Rapeseed imports remain strong… but for how long?: Grain Market Daily

Wednesday, 13 November 2019

Market Commentary

- UK feed wheat futures (May 20) closed yesterday at £151.75/t, the highest since the end of July.

- Concerns that US-China trade talks may stall have kept a lid on any gains in US soyabean futures amid harvest pace concerns. Nearby futures closed yesterday at $332.77/t, up $0.27 from the day before.

- Yesterday, US Chicago wheat futures (May 20) gained $4.05/t to $193.44, with traders apprehensive the cold snap on the US Plains could potentially damage recently planted crops.

Rapeseed imports remain strong… but for how long?

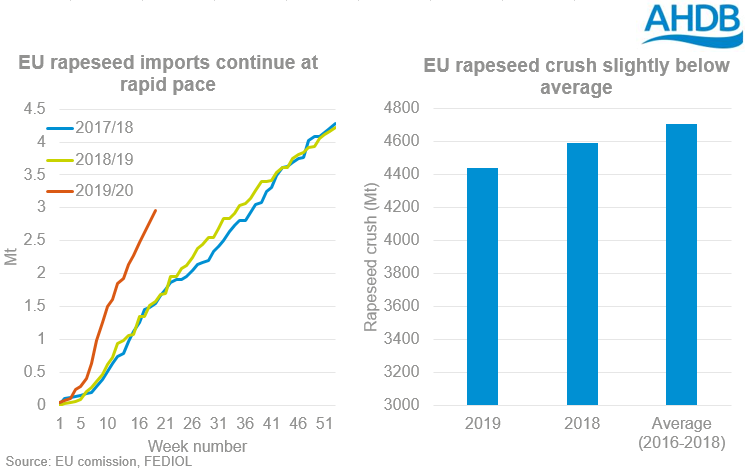

The EU rapeseed deficit has continued to draw in large levels of the crop. Cumulative imports so far in 2019/20 (up to 10 Nov) have reached 2.97Mt, according to the EU commission. Given that the EU is forecast to need 6Mt of rapeseed imports this season, questions remain on where this will come from. The predominant supplier, Ukraine, has exported 2.3Mt to the EU so far this season, accounting for c.83% of Ukraine’s estimated rapeseed exports.

Where the rest of these imports will come from is uncertain, with issues sourcing from both Canada and Australia (read more here). However, EU crushing has not appreciably slowed down this season to date, with FEDIOL crush statistics from July-Sep showing a crush of 4.4Mt of rapeseed so far in 2019/20. This is only 3% down on last season and 6% below the three year average (2016-2018).

While we are likely to see substitution occur wherever possible, the underlying tightness could support prices as availability of imports dwindles. Domestically, we are in much the same situation. UK rapeseed imports since the start of the season (July-September) are the highest on digital record, at 159Kt. Currently, crushers appear to be running off mostly imported supplies with little domestic trade reported.

Lending further support to rapeseed is the underlying strength of the veg-oil market. Palm oil futures (nearby) have risen over 20% since the start of October. This appreciation in value is due to a combination of strong export demand and lower than expected supply in October.

Moving out of winter it is likely that we will see a decreased use of rapeseed oil in industrial use. Biodiesel plants can then switch to alternative oils, which do not function well in the low winter temperatures. However, for supply used in food and feed production, the potential tightness of Australian canola could provide support to prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.