Rising costs limit gains in producer margins in Q1

Thursday, 28 May 2020

By Felicity Rusk

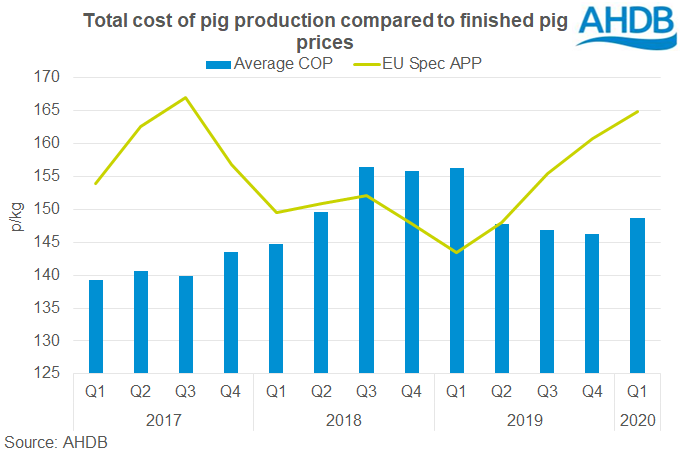

Finished pig prices continued to rise in the first quarter of 2020. However, an increase in feed and labour costs have eroded away some of the potential margin gains.

During the first three months of the year, the EU-spec APP averaged 165p/kg. Meanwhile, the average cost of GB pig production was 149p/kg, according to the latest AHDB estimates. Therefore, in Q1 2020, the estimated net margin was 16p/kg or £14/head.

On a per kg basis, production costs were 3p higher than in the previous quarter. This is due to a combination of higher feed and labour costs. While there was a 1p decline in ‘other’ variable costs, this was not enough to compensate for the rise in feed and labour costs.

Despite the global turmoil due to the pandemic, GB finished pig prices have continued on a slight upward trend so far this year. Since the end of March, pig prices recorded an increase of just under 2p. However, looking at feed wheat prices, feed prices have probably also been a little higher from late March. So, it seems unlikely margins will have increased further in recent weeks.

Looking forward, much uncertainty remains, as we still don’t know how domestic demand will develop as lockdown measures are eased. However, the export outlook remains cautiously optimistic.

China’s own battle with the coronavirus has only slowed the nation’s recovery from African Swine Fever (ASF). As a result, the Chinese pork output this year is likely to be lower than previously anticipated. This will only increase the nation’s reliance on imported protein, which if realised, would be price supportive. However, there is still a range of factors that could present challenges. A second wave of the virus in China remains an ongoing risk as the nation continues to adjust to post-lockdown life. Furthermore, there remains a risk of competition from lower-priced US and Brazilian product, although the ongoing disruption to pig slaughter in the US might mitigate this.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.