Regional variation in 2025 UK area forecasts: Grain market daily

Friday, 13 December 2024

Market commentary

- UK feed wheat futures edged back yesterday following falls in Chicago futures prices. But a dip in the strength of sterling against both the euro and US dollar helped limited losses. UK feed wheat futures for May-25 lost £0.55/t yesterday and closed at £187.70/t, while the Nov-25 contact lost £0.80/t to settle at £189.20/t. Both contracts are still slightly up compared to Friday’s close

- Chicago wheat and maize futures fell due to weaker than expected US wheat and maize export sales, forecasts of beneficial rain in US winter wheat areas and a stronger US dollar. From a Paris wheat futures perspective, expectations that Black Sea grain will win the latest tender from Saudi Arabia, outweighed the weaker euro

- Spot Paris rapeseed futures (Feb-25) prices rose €3.50/t to €538.00/t (approx. £443.50/t) yesterday from re-positioning by traders. This follows the Euronext exchange suspending physical delivery for the Feb-25 contract on the Mosel river after an accident shut it in western Germany

- Meanwhile, Paris rapeseed futures for May-25 edged lower yesterday, down €1.25/t to settle at €528.75/t (approx. £436/t). The Nov-25 contract lost €1.75/t to settle at €474.25/t (approx. £391/t). This echoes dips in Winnipeg canola futures with profit-taking after recent gains

Regional variation in 2025 UK area forecasts

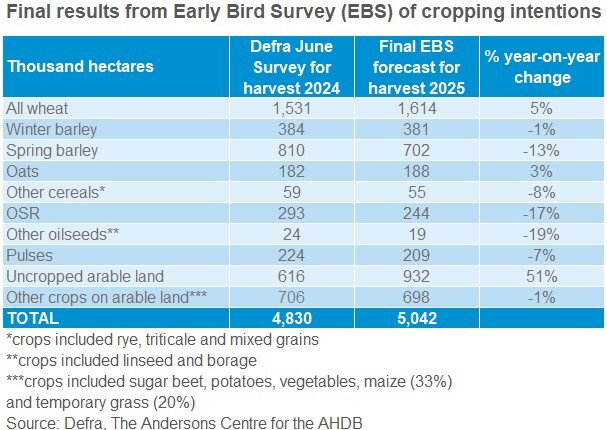

Yesterday, Defra released full 2024 UK area, yield and production data. Following this data’s release, we have finalised the results of our Early Bird Survey (EBS), including publishing regional information.

Headline 2025 UK area forecasts

The headline forecasts for wheat, barley, oats and oilseed rape are little changed from last month’s provisional results. The largest change for these crops is for oilseed rape (+5Kha) and all these changes reflect the incorporation of the finalised 2024 areas.

Please be aware that no new surveying has taken place; the data reflects planting intentions and plantings to date as of early November. Most data was collected by 11 November, though results were received up to 15 November.

While typically, adjustments are made to the final EBS forecasts to allow for any weighting differences (crop mix or regions) between the survey area and official data, none are applied this year. The large changes in cropped areas and uncropped land for harvest 2024, plus another challenging autumn planting period this year means there is greater uncertainty over some figures. Against this backdrop, unadjusted figures are presented to better show the cropping intentions for the main crops in arable rotations for harvest 2025.

Variation across the UK

While generally improved compared to the extreme situation in autumn 2023, periods of very wet weather again presented challenges for establishing winter cereal crops. There was notable variation across the UK, with varying impacts by crop - read more in our crop development report.

Efforts to return to more desired rotations amidst the variable weather and delays harvesting 2024 crops, can be seen in the regional cropping forecasts for harvest 2025.

For example, both the largest rises in wheat planting and steepest falls in spring barley planting in England are forecast across northern England, and in the East Midlands. These areas suffered some of the steepest falls in wheat area were recorded in 2024.

Meanwhile, limited recovery in wheat areas and corresponding smaller falls in spring barley areas are recorded for the South, East and West Midlands and Eastern England. These areas suffered particularly wet weather in September.

In Scotland, further rises in the spring barley (+2%), winter barley (+3%) and oat (+12%) areas are forecast, at the expense of wheat (-3%), and OSR down (-25%).

Despite the better conditions for OSR planting, only Wales and Northern Ireland together report a rise in OSR areas. All parts of England and Scotland reported further falls, keeping the focus on crop conditions to limit the fall in production.

Read all the regional estimates. However, with shifts in cropping again across the UK, this is likely to change pricing relationships between crops and compared to the UK futures for harvest 2025. So, it’s important to check in with your local grain traders and merchants about what local basis to use to monitor new crop prices.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.