday’s close. However, the Nov-24 contract lost €1.25/t over the same period, to settle at €454.00/t.

- The USDA report unexpectedly revised down the US soyabean crop ratings at the start of the week which is unpinning prices. In the report (to week ending 02 July) 50% of US soyabeans were rated good-to-excellent, down from 51% in the previous week and the trade average outlook was expecting 52%.

Growers given more time to complete the Planting and Variety survey

We have extended the deadline to complete the 2023 AHDB Planting & Variety Survey in order to gain the best possible planted area estimate for the upcoming UK harvest.

The survey takes just five minutes to complete, and you have until Friday 21 July to take part – click here to complete the survey.

The results of the survey will:

- Provide planted area estimates for the upcoming UK harvest.

- Show regional breakdowns of major crops growing, helping understand any shortfalls which could impact prices.

- Help you to identify marketing opportunities for the season.

Data accuracy and transparency is key to functioning markets. As such, accuracy in data collection is vital. Therefore, it is critical that as AHDB, we produce accurate, unbiased data which the industry can trust.

By having impartial accurate data in the Planting & Variety Survey, you are able to put reason over rhetoric when it comes to making decisions for your arable enterprise.

SFI soils payments given a boost for 2023

In August, farmers will be able to apply for the Sustainable Farming Incentive (SFI) 2023. In analysis released this morning by AHDB, we show the advantages of this latest version of the scheme.

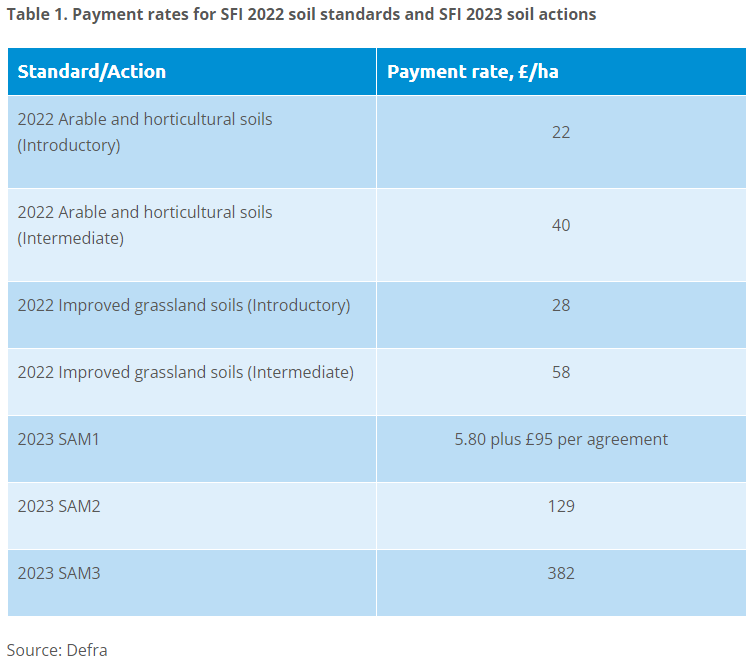

SFI 2023 actions for soils were published by Defra in late June. We’ve compared them with the SFI 2022 scheme.

Main findings show that:

SFI 2023 will have more flexibility. Farmers as can choose actions rather than having to carry out a list of defined activities under various standards. Farmers who are already taking part in the SFI scheme will have their agreements updated to reflect the 2023 criteria.

Farmers will receive higher payments. Published rates for the soils actions under SFI 2023 are considerably larger than their SFI 2022 counterparts. The net payments, which take into account the costs involved in carrying out the actions, are also higher for 2023.

The improvement in a farm’s net profit levels, as a result of the increased net payment is only a percent or two at most. This is because the reduction in Direct Payments far outweighs the additional income from SFI payments.

To make a more substantial improvement in the overall net profit, farmers will need to ‘stack’ multiple compatible actions together. We will be following up on this analysis by looking at stacking various actions together in the coming weeks.

For more information and further details on how the SFI has evolved, 2022 vs 2023 comparison of SFI payments and further analysis into what this means for arable soils and grass land soils, please read the full article here.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.