Optimism over grain corridor adds further pressure: Grain market daily

Wednesday, 26 October 2022

Market commentary

- UK feed wheat futures (May-23) closed at £279.50/t yesterday, down £2.50/t on Monday’s close. The Nov-23 contract closed at £263.75/t, down £0.30/t over the same period.

- The UK market followed both the Chicago and Paris wheat markets down. Rains in the U.S. and Argentina are weighing on wheat markets. This combined with optimism of the Black Sea grain corridor continuing is pressuring markets – read more about this below.

- Paris rapeseed futures (May-23) closed at €637.25, down €6.75/t on Monday’s close.

Optimism over grain corridor adds further pressure

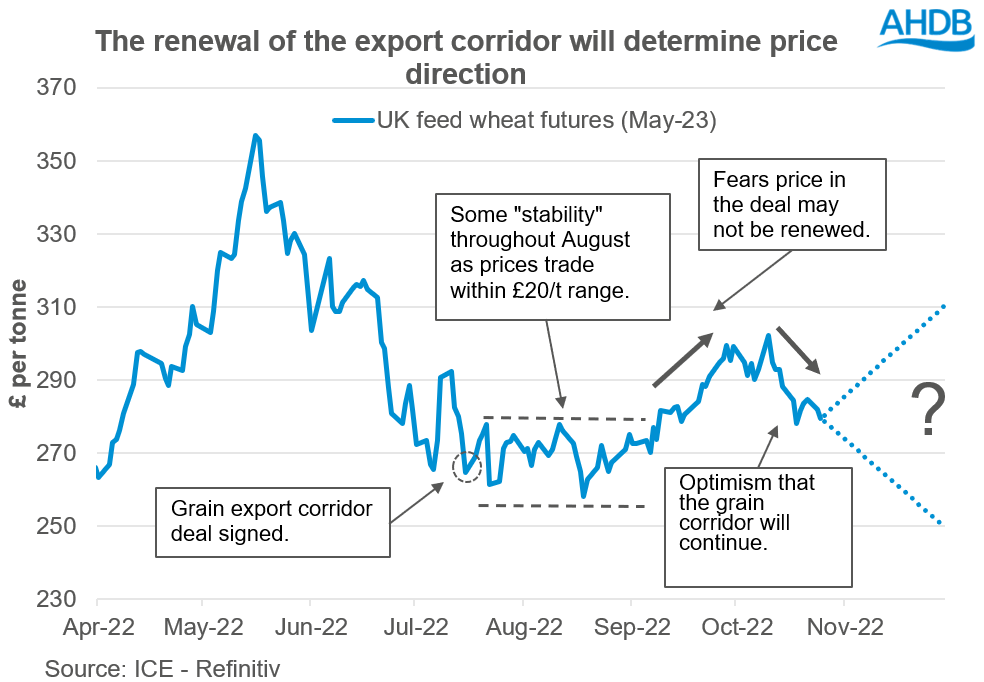

This week, bearish market news such as rains in the US, and optimism that the Black Sea grain corridor will continue beyond the end-November is pressuring markets. However, as of this moment, there hasn’t actually been a deal struck to extend the corridor which is set to expire.

When the Ukraine export deal was struck on 22 July and commodities started to flow out of Ukraine from the start of August, UK feed wheat prices stabilised (to some degree) and traded within a range of around £20/t over the month.

However, from the start of September prices rose, largely off the back of the unknown renewal of the export agreement, as well as currency fluctuations. May-23 UK feed wheat futures reached a near four month high on 10 October of £302.00/t. However, over the last few weeks they have been pressured over the optimism of this corridor continuing. Since 10 October, UK feed wheat futures (May-23, based on yesterday’s close) have dropped £22.50/t.

So where next for prices?

We are currently at a juxtapose as to where the market could go and a lot of it hangs on whether or not the Ukraine export corridor will be extended past end-November or not.

If the Ukraine export deal is not extended, then this will likely add support to markets. However, if exports from Ukraine continue, we could see further pressure on grain prices. Coinciding with this pressure is other bearish factors too.

These bearish factors include:

- Patchy rains forecast over the U.S. plains in the next seven days – although this isn’t widespread. However, rains are falling in areas such as Oklahoma where it is much needed, as most of the state is in extreme drought, read more about that here.

- A healthy amount of rain is forecast in Argentina over the next seven days. Although this will not do much for their wheat crop, it will help the plantings of their maize crop significantly. Much of the forecast rain will be in the North of the country, where all the maize is grown.

- Recently, Russian and Ukrainian exports have been pricing competitively onto the global market. This combined with recessionary demand concerns has pressured global futures markets.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.