Rapeseed prices see pressure from global markets: Grain Market Daily

Tuesday, 4 February 2020

Market Commentary

- Global agricultural markets continue to be affected by concerns surrounding the impact of coronavirus on Asian regions. UK feed wheat futures (May-20) closed at £151.75/t yesterday, down £3.50/t from 27 January. This decline has also affected new-crop UK feed wheat futures with declines seen. Nov-20 futures closed at £159.75/t yesterday, down £4.55/t over the same period.

- Brent crude oil prices has continued to see declines this week over coronavirus fears, despite the OPEC announcement to potentially cut their oil output by 500,000 barrels per day. Brent crude oil closed yesterday at $54.45/bbl, down $4.82/bbl from 27 January.

- At 135K long wheat contracts, US Managed Money funds now hold a record number of long contracts, surpassing the highs of the summer of 2018, 2017 and 2012. Peter examines if US wheat is at risk of a sell-off.

The US/China trade deal impact on European rapeseed markets

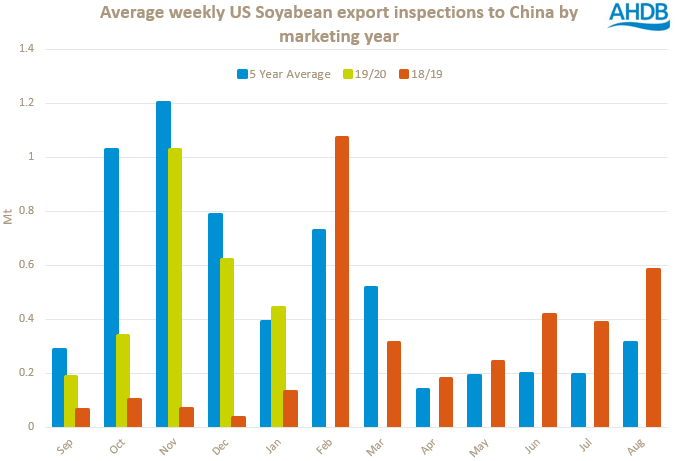

A key influence on domestic rapeseed prices this season is the sentiment surrounding soyabean markets. Towards the end of 2019, oilseed markets found support from a positive market sentiment regarding the US-China trade agreement. The thought being that the large volume of US soyabeans pressuring European markets will start to be bought again by China.

A large deficit of rapeseed in the EU has supported domestic rapeseed prices; however some of the rapeseed demand is able to be substituted for soyabeans. The EU has imported 4.03Mt of US soyabeans this season to 02 Feb, accounting for 49.9% of total EU soyabean imports.

Following the signing of the ‘phase-one’ trade agreement, China has yet to make any significant purchases of US soyabeans. US soyabean futures (nearby) have fallen $19.01/t since the signing of the deal on 15 Jan to 03 Feb. This decline has filtered through to Paris rapeseed futures (nearby) which have declined €21.75/t over the same period.

Typically, China splits the large weight of its purchases between the US and South America, opting to switch origins to follow harvests. However, a greater volume of Brazilian soyabeans has been purchased already this season by China, within the typical US export months, signifying China’s intent to purchase on price alone. Brazil accounted for 80% of China’s soyabean purchases in 2019.

Chinese demand is a question point currently, the outbreak of coronavirus has hit economic markets on worries of anticipated lower demand from the country. Its pig herd declined last year by 40% amidst the outbreak of African Swine Fever which will continue to affect soyabean import volumes.

European rapeseed markets will continue to see pressure from the US soyabean supply until significant purchases are made by China.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.