New Zealand sheep meat shipments to the EU remain at lower levels

Thursday, 2 April 2020

By Rebecca Wright

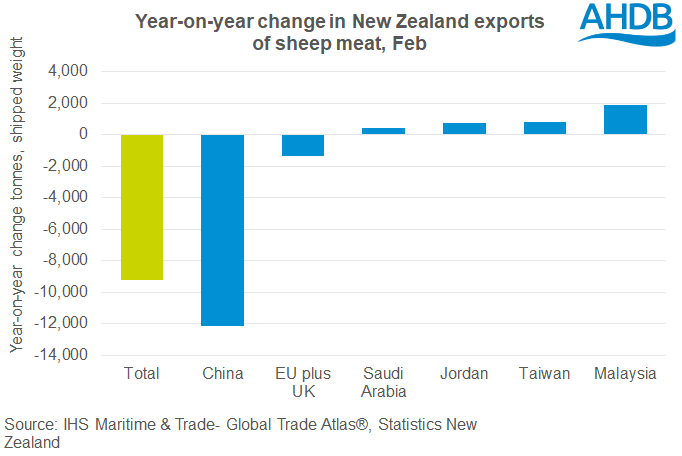

Overall New Zealand sheep meat exports declined by 9,000 tonnes year on year during February, to 42,000 tonnes, according to Statistics New Zealand. This was entirely driven by a decline in shipments to China (-12,000 tonnes). Partially offsetting this, exports to Malaysia (1,900 tonnes), Taiwan (+800 tonnes) and Jordan (+800 tonnes) all increased. Exports to Saudi Arabia also increased (+400 tonnes).

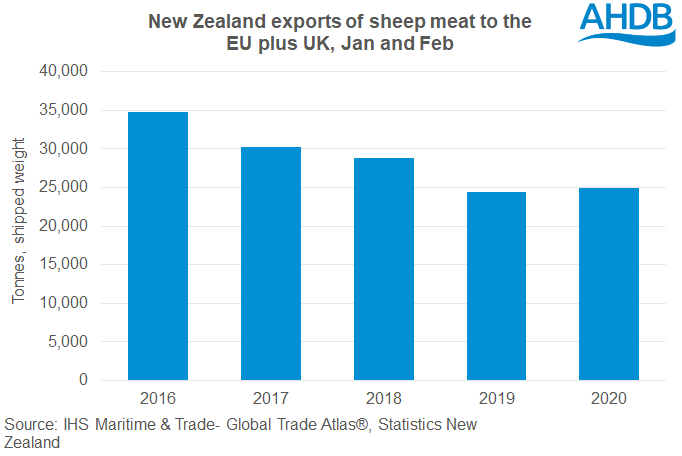

New Zealand volumes of sheep meat to the EU plus UK were marginally up during the first two months of 2020 at just shy of 25,000 tonnes. Shipments increased during January, but were down in February. Equally reassuring for some farmers, New Zealand’s usage of its EU quota (which for now includes the UK) during the first three months of the year was steady on-the-year, according to European Commission data. There was a small up-tick in quota usage from Australia of less than 800 tonnes.

New Zealand shipments so far this year are down, entirely driven by coronavirus in China. For almost two months China was in ‘lockdown’, and although China is beginning to resume normal activity, demand for sheep meat could remain lower for some time. Around half of imported sheep meat in China is consumed in restaurants. Consumers are still cautious about attending crowded places, and potentially suffering from reduced income during the lockdown. China is also reported to be increasing its own flock size. This is perhaps not only in response to coronavirus, but also due to high sheep meat prices over the past few years and the protein shortage caused by African Swine Fever.

New Zealand itself is now in lockdown due to coronavirus. The government is keen to keep agri-exports flowing. However, to comply with new regulations brought into control the spread of coronavirus, capacity to kill at abattoirs has been reduced. Sheep and cattle were already backing up on farm due to disruption at Chinese ports and global shipping, and so any slowing of kill lines is only likely to exacerbate the situation. There are also some concerns about feed, due to low yielding crops following a summer of drought, and followed more recently by flooding.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.