Record highs for Northern Ireland milk deliveries

Thursday, 24 October 2024

Northern Ireland faced similar weather challenges to Great Britain, but an earlier uplift in farmgate prices tipped NI into growth first. Strong performance has helped reduce supply pressure in the UK as a whole.

Milk production in Northern Ireland makes up a significant chunk of the total UK milk pool, equating to 17% of the 2023/24 milk season. However, there are some key differences that impact the dynamics. Dairy farmers in Northern Ireland export around 80% of their products and are therefore even more exposed to the vagaries of global markets than in Great Britain. In GB, more milk goes into liquid processing, and more is on aligned retailer contracts which are based on the cost of production, offering some insulation from market driven price changes. This can be beneficial or deleterious depending on whether the global market is rising or falling.

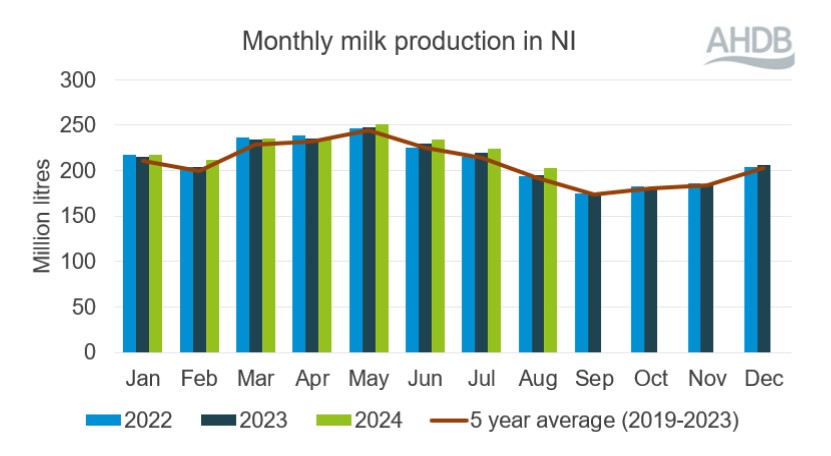

Northern Ireland’s milk deliveries have been trending above 2023 (and the 5-year average) since May. Most recently, August milk deliveries were up by 4.0% vs the same month in 2023. This contributed to a year to date (April-August) increase of 1.6% vs the same period in 2023, marking a record high.

In contrast, GB deliveries in August saw a 0.5% decline compared to last year with milk year-to-date deliveries at -0.6%. Until very recently, GB production has been trending lower than 2023 levels.

Source: AHDB, DAERA

Milk supply challenges in the Republic of Ireland over the past 12 months, as a result of poor weather and some regulatory challenges, will have meant that extra milk crossing the border from the north will have been very welcome.

In terms of milk quality, both NI and GB recorded improved butterfat and protein percentage levels in 2023, despite disappointing grass yields.

Both GB and NI farmgate milk prices have been increasing since May, reacting to low global production. Northern Ireland is a net exporter of dairy and are more exposed to global market forces, and therefore more responsive to price direction. This contrasts the more stable GB market, where many producers have aligned retailer contracts that are based on the cost of production. Average milk prices in NI rose from a low of 30.7ppl in August last year to a high of 41.9ppl in August this year, a 37% difference. In contrast, as yet, GB prices have only risen by 12% from July 2023 to 2024.

This relative price boost is likely to have incentivised further milk production in NI, pushing them further ahead in the commodity cycle.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.