Analyst Insight: US wheat sell off risk?

Monday, 3 February 2020

US wheat sell off risk?

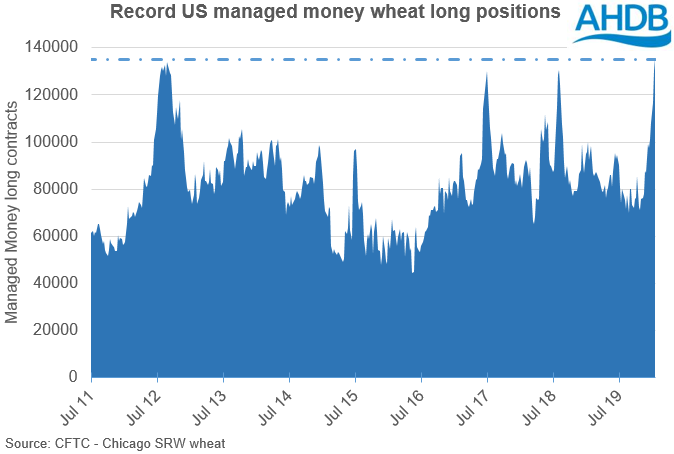

In the midst of a global commodity downturn, US Managed Money speculative funds have increased their number of long contracts in CBOT Chicago SWR wheat futures.

This appears contradictory to the current grain market sentiment, which in current state of affairs, has been on a bearish downward trend.

While the reasons for choosing to own such a large degree of long contracts could be due to a number of reasons, the degree of risk to markets that his has created is not inconsiderable.

At 135K long wheat contracts, US Managed Money funds now hold a record number of long contracts, surpassing the highs of the summer of 2018, 2017 and 2012.

In the current somewhat bearish market, there are no signs of an imminent price hike. Additionally, prospects for an increase in Black Sea wheat production for 2020/21 leaves little significant shifts in fundamentals for a substantial future tightening of global wheat supply and demand.

As such, with global markets moving against the position of speculative funds there is a real possibility that these positions may be quickly exited.

A selling of the speculative long positions and possibility for entering into short positions could quickly change the US and indeed wheat market at a greater rate of change than recorded previously and with reduced warning.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.