Pig production costs at record high; worst margins in a decade

Thursday, 27 May 2021

By Bethan Wilkins

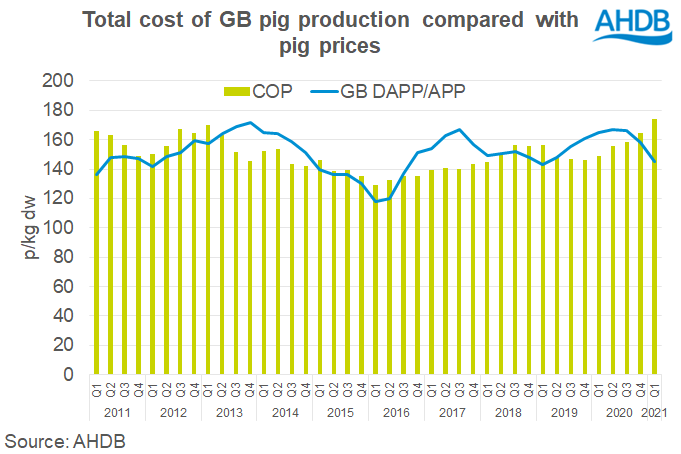

Our estimates for GB pig production costs rose by 10p/kg in the first quarter of 2021, to 174p/kg. This is the highest level since our series began in 2009.

The high production costs are primarily the result of high feed prices, and feed costs were also the highest on record at 117p/kg. Feed price estimates are based on monthly spot compound prices, which do not take into consideration risk management strategies that may be used by individual businesses. So, some producers may have been less exposed to this challenge. In addition, there has also been some worsening in feed efficiency. The feed conversion ratio for both the rearing and finishing stage increased in the 12-months to March 2021, compared to the previous 12-month period.

Pig prices also fell early this year, with the APP declining by 13p/kg from the last quarter of 2020 to average 145p/kg in Q1.

This means that producers lost on average 29p/kg (or £26/head) during the first quarter of the year. The last time margins were comparable to this was early 2011. These margins are estimated on a full cost basis; actual financial performance can vary significantly between producers.

The rise in feed prices over the past year has been a considerable challenge for pig profitability. Although UK wheat supply is forecasted to be larger for this year’s crop, the UK is set to remain a net importer. A tight global supply and demand balance for oilseeds is expected to remain, so there aren’t definite signs that feed prices will fall significantly any time soon. With feed now at 67% of production costs, it is certainly possible that costs will remain relatively high even if productivity can improve.

Feed update – will prices rise further? (Pork Talk, June 2021)

On a brighter note, pig prices have been improving recently, reaching nearly 154p/kg (APP) in the week ended 15 May. The average for the second quarter to date is already 4p above the 145p/kg average for the first quarter of 2021. If the upward trend continues for the remaining weeks of Q2, pig producer margins may well be a little better for this period overall, though still a way off profitability.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.