Philippines open up pork import market to alleviate tight supplies

Wednesday, 14 April 2021

By Felicity Rusk and Bethan Wilkins

African Swine Fever has continued to pose significant challenges to the Philippine pig market. While there are conflicting reports on the number of pigs affected, the USDA estimate that production fell by 30% in 2020, and forecast a further 10% decline in 2021, at 1.0 million tonnes.

Pork is pivotal to the Filipino diet, ranking as the second-highest source of food energy after rice in a recent study. However, tight supplies of pig meat as a result of the outbreak have resulted in significant rises in retail prices of pork. In January, pork was reported at Philippine Peso (PHP) 400/kg (£6.10), 60% more than six months previously. For context, the minimum daily wage in the nation’s capital is PHP537. This has also resulted in subsequent price rises for other proteins, including chicken. In response, the Philippine Government introduced a two-month price cap on pork and chicken in early February. Despite this, reports indicate that pork retail prices were still around P350-P380/kg, compared to the capped level of P270-P300/kg.

In order to address the shortfall of pork, last week the president signed an executive order to temporarily lower tariffs on imported pork. The order cuts tariffs within the “minimum access volume” (MAV) quota from 30% to 5% for the first three months, and to 10% for the following nine months. For pork imports outside the quota scheme, the tariff will drop from 40% to 15% during the first three months and to 20% for the remaining nine months. The president has also recommended increasing the MAV pork quota from 54,210 tonnes to approximately 400,000 tonnes for 2021. There have been some challenges from local farmers about the impact of these tariff reductions.

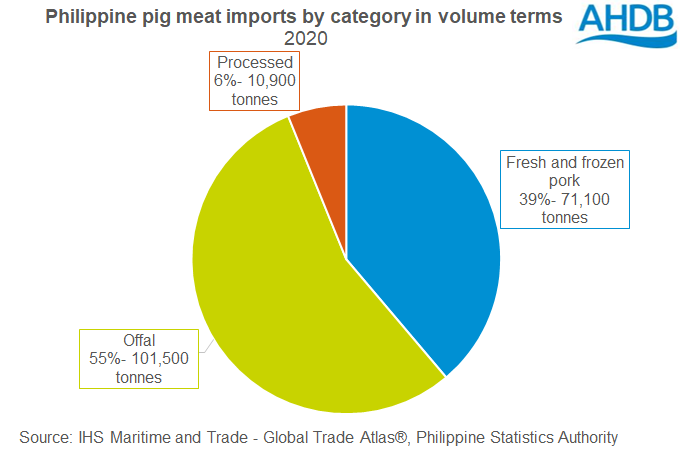

In 2020, the Philippines imported a total 183,500 tonnes of pig meat, of which 55% was offal. The quotas and tariff rate changes discussed above do not cover offal. Last year’s pig meat imports were nearly 40% lower compared to the previous year, which is reportedly due to disruption from the pandemic. However, the USDA expects that import levels will exceed pre-pandemic levels in 2021.

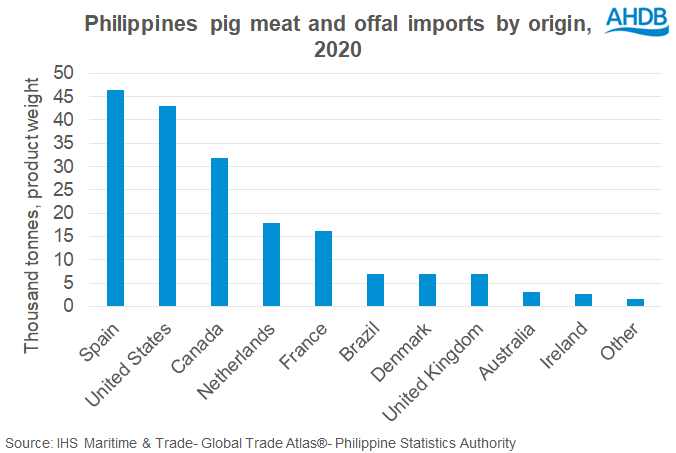

Last year, Spain, Canada and the United States supplied two-thirds of the nation’s pig meat imports in volume terms. The UK supplied 6,900 tonnes, 4% of total Philippines pig meat imports, during this period. The introduction of these changes to import regulations will likely make the Philippines a more significant export market over 2021. We already have a foothold in this market, and the changes could well boost our export prospects this year. However, there will likely be stiff competition from the main exporting regions to capitalise on the increased market potential, and price competitiveness will be key.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.