New season prices holding a premium to old crop: Grain market daily

Thursday, 23 November 2023

Market commentary

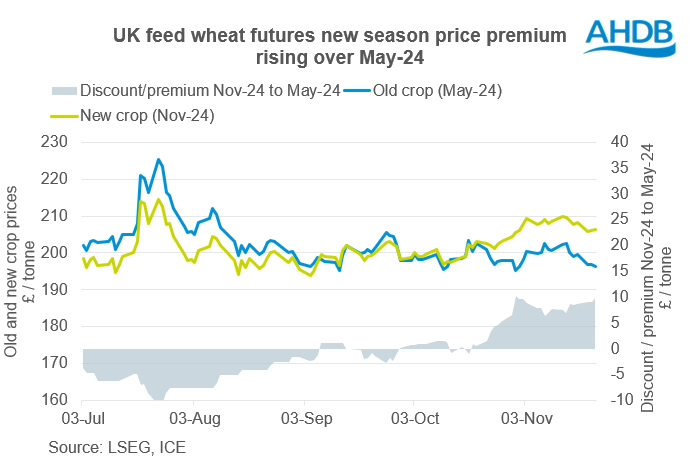

- UK feed wheat futures (May-24) closed yesterday at £196.30/t, down £0.70/t from Tuesday’s close. Nov-24 futures gained £0.20/t over the same period to £206.25/t.

- UK wheat markets felt pressure from lower prices on the continent yesterday as concerns ease over Black Sea exports. The impact of the latest Russian strike against a Ukrainian port on Ukrainian seaborne exports looked limited. Paris wheat futures dipped despite some rises in Chicago wheat futures, ahead of a US market closure for Thanksgiving today.

- The Black Sea port of Constanta shipped a record of 29.4 Mt of grain in Jan to Oct 2023, with Ukrainian grain reportedly accounting for 40% of this according to the port authority (LSEG).

- Paris rapeseed futures (May-23) eased €0.75/t yesterday, to close at €445/t. Nov-24 futures gained €0.50/t over the same period, to close at €452.25/t. Although pressure was felt on Chicago soyabean futures yesterday, though rapeseed futures did see some support from Malaysian palm oil futures and a weaker euro.

- Despite weather issues, Brazil's soyabean crop is still forecast to reach a record 161.6 Mt, according to consultancy Agroconsult yesterday.

New season prices holding a premium to old crop

New crop news is becoming more in focus in markets currently and will become increasingly prominent in market price action by the time we get to May.

Further improvements to US winter wheat conditions have been adding to some pressure in Chicago wheat markets this week. 48% of the crop was rated ‘good’ to ‘excellent’ in the week ending 19 November, up 1 percentage point (pp) from the week before. Improved conditions are much improved from last season and the highest for the time of year since the 2020 crop.

It’s worth noting that the recently released 10-year ‘baseline’ projections from the USDA shows a 3% drop in the US wheat area for harvest 2024. If confirmed, good crop conditions and higher yields will be needed to maintain production.

On the other hand, the French winter wheat crop condition has deteriorated and plantings delayed by heavy rain since mid-October. In the latest data to 13 November, FranceAgriMer said French farmers had sown 71% of the forecast soft wheat area, up just 4pp from the week before, and behind the same point last year when 96% of plantings had been complete. To the same date, only 86% of the 2023 crop was in ‘good’ or ‘very good' condition, down from 91% a week earlier and 98% at the same stage in 2022. For winter barley, planting progress to the same date stood at 84% complete, with 86% of planted crops in ‘good’ to ‘very good’ condition, compared to 99% this time last year.

France is experiencing drier weather this week and this weighed on prices earlier in the week. The emergence of drier weather brings some optimism that outstanding sowing can take place as we head towards December.

So, how is this reflected in pricing and where next?

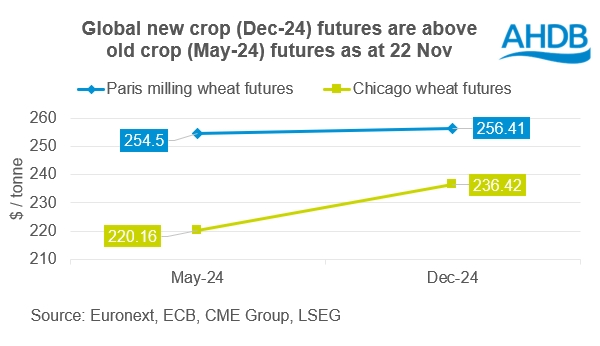

In global markets, as at yesterday’s close, new crop contracts (Dec-24) in Chicago wheat and Paris milling wheat futures were both above old crop (May-24) contracts. But there was some disparity in by how much, with Chicago wheat futures in Dec-24 at 7% higher than May-24 and Paris milling wheat at just 1% above.

Chicago new crop prices are currently weighed on by the slow pace of US exports in 2023/24, while the possible need for higher yields to support production in 2024 supports new crop prices.

Whereas, in the Paris market, a month ago new crop prices were below old crop. So, although the new crop premium is currently smaller than in Chicago, the pricing relationship is now one of higher new crop prices.

UK feed wheat futures follow a similar pattern, with May-24 feeling a little pressure yesterday, though new crop futures gained a little over the same period. Though these movements were small, it does reflect a growing premium that new crop (Nov-24) futures have been developing, led by concerns growing for next season’s availability considering the planting difficulties seen for many from the rain. As at yesterday this premium stood at £9.95/t (5%).

So, where next? Going forward, crop conditions across the Northern Hemisphere will be followed closely, though US and French crop condition reports will soon pause for the winter. Something to closely monitor is whether weather dries up here and in parts of the EU enough to allow farmers to get out in fields.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.