Powder purchases drive China’s Q1 dairy imports

Wednesday, 4 May 2022

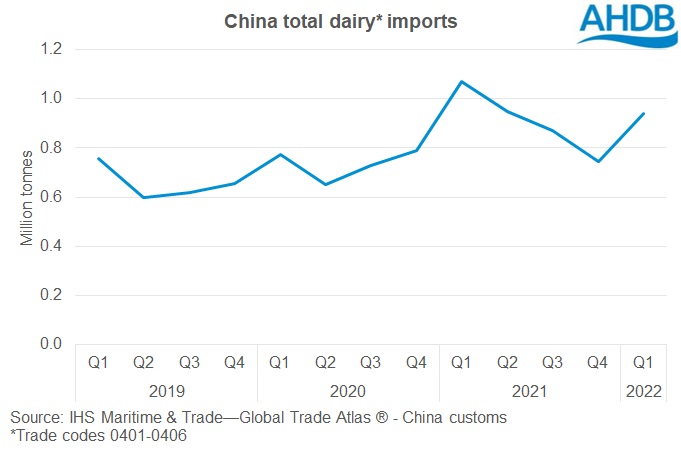

Chinese dairy[1] imports picked up in the first quarter of 2022, after 2021 started strong but then declined through the year. Dairy imports totalled 940k tonnes in Q1 2022, up 26% on Q4 2021. However, a lift in the first quarter is usual for China, and Q1 2022 imports were down 12% year on year.

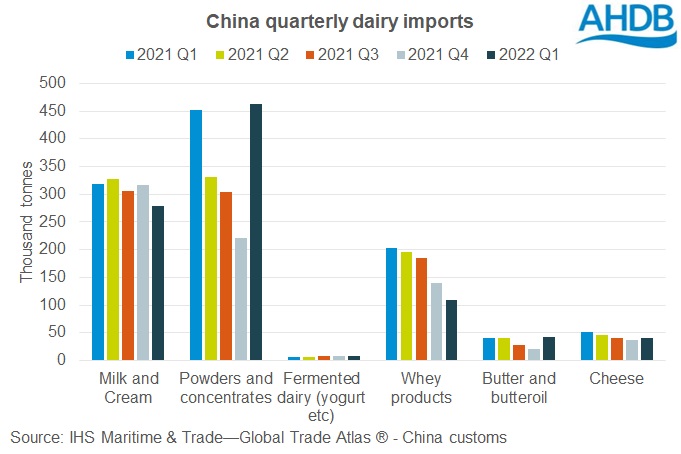

Imports of milk powders and concentrates drove Q1 imports overall. Of the three largest import categories, both milk & cream and whey products fell fairly steadily over the last year, with Q1 2022 showing another decline. In contrast, imports of powders & concentrates jumped back up at the start of 2022, after a steady decline through 2021. Powder & concentrate imports totalled 463k tonnes in Q1 2022, double the previous quarter and 3% up on Q1 2021.

China’s powder buying tends to peak in the first quarter of the year, so it is likely we will see a drop off in imports in subsequent months. There have been signs of this already, as the Global Dairy Trade price index has fallen at the last four events, and reports suggest a drop of demand from Asia was a factor.

While a dip in imports between Q1 and Q2 is usual, any large or prolonged drop-off in import demand could pressure otherwise high prices given China’s place as the largest global buyer of dairy products. The actual impact on pricing will depend on the balance between milk production, forecast to be low, and the degree to which China reduces its imports.

[1] Trade codes 0401-0406

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.