New year, same key markets drivers: Grain market daily

Wednesday, 3 January 2024

Market commentary

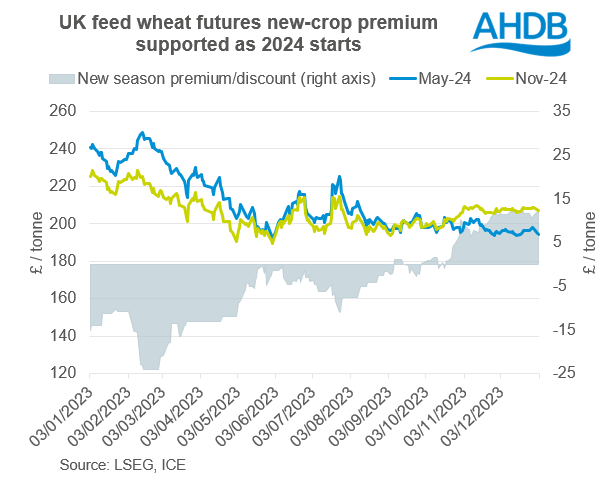

- UK feed wheat futures (May-24) closed yesterday at £194.60/t, down £3.05/t from the last close on 29 December. The new crop futures (Nov-24) fell £1.75/t over the same period, to close at £207.00/t.

- Domestic wheat futures followed pressure on the continent yesterday, weighed on by falling US markets impacted by US dollar movement and as the first day back after the New Year holiday (more on this below).

- Paris rapeseed futures (May-24) fell €7.50/t yesterday from the last close on 29 December, to end the day at €433.25/t. New crop futures (Nov-24) fell €8.25/t over the same period, to close at €435.75/t. Rapeseed markets followed pressure on both the Chicago soyabean futures and Malaysian palm oil.

- Nearby Brent crude oil futures closed at $75.89/barrel, down $1.15/barrel from the 29 December.

- HSBC said yesterday that squeezed supply, improved Chinese demand and the global energy transition will support commodity prices this year, before then falling in 2025.

New year, same key markets drivers

Yesterday, UK feed wheat futures slid back in line with prices on the continent, with pressure from US wheat markets on the first day back after Christmas. Though as explained above, May-24 futures fell more noticeably (1.5%) than the new-crop Nov-24 contract yesterday (0.8%) on UK feed wheat futures, rebuilding the premium into the new season to £12.40/t. This sits near values reached in December, recording a premium of £12.55/t on 20 December.

As we start the new year, it is a good time to review key factors driving the wheat market currently, current season versus new crop.

Global competition

Competitiveness and flow of Black Sea wheat remains in focus for this season’s market movements, with abundant Russian wheat continuing to be a bearish factor. As discussed yesterday in Market Report, fresh export demand looks slow. Though, attention is on the US dollar/Euro exchange rate currently especially. Yesterday saw the US dollar rising significantly on higher US bond yields. According to a German trader, any fall in the value of the euro is taken positively by the market (LSEG).

Russian Black Sea grain ports are looking full, and Sovecon have recently trimmed back their Russian wheat export forecast for 2023/24. Full ports bring some hopes for the EU they may pick up shipments, though as reported by LSEG, Russian wheat is starting 2024 with a price advantage. Yesterday, Russian 11.5% (Free On Board) wheat for January shipment initial prices saw a discount of $10-12/t under western EU.

Geopolitics/war

Unfortunately, as we start 2024, war remains in focus not only in Ukraine but also in the Middle East. Monday saw Russian air attacks, with a drone attack on the southern port of Odesa bringing focus continued supply. Though exports continue from Ukraine, these remain slower year-on-year.

On top of this, two shipping giants said yesterday their container ships would avoid the Red Sea route giving access to the Suez Canal following an attack over the weekend by Houthi militants.

Northern Hemisphere harvest 2024 supply in focus

Rain delayed winter cereal planting for many before Christmas in the UK and some areas on the continent. UK new crop futures are pricing for tightening wheat supply next season currently as seen above. Significant rainfall continued yesterday in parts of the UK. Though UK storm Henk has passed, local flooding and rain has come into focus in Germany too, as well as rain in France. Something to watch in how long the rain continues for.

South American maize supply

Finally, South American maize supplies remain in focus, with maize the floor to the global grain market. Drought conditions in Brazil have been covered by the AHDB considerably in recent months. Conab are due to publish production forecasts tomorrow.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.