Natural gas prices have eased but still high: Grain market daily

Friday, 17 January 2025

Market commentary

- UK feed wheat futures (May-25) closed yesterday at £188.40/t, down £1.85/t from the previous day’s close. New crop (Nov-25) futures closed down £1.35/t over the same period, to end the day at £192.90/t.

- Domestic futures followed US and Paris wheat prices down yesterday, pressured by weaker global export demand and spillover weakness from declines in maize and soybean futures.

- Paris rapeseed futures (May-25) also felt pressure yesterday, falling €13.50/t, to close at €524.50/t. The Nov-25 contract dropped €8.25/t over the same period, settling at €480.50/t.

- Rapeseed markets fell alongside Malaysian palm oil and Chicago soyabean oil futures yesterday. Chicago soyabean futures (May-25) fell by 2.25% on improved weather outlooks in Argentina and ample crop expectations in Brazil.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Natural gas prices have eased but still high

Earlier this month (02 January), nearby European natural gas futures rose to €50.14/MWh, their highest since October 2022. This was driven by colder weather, the end of Russia's transit agreement with Ukraine, and escalating geopolitical tensions.

Since then (2 – 16 January), prices have dropped by 8% as demand briefly shifted to alternatives like Liquified Natural Gas (LNG), leading to a temporary rise in LNG imports into the European Union.

Despite this decline, prices remain historically elevated. The nearby contract closed yesterday at €46.25/MWh, representing a 66% increase year-on-year. It is also up €0.47/MWh compared to the average price of €45.78/MWh for the start of December to date.

Nearby UK natural gas futures yesterday settled at 116.39 pence/therm. This price is up by 70% compared to the same time last year.

.png)

The underlying supply and demand continue to support prices. Forecast indicates colder weather across the north of the European continent in the next two weeks, likely increasing demand. Also, the terminated Naftogaz-Gazprom contract, which facilitated Russian gas flow through Ukraine, is expected to reduce EU gas imports from Russia by 14 billion cubic meters (LSEG).

The continent’s gas inventories are depleting at a rapid rate, with current storage at 63% compared to 78% at this point last year (Gas Infrastructure Europe). Further depletion is also possible before the end of winter. The ongoing Middle East crisis also adds a layer of volatility to the market. However, higher natural gas prices and the need to replenish depleting reserves are driving increased LNG demand. This is helping to stabilize prices and could shape future market dynamics.

How does this affect fertiliser?

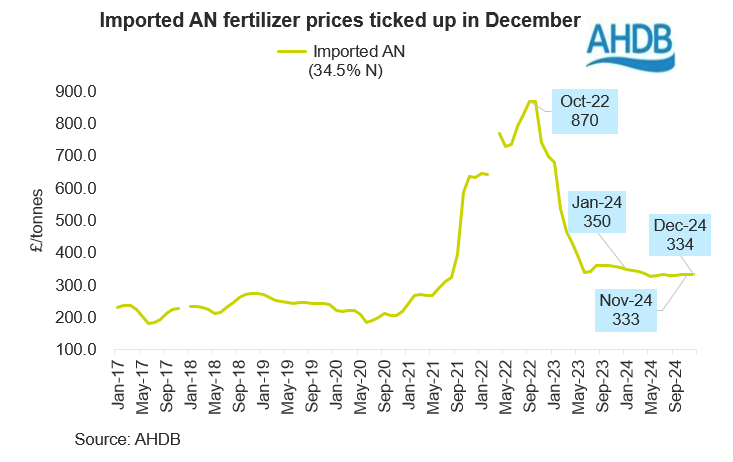

In December 2024, price for imported Ammonium Nitrate (AN) (34.5%) averaged £334/t, up £1/t from November’s figure. However, this was down £16/t on the year and £536/t below the high of £870/t seen in October 2022, after the outbreak of the war in Ukraine. Despite stabilizing, fertiliser prices remain above historical averages.

Natural gas prices are a big factor in the cost of making nitrogen and so nitrogen fertilisers. Further rises in natural gas prices are possible due to the current market conditions. If this occurs, it could lead to a decrease in fertiliser production and impact prices. So, the current trend in natural gas prices needs to be monitored closely given the potential for knock-on impacts on farm expenses.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.