Plenty of pork in Europe, but just how much more pork is there?

Tuesday, 1 March 2022

Throughout 2021 there were two key trends in the European pig meat market, increased production, and lower export demand. Combined, these have caused extreme price pressure on farmgate prices across Europe. It has been said for months that Europe is awash with pork, but just how much pork is there looking for a home?

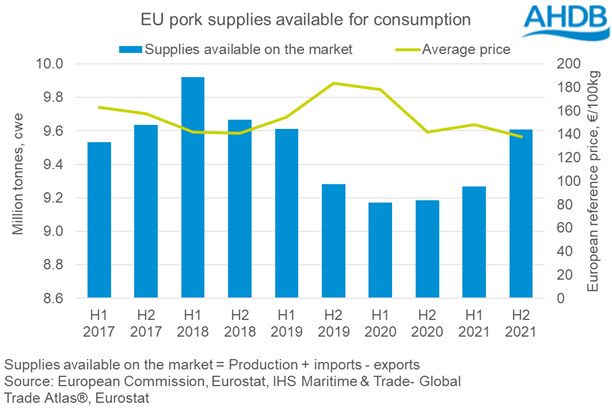

In short, quite a lot. If we look at data on an annual basis it looks as though the market could probably absorb it, albeit with a small amount of price pressure. However, if we look at a more granular level, we see a big rise in the amount of pork searching for a home in the second half of 2021.

Pork production does tend to go in cycles (as do many other commodities), expanding during periods of high prices/profitability and contracting during low prices/loss-making. Due to the African Swine Fever outbreak in China, China started buying up pork which underpinned the European market and pushed prices up. In response to this, EU production levels increased. China has now toned down its buying as its national production has recovered. This has left Europe sitting on large volumes of pork, and with supply far outweighing demand, prices have fallen.

Looking at the chart above, supplies on the EU market during the second half of 2021 were below levels in the first half of 2018, due to slightly lower imports, and much larger exports. Exports, while removing product from the market, does not always mean achieving a good price. Compounding the oversupply situation are restrictions imposed by some importing countries on EU countries that have African Swine Fever. Germany and Poland, the bloc’s second and fourth largest pig meat producers in 2021, for example are shut out of almost all Asian markets due to having ASF.

Not only has there been additional product on the market, but demand within the bloc is reported to be weaker. In Britain demand at consumer level has been steady, with declines in retail being offset by the increases in out of home eating; with the increased supply of finished pigs outweighing demand/capacity at processing coupled with the lower prices in Europe which have pressured British farmgate prices. In Europe, consumer demand has weakened at retail and industry reports suggest this has not fully been offset by a rise in out of home eating.

While lower consumer prices can help stimulate demand, reports do suggest that some of this additional product is going into cold storage. Clearing this additional product sitting on the market will be fundamental to give farmgate prices the opportunity to rise. Reports suggest pig supplies in some EU countries are beginning to contract, which may provide some relief to prices. Some European abattoirs are also reported to have offered higher payments in response to the increase in feed prices. All reports do agree that while the number of pigs may be easing, supplies of pork remain plentiful.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.