Rising dairy prices squeezing the wholesale-retail price margin

Wednesday, 2 February 2022

UK wholesale prices for dairy products have risen sharply in recent months, and market dynamics look set to keep them supported in at least the short-term. But, will this translate to an increase in consumer prices?

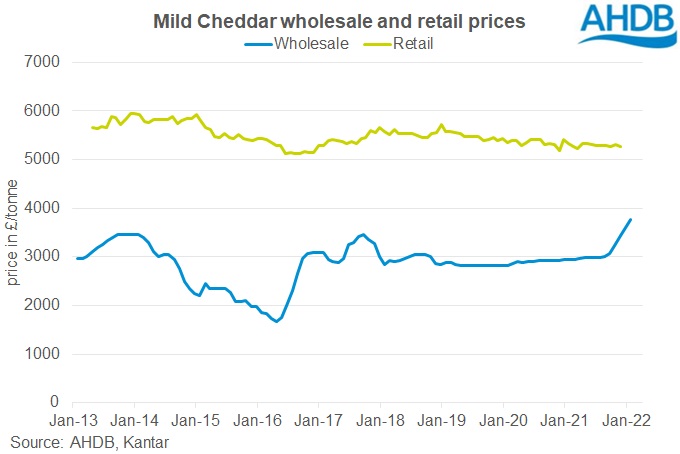

If we take the retail and wholesale prices for mild Cheddar as an example, we can see that historically the retail price is much steadier than the wholesale price:

- Between January 2014 and April 2016, the wholesale price fell by £1,775/t. Meanwhile, the average retail sales price didn’t bottom out until June 2016, and fell by only £788/t between Jan 2014 and that point, according to data from Kantar.

- When the price then jumped back up for wholesale – rising by £1,575/t between April and December 2016, retail prices didn’t really start rising again until the end of the year, and only rose by £250/t between November 2016 and April 2017.

Before the recent uplift in prices, the wholesale mild Cheddar market was steady for quite some time. In November 2018 the margin between the wholesale and retail prices was £2,695/t. By July 2021, it had narrowed by only £385 to £2,310/t, partly from a slight increase in the wholesale price and also from a gradual decline in the retail price. However, by November 2021 (the most recent month we have retail data for), a sharp increase in the wholesale Cheddar price meant the margin had shrunk by £490 to £1,820/t in just 4 months. Assuming the retail price remains unchanged for January, the margin will be just £1,500 per tonne, the smallest it has been on our records – going back nine years.

What happens next?

It’s not as easy as saying that because wholesale prices have increased, retailer prices should also increase. Most retail buying is done on long-term contracts, rather than spot prices. However, when spot price increases are sustained, processors will, quite rightly, compare the returns they can get through the various market channels. In other words, the spot prices will influence contract prices when it comes to negotiation. On the other side, the average retail price is based on what’s paid by shoppers. If the retailers’ prices do go up, some shoppers tend to trade down to cheaper product, resulting in less fluctuation in the overall average price.

It’s also not just the wholesale price of cheese that will affect processors’ selling prices. The margin between the retail and wholesale price needs to cover all the costs of taking the bulk product from factory to shelf – cutting, packaging, packing, transport, and labour. These costs have risen significantly over the last year.

With upwards pressure coming from all these different aspects, it is becoming more likely that retailers will have to increase their prices. But, the pressure to keep consumer price inflation under control will fight against this, making it a key watch point in the coming months.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.