Pig producers remain in the red as production costs rise further

Thursday, 2 September 2021

By Bethan Wilkins

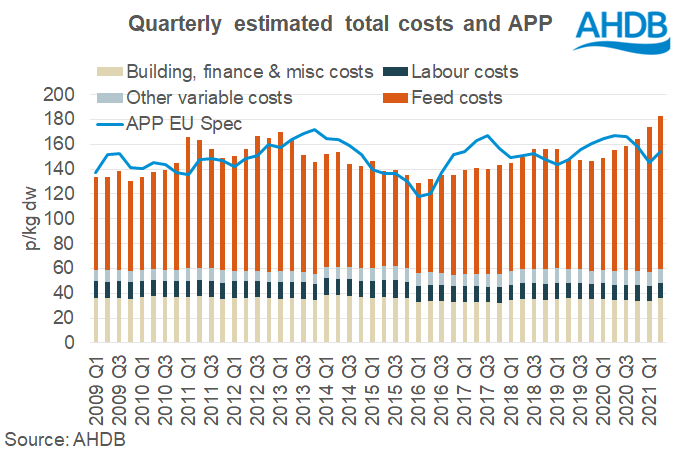

Estimated GB pig production costs in the second quarter of this year reached a record 182p/kg, according to the latest AHDB estimates. This was an increase of 8p/kg from the previous high of 174p/kg recorded in the first quarter of this year. Compared to the same time last year, production costs were 27p/kg higher.

The increase primarily reflects rising feed costs, as elevated global cereal and oilseed prices feed into the cost of pig feed. However, both labour and fixed costs had also increased compared to the first quarter of 2021.

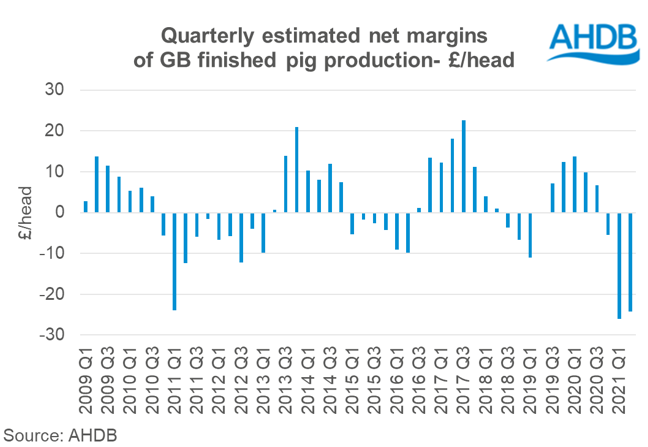

Pig prices have also increased compared to the start of the year. The APP averaged 154p/kg in Q2, 9p/kg more than during the first quarter. However, compared to last year, prices are 13p/kg lower. This means that, on average, pig producers remain in a significant loss-making situation. Estimated net margins stand at -28p/kg (or -£24/head) in Q2 2021, a similar situation to the first quarter.

The first half of 2021 therefore represents the worst financial situation for pig producers, across a six-month period, on record. It is typical for pig production to go through cycles of profitability and loss-making. However, it is unusual for margins to be this low for a prolonged period.

Our estimates for net margins use spot feed prices. Producers will have varying buying strategies to mitigate the volatility in feed markets and this will mean the level of exposure to rising feed costs may be less than our estimates indicate. We also include non-cash costs (such as depreciation and family labour) in the cost of production calculation, which do not affect the short-term cash flow of business. Nonetheless, the latest estimates paint a picture of finances that will be difficult for British pig producers to sustain for long.

It is not clear that the situation will be better overall in the third quarter. The EU-spec APP averages 165p/kg from the start of July to mid-August, which is higher than the Q2 average, but prices are now on a downward trend. Low EU prices and a more challenging Asian export market may mean this trend stays in place for the coming weeks. At the same time, it seems feed markets have remained strong. As such, the outlook for British pork producers remains difficult. In the July Outlook, we already believed some reduction in breeding herd numbers was underway and these latest financial figures support the view some industry contraction would be expected.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.