Poor autumn conditions see a rise in spring cropping for harvest 24: Grain market daily

Tuesday, 14 November 2023

Market commentary

- UK feed wheat futures rose yesterday, supported by rises in the US markets. The May-24 contract gained £1.65/t to close at £202.40/t, while the Nov-24 contract rose £1.40/t to £209.90/t. US exporters announced the sale of nearly 144 Kt of maize to Mexico yesterday, which along with the hot, dry weather in Brazil helped lift US maize prices.

- The USDA also reported a drop in the condition of US winter wheat last night. 47% of the crop is rated good / excellent (as of 12 November), down from 50% a week earlier. According to a Refintiv poll, the market had expected the crop condition rating to remain stable.

- Paris rapeseed futures gained sharply, following Chicago soyabean prices on the back on worries about Brazilian weather. The Paris rapeseed May-24 contract gained €11.50/t from Friday’s close, closing at €450.00/t (approx. £392/t), while the Nov-24 contract rose €8.25/t to €454.25/t (approx. £396/t).

- Brazil is experiencing unusually hot and dry weather posing risks to the forecasts for large maize and soyabean crops. Yesterday consultants AgRural cut its forecast of the 2023/24 Brazilian soyabean crop by 1.1Mt to 163.5 Mt and warned further downgrades were possible. This, along with buying by speculative traders, pushed the May-24 Chicago soyabean futures contract to its highest level since 29 August.

- The AgriLeader Forum 2024: Farming your network – playing your field takes place from 12:00pm Tuesday 30 January – 1:00pm Wednesday 31 January, in Manchester. The forum will focus on helping you to develop and drive the three pillars essential for running a successful business: leading yourself, leading your people, leading your business. To sign up, use this link.

Poor autumn conditions see a rise in spring cropping for harvest 24

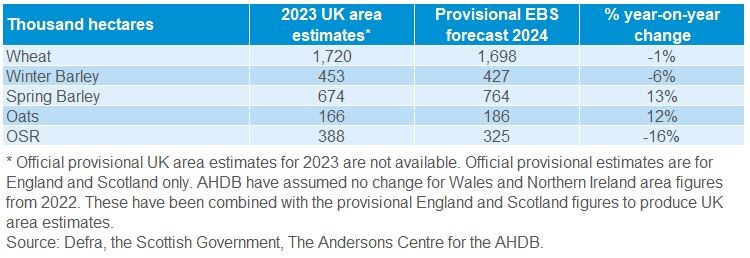

Earlier today, AHDB published the provisional release of the AHDB Early Bird Survey (EBS) of early plantings and planting Intentions for harvest 2024.

The survey was carried out in early November 2023 with data collected up to 09 November. This survey gives a first look at early plantings plus planting intentions in the UK for wheat, barley, oats and oilseed rape, as well as some insight into what we can expect from other crops too.

The key takeaways from the survey are expected declines in winter wheat, winter barley and winter oilseed rape (WOSR) areas on the year due to the poor autumn conditions, but a rise in spring wheat, spring barley, oats, fallow and other arable crop areas.

The rain has been less persistent than in 2019, the last year when poor weather hampered drilling in a national and significant way. However, the intensity of rain this year in some regions left some growers with problems they have not experienced for several years.

However, given the challenges faced this autumn and the condition of soils, winter crop areas may well be lower than this survey indicates. AHDB will provide an update on the situation in early 2024 when planting progress allows.

There’s more details on the condition of crops and the challenges faced in the latest crop development report, also released today.

Total UK wheat area on the decline

The UK wheat area for harvest 2024 is forecast down 1.3% on the year, at 1,698 Kha and the smallest since 2020. It’s perhaps unsurprising that winter wheat plantings have seen a decline in area this season, as wet weather persists across much of the UK, with drilling windows limited for most farmers. The survey of planting intentions was carried out as at early November and the ongoing wet weather is changing decisions last minute.

In addition, much of the recently planted wheat is looking poor. The extent of the issues depends on planting date, local rainfall and soil type, but widespread issues with root development and slugs are reported. This will likely hinder crop development (and potentially yields) into 2024. Many fields are patchy, making decisions about the future of the worst affected fields more difficult.

In response to the concern for winter wheat crops, Nov-24 UK feed wheat futures have already risen above old crop prices. A smaller area for harvest 2024 could mean tighter supply and demand next season. So, UK futures have already moved to prevent pre-season export sales and to position in case higher imports are needed as has been seen in previous seasons when wet weather reduced winter plantings.

Less winter barley and WOSR too

The winter barley area is projected to fall 6% to 427 Kha. Generally, winter barley is faring quite well. Most crops established before the weather deteriorated, though later planted crops are struggling slightly more.

Meanwhile, the WOSR area is forecast at 325 kha, down 16% and the smallest area since 2021. WOSR was mostly well established before experiencing any heavy rain on a widespread or intense nature. But, a combination of water-logged soils and pest pressure, including Cabbage Stem Flea Beetles (CSFB) in areas previously less affected, mean that there is likely to be an increase in write offs. As a result, the final harvested area could be considerably lower.

Higher reliance on spring cropping

Given the decline in winter areas, the market will be more reliant on spring cropping in 2024. Spring barley and spring oat areas are both predicted to rise markedly, up 13% and 12% respectively. The hope is that spring weather conditions will be more favourable, but as always there no guarantees.

It’s also worth noting that the area of fallow is forecast to rise sharply too, up 27%.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.