Opportunities for South American beef in a no deal

Thursday, 21 March 2019

By Tom Forshaw

Last week we undertook some initial analysis as to what implications the no deal tariff regime might have on beef imports. Around 75,000 tonnes of beef that currently comes in tariff free, either from within the EU or from outside it under a specific quota, could now be subject to tariffs. While this may offer some amount of protection for the UK beef market, in a no deal scenario there would be a tariff free quota of 230,000 tonnes, open to all countries with a licence to export the UK, on a first come first served basis. So how may this affect the UK beef market if exporters in countries like Brazil and Argentina are able to develop supplier relationships?

In the UK we currently consume around 1.2 million tonnes cwe* of beef (production plus imports, minus exports). This makes us around 80% self-sufficient in beef and so currently we rely on imports to meet our demand. In 2018, 73% of UK beef imports came from Ireland, with the vast majority of the rest being from other EU countries, with free access to the UK market.

.png)

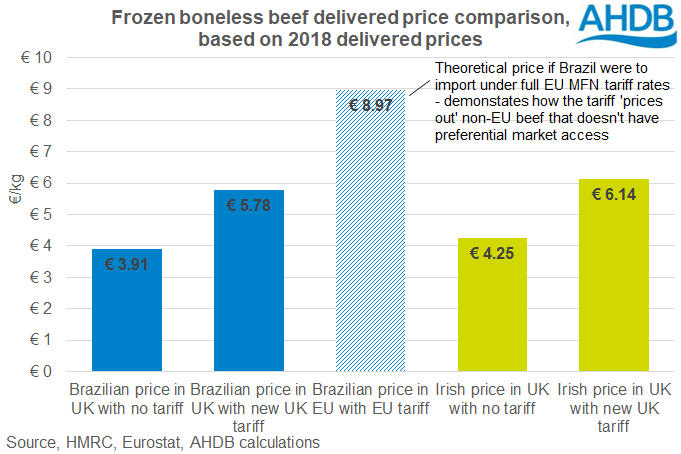

In a no deal scenario, countries like Brazil and Argentina will have equal access into the UK beef market. Until now they were priced out by the EU external tariff policy, making their beef uncompetitive. However, South American countries have significantly lower cost of production than the UK and Ireland. As such their beef could be an attractive option for importers, especially those supplying the food service sector where provenance is not always prioritised as highly as it is in the retail sector. Further to this, we estimate shipping costs across the Atlantic to be around 20 eurocents/kg which would keep the price competitive. In a scenario where South American companies are able to build relationships with UK supplies to take advantage of the tariff free access, this could affect both the Irish export price and the UK domestic price.

Looking at the price of frozen boneless cuts delivered in 2018, the Brazilian price delivered into the UK was similar to the Irish price. These products constitute the vast majority of Brazilian exports. It is possible that Brazil is deliberately pricing just below Irish beef in order to maximise the returns on its current guaranteed volume quota. In a no deal scenario, when Brazil could be competing directly with Irish beef for the tariff free quota and considering the lower cost of production in Brazil, it is feasible to suggest that Brazilian exporters have room to further reduce their price.

As such, while the 230,000 quota will limit the exposure of the UK domestic price to South American beef, Irish beef may potentially have to compete directly with South American beef.

AHDB have developed a range of reports and resources to help levy payers prepare for Brexit. These can be accessed here: https://ahdb.org.uk/brexit.

*Carcase weight equivalent

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.