November dairy market review

Thursday, 2 December 2021

By Patty Clayton

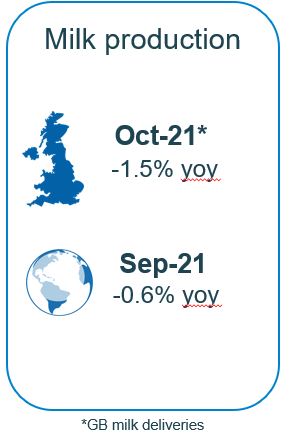

Milk production

Average GB milk deliveries through October were 1.5% lower than year earlier levels, although showing typical growth out of the trough. So far in November, average deliveries1 are running 2.5% below last year, and 1.4% below forecasted figures. The relatively low milk production will have further tightened product availability, and high spot milk and bulk cream prices will have limited volumes going into manufactured products.

Global milk delivieries saw a year on year drop in September of 0.6%, equivalent to a drop of 4.9m litres of milk per day. Production is dropping year on year in all the key regions except Argentina where there is some growth, and the US where production was in line with last year.

Production in both New Zealand and Australia is being negatively impacted by unfavourable weather. Variable wet and dry spells in New Zealand have seen production in the peak periods of September and October drop by 4.3% and 3.3% respectively. In the US, tight margins are reducing yields and leading to herd reductions. After nearly 18 months of year-on-year growth, US production was steady yoy in September, and marginally down (-0.5%) in October. Production in the EU-27 has also been hit by high costs and herd rationalisations, hampering production growth in its three largest regions of Germany, France and the Netherlands.

AHDB

AHDB

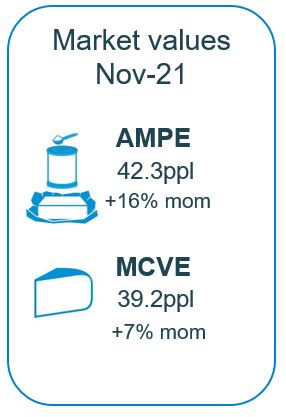

Wholesale markets

Commodity prices have continued to increase in both domestic and global markets, driven by tight supplies of both milk and manufactured products and firm demand.

There was a sizeable jump in both AMPE and MCVE in November, which were up 16% and 7% respectively on October figures. While the current levels of these indicators may overestimate the equivalent market value of milk2, it is the move in market values that is of relevance.

AHDB

AHDB

Farmgate prices

The Defra average price across all contracts in September was 31.58ppl, and 31.26ppl when excluding retailer aligned contract prices. The higher market returns in recent months suggest increases in market-related farmgate milk prices should start to filter through over the winter. Some of these have already been announced, and several companies have announced further price increases for December and January.

Despite higher prices, farmers are likely to struggle to cover additional costs. Input costs of the three ‘Fs’ – feed, fuel and fertiliser, have all seen significant increases. Fuel and fertiliser costs have seen the largest jumps, which have occurred in the past couple of months. Feed prices have been at relatively high levels for an extended period, and will have been depleting margins throughout the year.

AHDB

AHDB

17-day rolling average

2increases in manufacturing costs have not yet been accounted for in the AMPE/MCVE calculations. These will be updated on publication of ONS cost indexes in December

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.